View My W-2/W-2C Tutorial Video

Purpose

The purpose of this Job Aid is to explain how to view and print W-2/W-2C forms from 2011 to the present within the Fiori My W-2/W-2C application and incorporates Frequently Asked Questions. Fiori applications are accessible via desktop, laptop, and mobile devices. You may also wish to review the FIO-23 My Online Selections Job Aid for more information.

Steps for accessing My W-2/W-2C

There are 8 steps to complete this process.

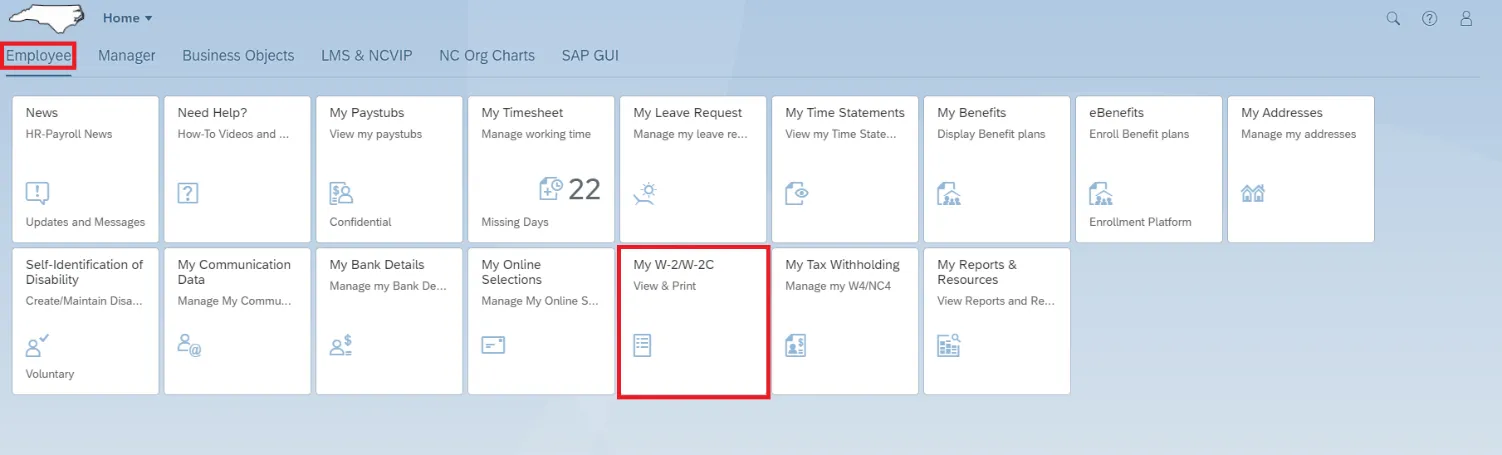

After logging into Fiori, you will see the My W-2/W-2C application tile located within the Employee tab interface. This is where employees can view and print current and past years’ W-2/W-2C from 2011 to the present.

Note: Additional tabs on the screenshot above – Manager, Business Objects, LMS & NCVIP, NC Org Charts, and SAP GUI - are based on employee security role access, so employees may not have all tabs as shown.

