View My Addresses Tutorial Video

Purpose

Keeping your address up to date is important for employees of the State of North Carolina. The purpose of this Business Process Procedure is to explain how to set up or change your address in the Integrated HR-Payroll System using the Fiori interface.

Overview

The My Addresses tile is located on the Employee tab in Fiori. You can use this application to set up (or change) the following address types:

- Permanent Residence - An employee's main address. You must have a Permanent Residence for payroll purposes and can only have one active record at a time. Note: If an employee has an in/out of state change for this record, they must also update their Tax Withholding Information.

- Emergency Contact - An employee's contact person, address, and telephone number in case of emergency. You may have more than one record.

- Mailing Address - An employee can set their mail to be delivered to an address other than their Permanent Residence. If used, employees may have only one active record at a time.

- Deleting an Address – Employees can remove Emergency/Mailing addresses.

Critical:

- Each address must be updated separately.

- A Mailing Address is needed only if it is different from the Permanent Residence.

- Addresses cannot be changed until the Agency HR has entered the original Permanent residence into the system. If the Address screen is blank, contact your Agency HR.

- If making an in-state or out-of-state change to the permanent residence, please ensure the tax withholding information is also updated.

There are 9 steps to complete this process.

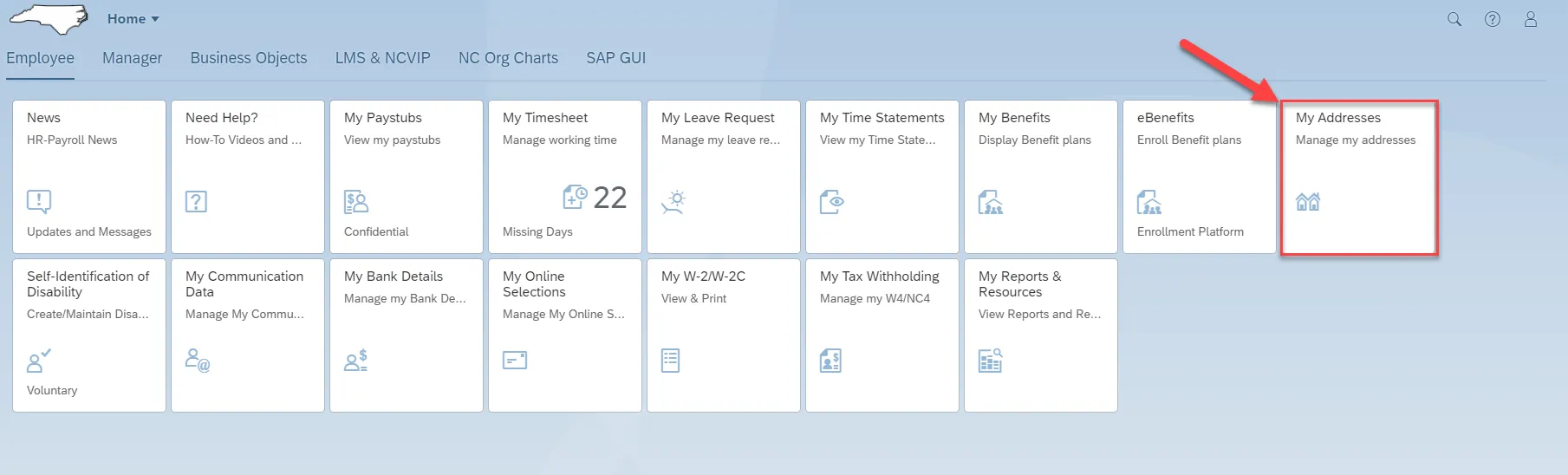

Step 1. From the Fiori Home page, click the My Addresses tile located under the Employee tab.

