Purpose

The purpose of this Quick Reference Guide (QRG) is to provide a step-by-step explanation on how to Validate Invoice Price Variances in the North Carolina Financial System (NCFS).

Introduction and Overview

This QRG covers the explanation on how to validate invoice price variance that arise when the invoice item cost varies from the current average cost in the inventory organization.

Validate Invoice Price Variances

To validate invoice price variances in NCFS, please follow the steps below. There are 9 steps to complete this process.

Step 1. Log in to the NCFS portal with your credentials to access the system.

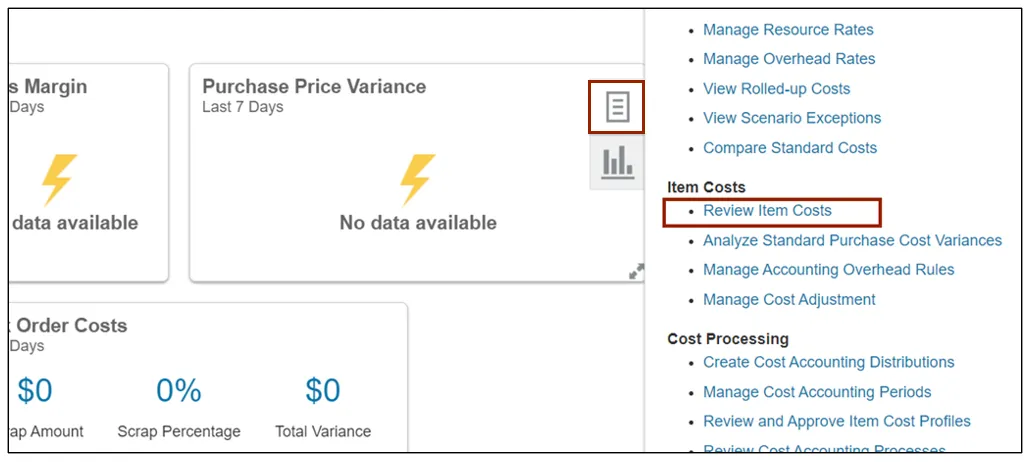

Step 2. On the Home page, under the Supply Chain Execution tab, click the Cost Accounting app.

Step 3. On the Cost Accounting page, click the Tasks icon. Under the Item Costs section, click Review Item Costs.

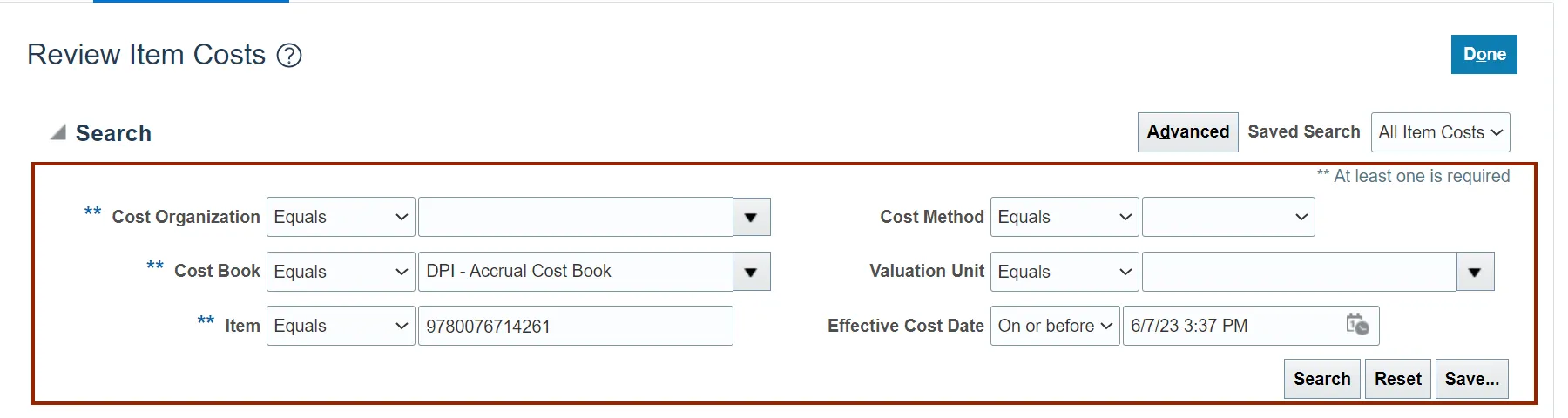

Step 4. On the Review Item Costs page, enter the required details in at least one field marked with [**] in the Search Criteria section and click the Search button.