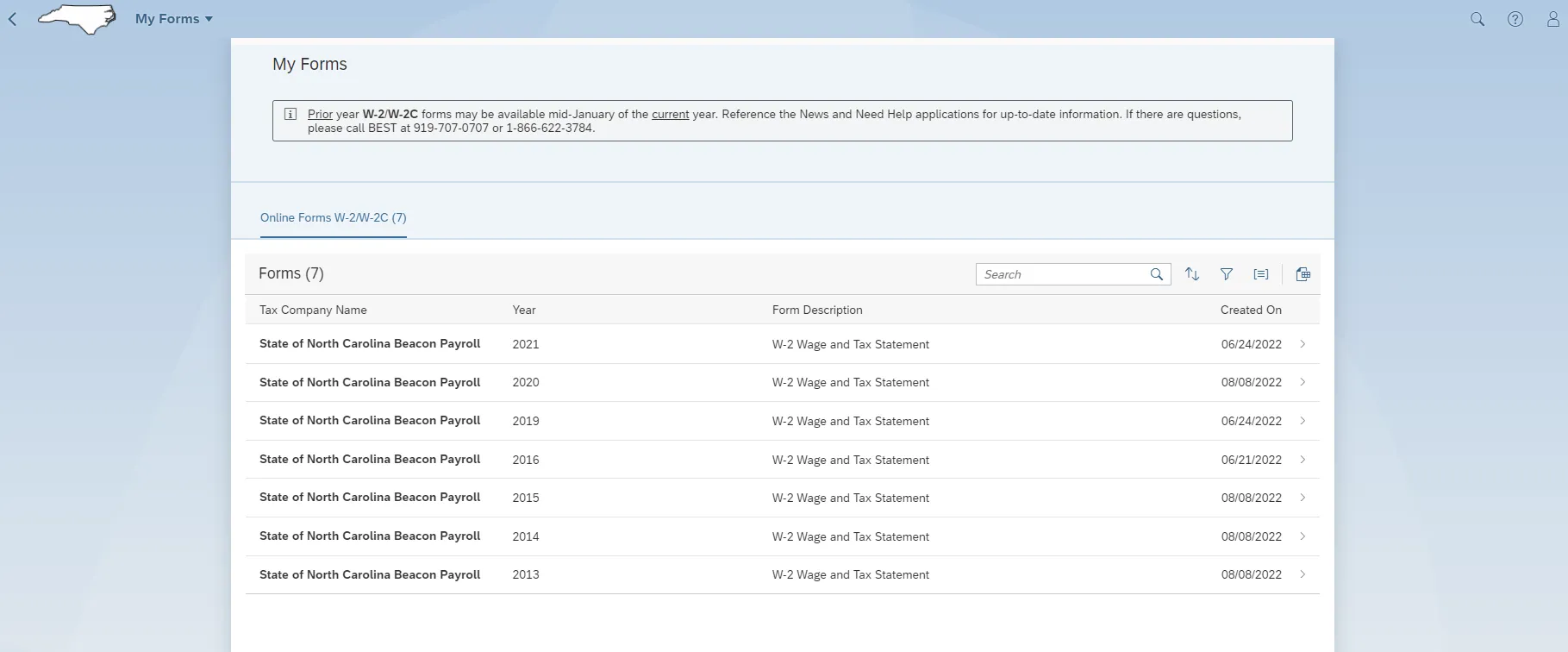

Step 1. Click on the My W-2/W-2C tile. Within the Online Forms W-2/W-2C section, a list of forms is available to view and print beginning in 2011 or the year of employment (if employment began after 2011) to the present.