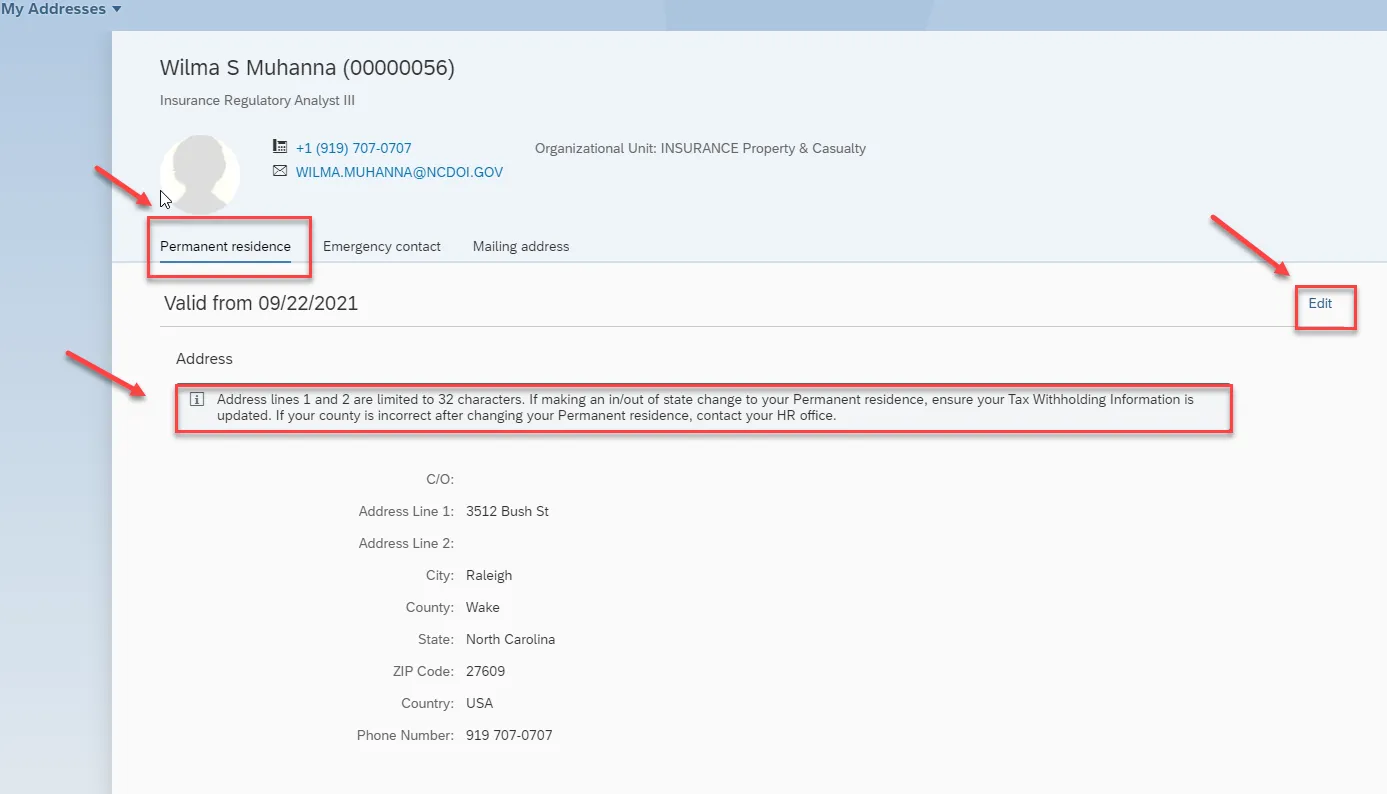

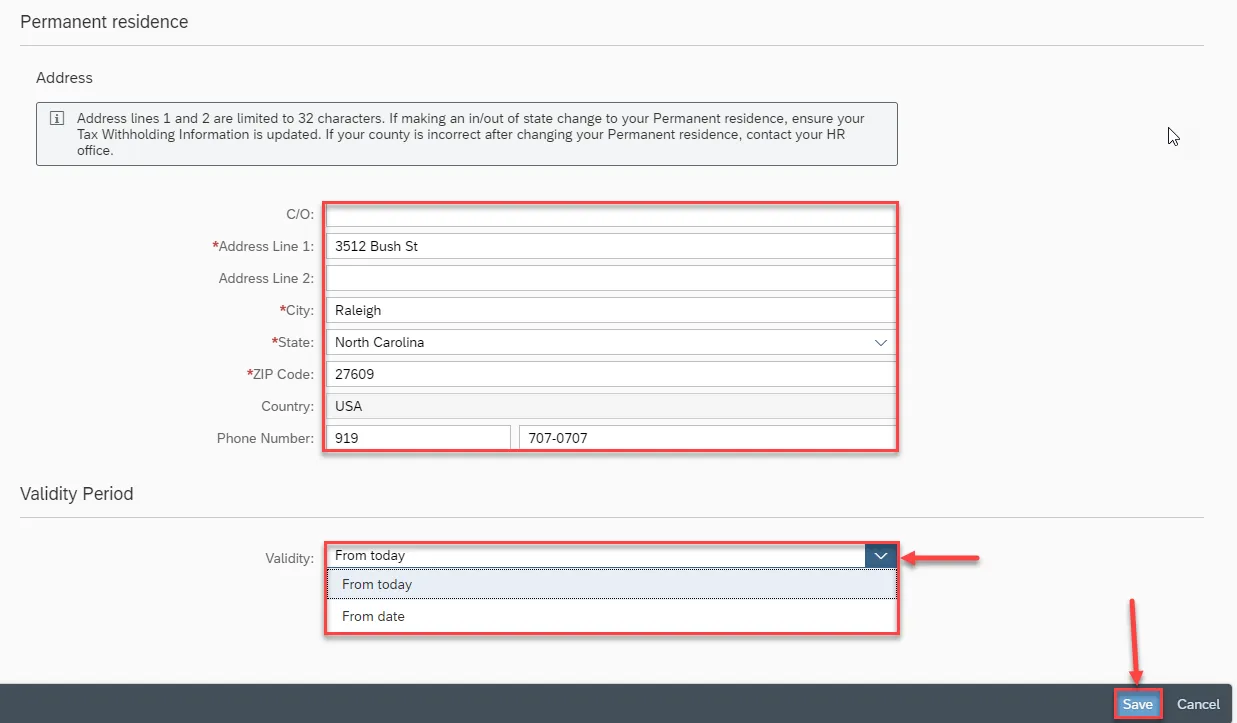

Step 2. To edit your Permanent Residence please click on Edit.

Note: Address lines 1 and 2 are limited to 32 characters. If making an in/out of state change to your Permanent residence, ensure your Tax Withholding Information is updated. Please advise your HR/PY office of the change to ensure all applicable tax data types are validated. If your county is incorrect after changing your Permanent residence, contact your HR office.

Step 3. Once you click on Edit it will allow you to update the address.

Note: A red asterisk (*) represents a field that is required.

| Field Name | Description |

|---|---|

| Country | Identifies country. Accept USA, for United States of America, as the default value. |

| c/o | |

|

*Address Line 1 Address Line 2 |

The address street name, number, and apartment number (if applicable). Only Address Line 1 is required. |

| *City | City |

Note: Some of the address fields default from the Personnel Record. Make sure to enter the following fields.

| *State | State |

|---|---|

| *Zip Code | Zip Code |

| Telephone | Telephone |

Note: The county cannot be maintained on the Edit Permanent Residence screen. After clicking the save button, the county will default based on the zip code entered. If the county is incorrect after saving the change to your Permanent Residence, please contact your HR office.

CRITICAL! If making an in-state or out-of-state change to the permanent residence, please ensure the tax withholding information is updated also. Please advise your HR/PY office of the change to ensure all applicable tax data types are validated.

Note: Updating your permanent address will NOT update the mailing address automatically.