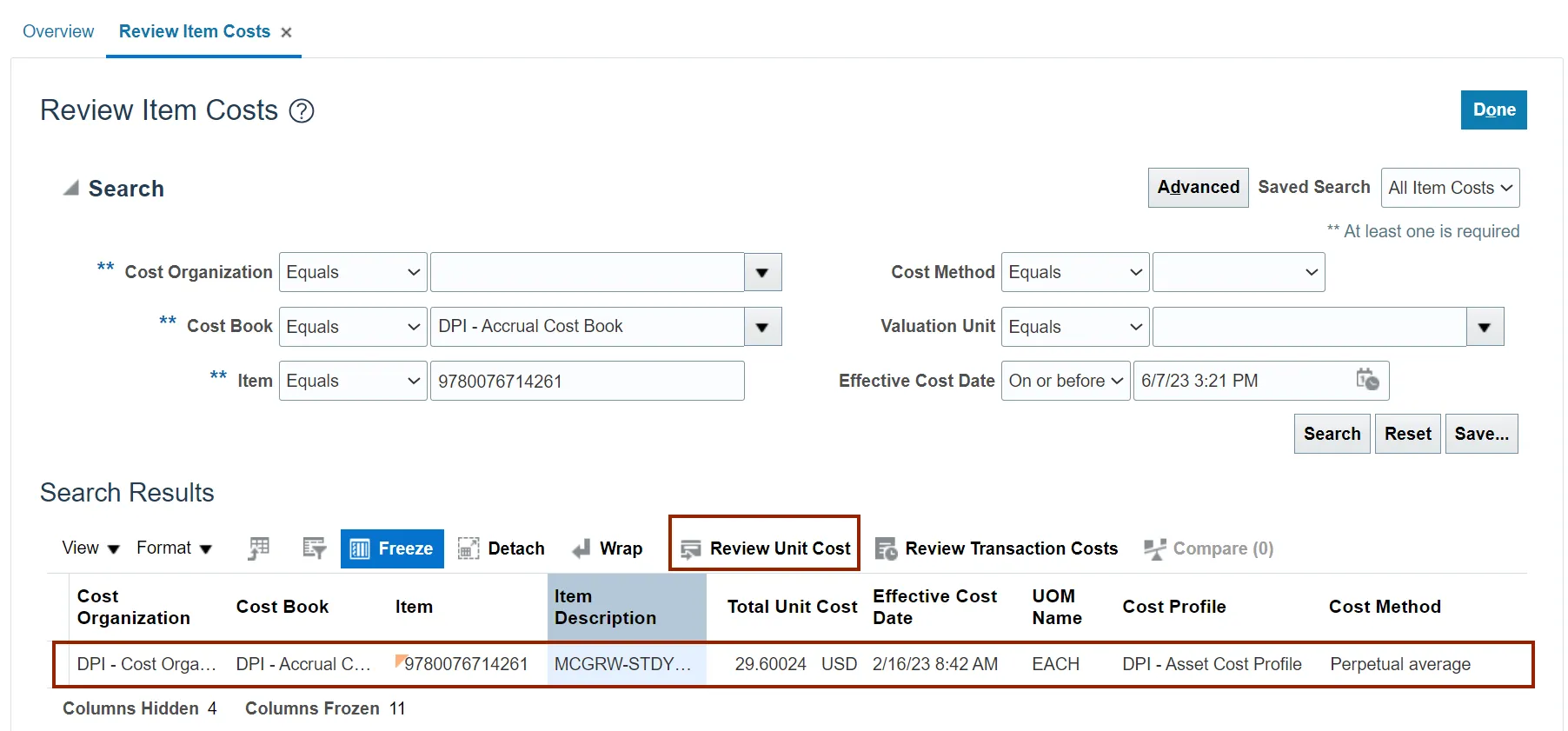

Step 5. Review Required Item Costs details. Click the Review Unit Cost button for the selected Item Costs.