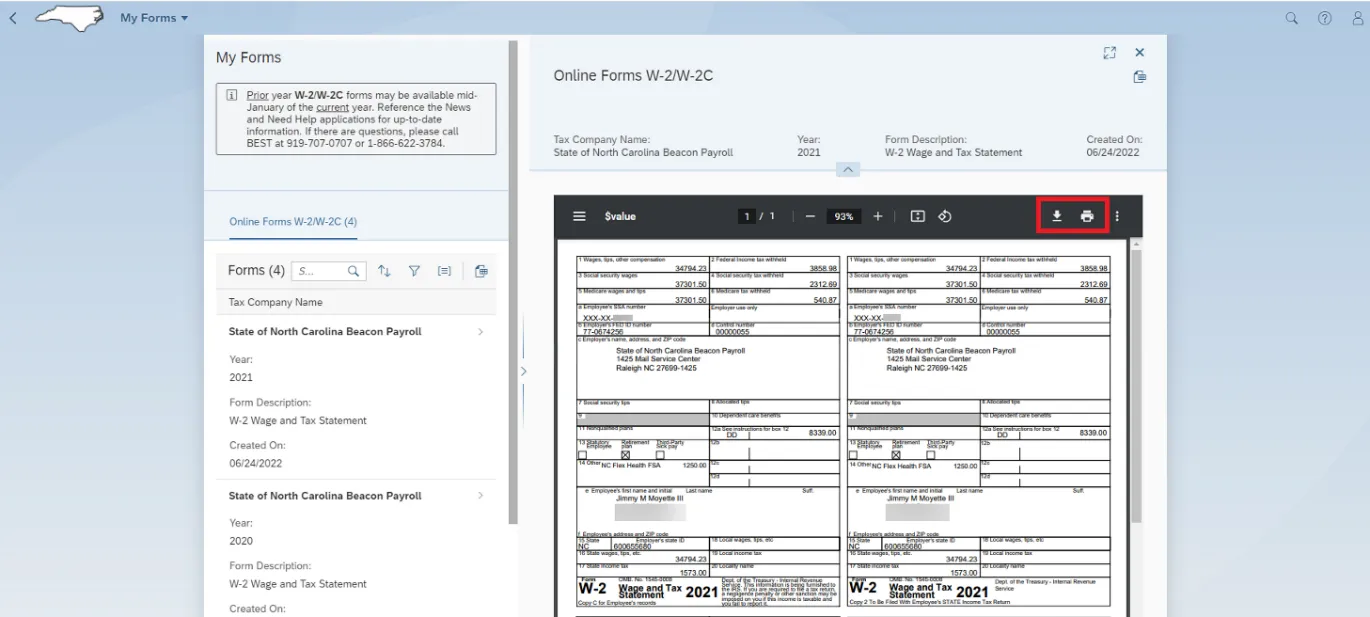

Note on screen: Prior year W-2/W-2C forms may be available mid-January of the current year. Reference the News and Need Help applications for up-to-date information. If there are questions, please call BEST at 919-707-0707 or 1-866-622-3784.

Step 2. You can Search, Sort, Filter, Group, and Export the Online Forms results using the navigation features shown here. For instance, you can type a specific year into the search field and click the magnifying glass icon to view only that year.

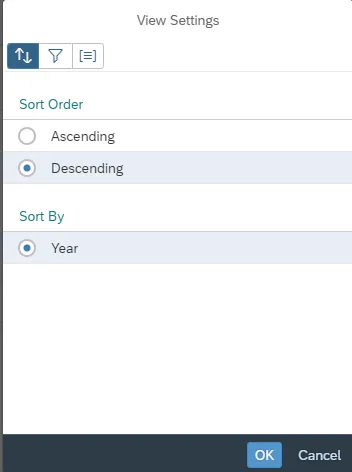

Step 3. Click the Sort arrows and select ascending or descending radio button to order list by year.

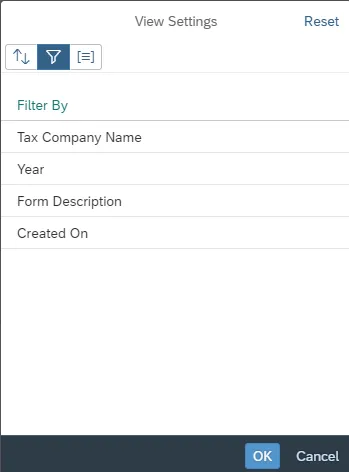

Step 4. Click the Funnel icon to filter by these categories: Tax Company Name, Year, Form Description, or Created On date.

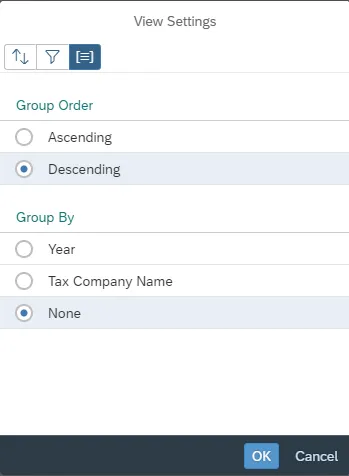

Step 5. Click on the Group icon (3 horizontal bars in straight brackets) to group results in ascending or descending order by Year, Tax Company Name, or None (which is the default).

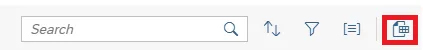

Step 6. Clicking on the Export icon on the results page will download a spreadsheet showing the list of results similar to the example shown below.

Note: Successful Export to mobile devices is dependent upon applications available to process the file format.

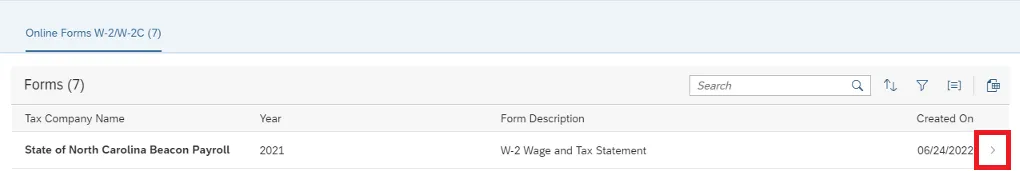

Step 7. Select the right-angle bracket next to each date in the Created On column to view individual forms in greater detail.