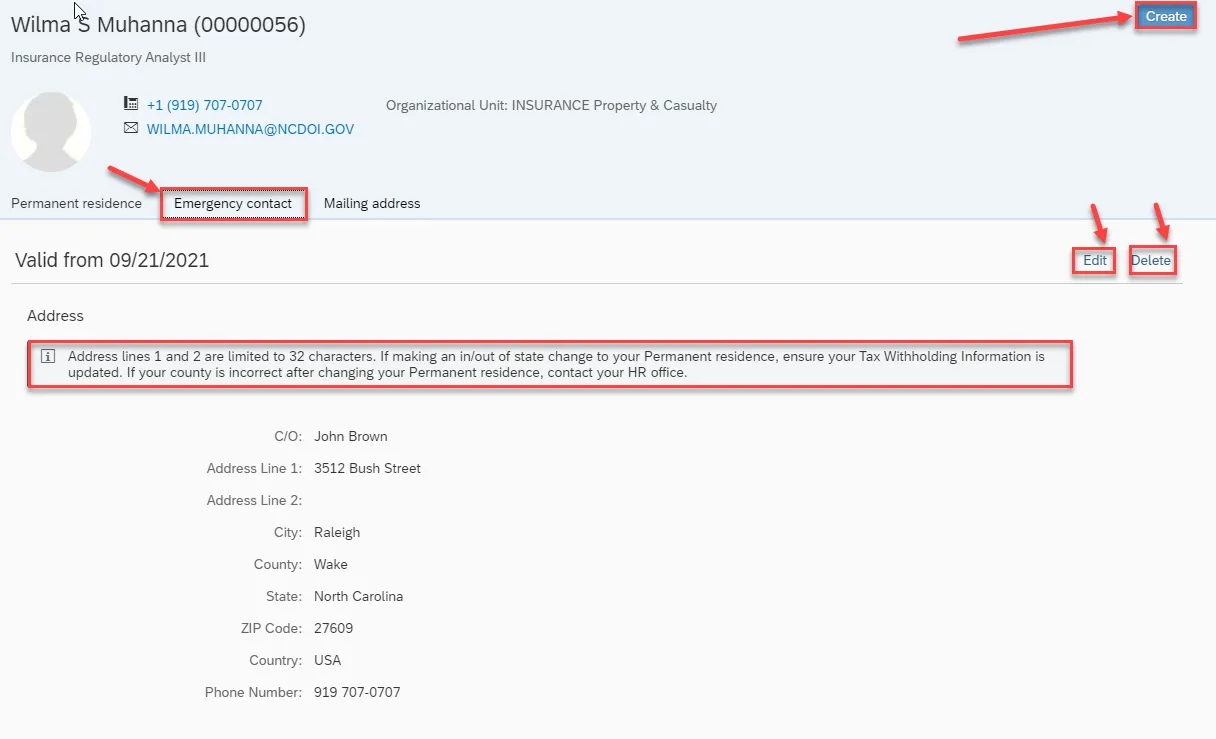

Step 4. Multiple Emergency contact addresses can be added. A telephone number is not required; however, it is highly recommended in case of emergency. To create an emergency contact, click on the Emergency Contact tab. Then click on the Create tab on the right edge of your screen. From the Emergency Contact tab, you can also Delete or Edit emergency contacts.

Note: You can add multiple Emergency Contacts.

Step 5. Once you click on Create you will be able to fill out the necessary information. Then click the Save button at the bottom of your screen.

Note: Emergency contact addresses are always updated on a current basis.

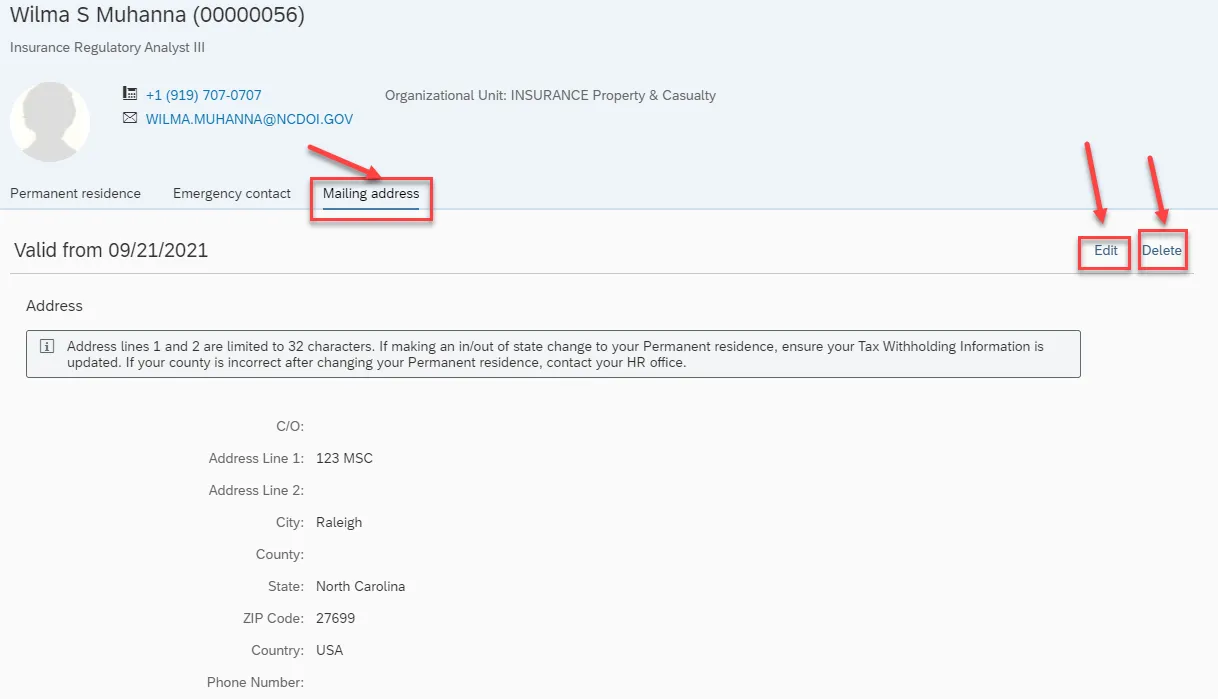

Step 6. It is important for the mailing address to be correct when it pertains to any written correspondence from the State regarding benefits, tax information, etc. If there is no mailing address setup in the Integrated HR-Payroll System, any written correspondence will be sent to the permanent residence.