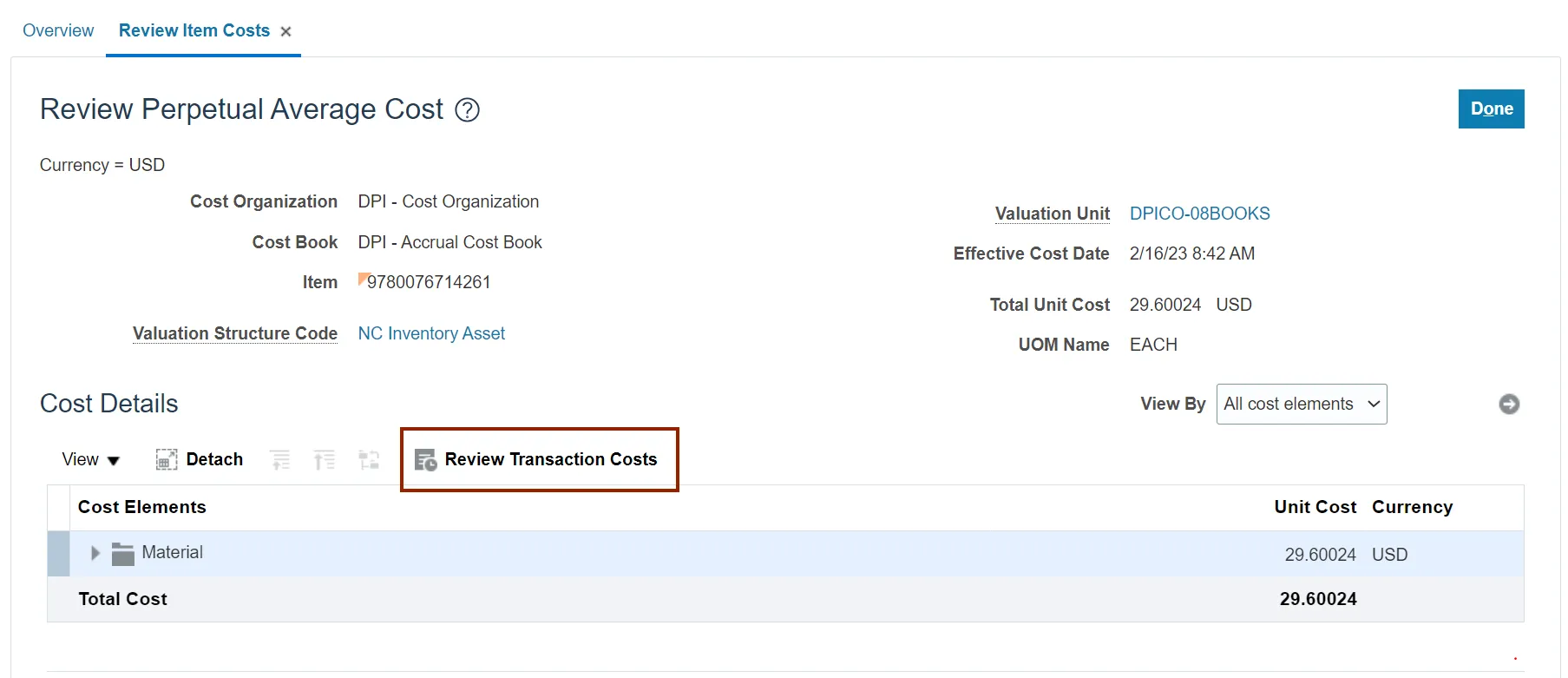

Step 6. On the Review Perpetual Average Cost page, click the Review Transaction Costs button.