Step 8. Download or print using the respective icons in the black toolbar at the top of the individual form.

Note: The Help? feature is available within all Fiori applications.

2021 W-2c Form

Employees that had the State Health Plan, Critical Illness, and/or Cancer Plan in 2021, will have a W-2c shown for year 2021 related to employer rate changes processed after the initial W-2 runs. For this population (65,000-70,000 employees), the correction is only for box 12DD, which is information only. There are no tax implications, and the form can be ignored. These W-2cs were not placed in the portal, were not printed, and not sent to any tax authorities. The Created On date for these W-2c forms will be 5/18/2022. Please see screenshot below.

Note: Some employees may have valid W-2c forms listed for 2021 (just not with Created On date of 5/18/2022).

W-2/W-2c - Frequently Asked Questions

When will I be able to view/print my W-2 within the Fiori My W-2/W-2C tile?

Copies of your W-2 will be available for you to reprint within the Fiori My W-2/W-2c tile no later than mid-February. Check the Fiori News tile for notification.

I need a W-2C reprint. When will I be able to get one?

W-2C reprints can also be reprinted within Fiori and selecting the My W-2/W-2c tile. See the link on the first question above.

If you do not see the W-2C you are trying to reprint or you do not have access to Fiori, contact BEST Shared Services.

My W-2 has been misplaced or damaged. How do I get a copy?

You can view/print your W-2 using Fiori and selecting the My W-2/W-2c tile following the instruction in this document and/or watch this video tutorial.

If you do not have Fiori access, call BEST Shared Services at 919-707-0707 to request a reprint. BEST will submit reprint requests only for employees who do not have access to Fiori. You will be directed to print your own if you have Fiori access.

My address has changed, how do I receive a W-2 reprint?

See above information. Be sure that you correct your address (permanent and/or mailing) within the Fiori My Addresses tile, with your agency HR office, or by submitting a form to BEST Shared Services for processing.

I need a copy of my W-2 for years 2010 and earlier.

Contact your agency’s payroll office to request a W-2 for 2010 and earlier.

Why is TSERS not reported on my W-2?

Per IRS regulations TSERS is not reported on W-2.

My social security number or name is incorrect on my W-2. How do I correct this?

You must take a copy of your original social security card to your agency HR office for assistance in correcting the number or name. Once the correction has been made by your agency, you will be issued a W-2C shortly thereafter.

I did not earn this much money. I need my W-2 corrected.

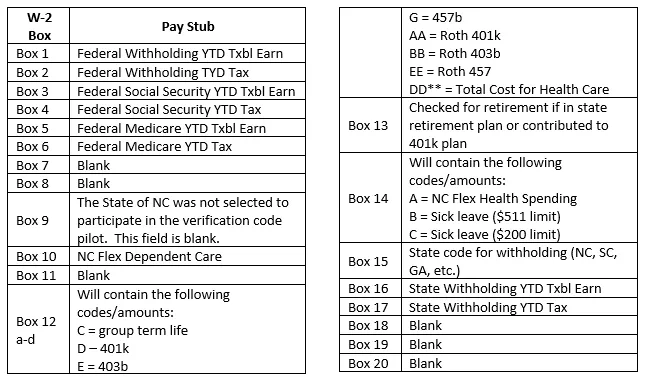

Please review your last pay statement for the calendar year and compare the taxable wages in the lower right portion of your pay stub with your W2. If you still have questions, please contact BEST Shared Services, and open a ticket for assistance.

How do I know what goes in each box? The following table shows you how to look at your pay stub fields and compare to the boxes on your W-2:

**Box DD – Total Cost for health coverage.

Employee and employer costs for State Health Plan, NC Flex Critical Illness, and NCFlex Cancer. For information only. Not taxable.

Where can I find the most up to date information about the W2 and W2-C forms?

You can visit the Federal IRS website to find the latest information about these forms.