Note: A Mailing Address is needed only if it is different than the Permanent Residence.

To edit the Mailing Address please click on the Mailing Address tab, then click the Create button to create a new mailing address or the Edit button on the right edge of your screen to change an existing Mailing Address. You can also Delete a Mailing Address from this tab.

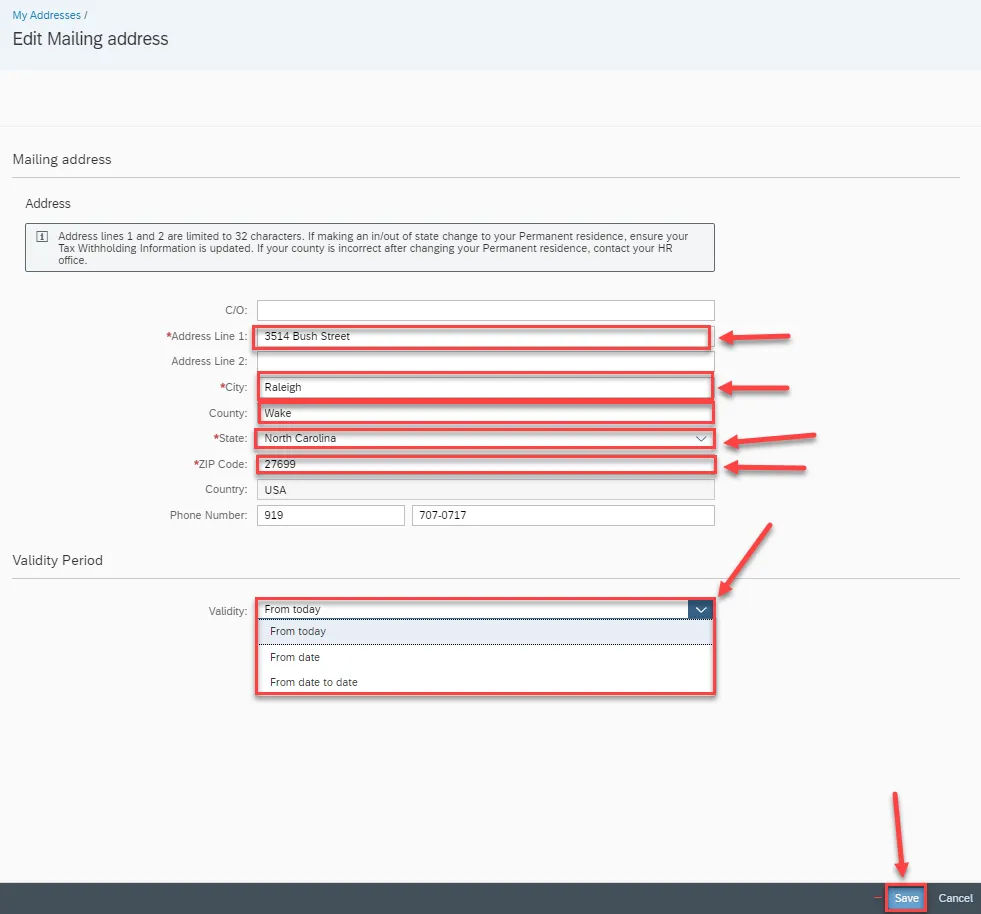

Step 7. Once you click on Edit and fill out the appropriate information, you can change the Validity. Then you can click Save.

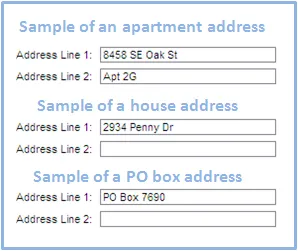

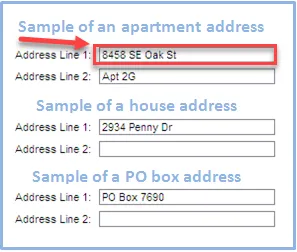

Note: Please follow this Sample of the Address as shown in the screenshot below. You do not need to complete Mailing Address if it is the same as your Permanent Address.

Step 8. Select one of the three options from the Validity Period section to choose when the change will take effect.

| From today: | The change will become effective immediately once you have saved. |

|---|---|

| From date: | Type in or click the date box to select the future date that the change will become effective. |

| From date to date: | Type in or click the date boxes to select the date when the change will start and when it will stop. |

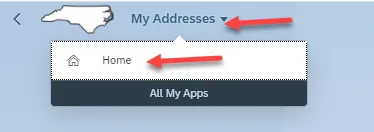

Step 9. To go back to the Homepage, click on My Addresses and then click on Home.