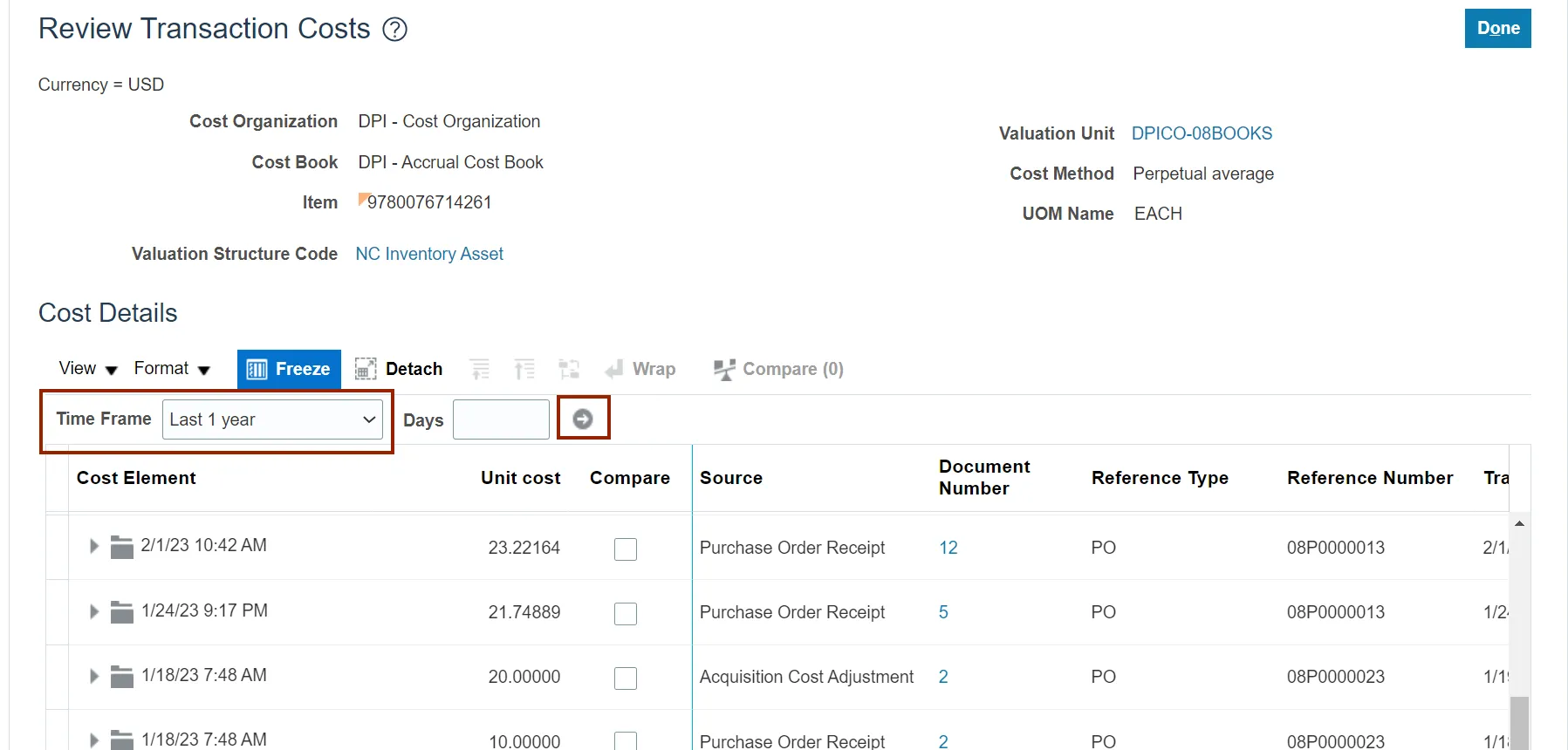

Step 7. Select the Time Frame drop-down choice list and then click the Arrow icon.

In this example, we choose Last 1 year.

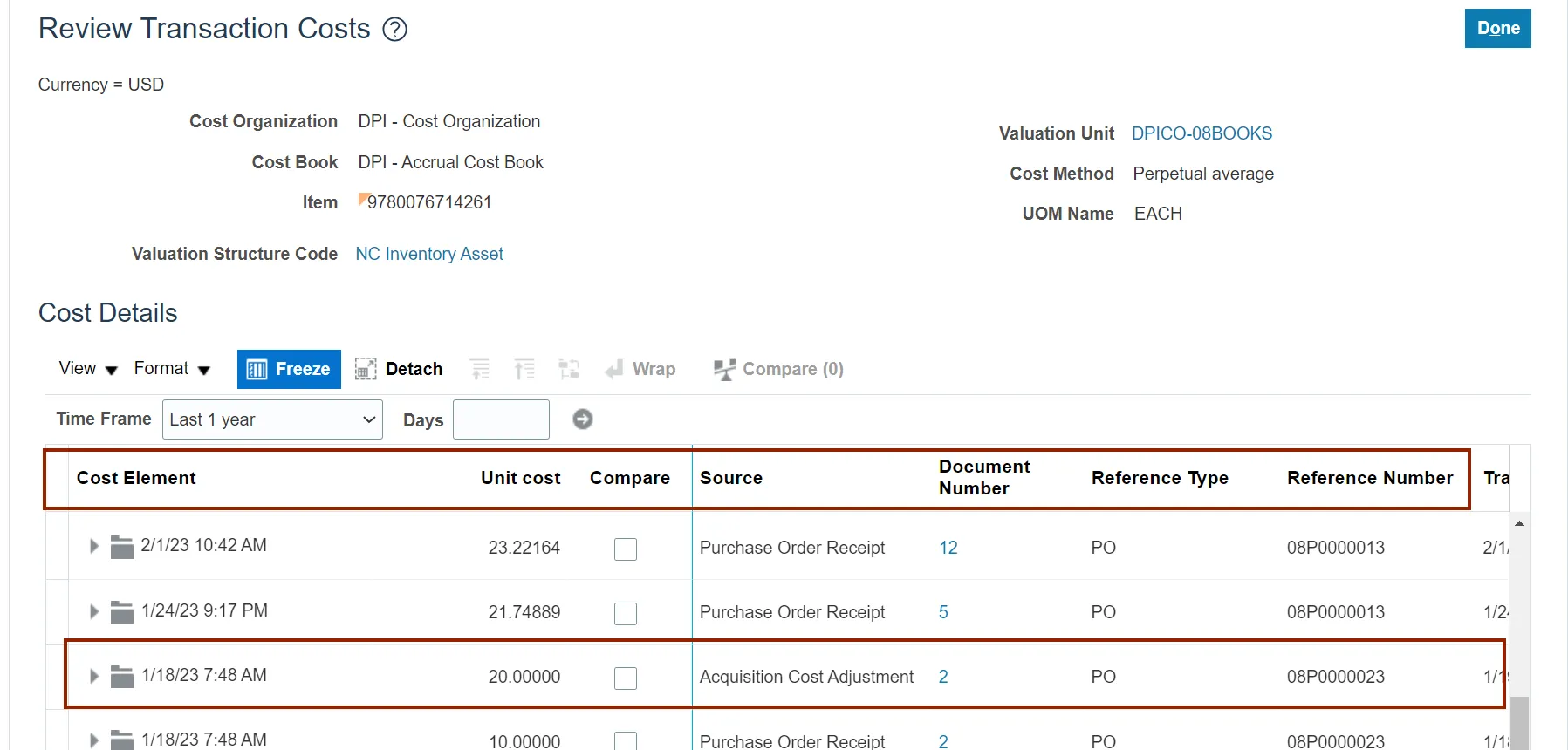

Step 8. Review the Cost Element, Unit cost, Source, Document Number, Reference Type, and Reference Number.

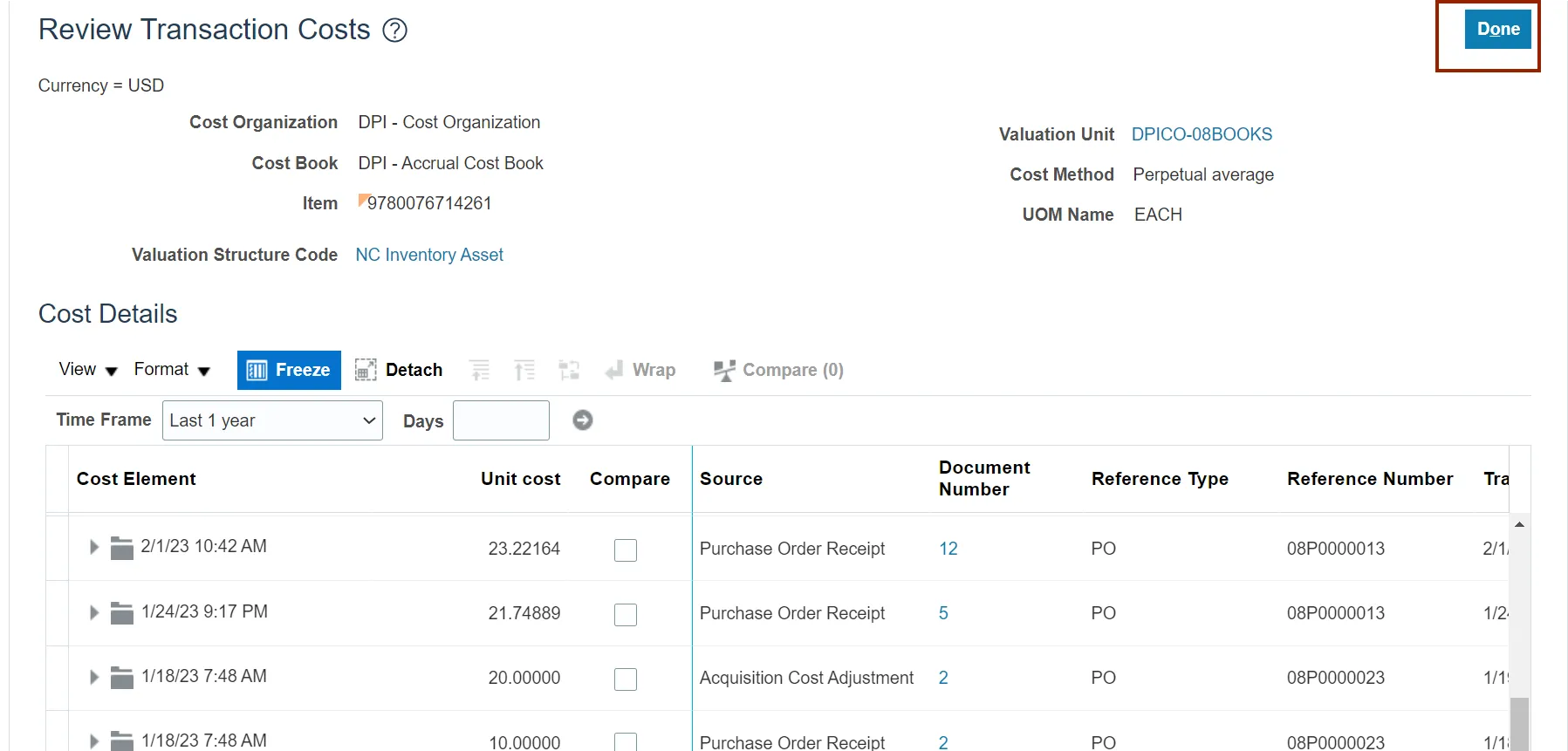

Step 9. Click the Done button.

Wrap-Up

Validate invoice price variance for items where item average cost is different from invoice price using the steps above in NCFS.

Additional Resources

- Virtual Instructor-Led Training (vILT)