Purpose

The purpose of this Quick Reference Guide (QRG) is to provide a step-by-step explanation of how to run depreciation in the North Carolina Financial System (NCFS).

Introduction and Overview

This QRG covers the process of calculating depreciation on assets. Depreciation is the reduction in the value of an asset over time. Depreciation of a fixed asset begins when the fixed asset is ready for its intended use. The Calculated (Straight-Line) Depreciation Method is used to calculate the depreciation equally monthly over the life (in years) of an asset. Depreciation is performed when the asset book is closed during either Single Book Close or All Books Close.

User Tip

The following are prerequisites to run depreciation:

-

Process all incomplete transactions.

Run Depreciation

To run depreciation, please follow the steps below.

There are 7 steps to complete this process for Method 1 and 11 steps to complete this process for Method 2.

Method 1: Single Book Close

Step 1. Log in to the NCFS portal with your credentials to access the system.

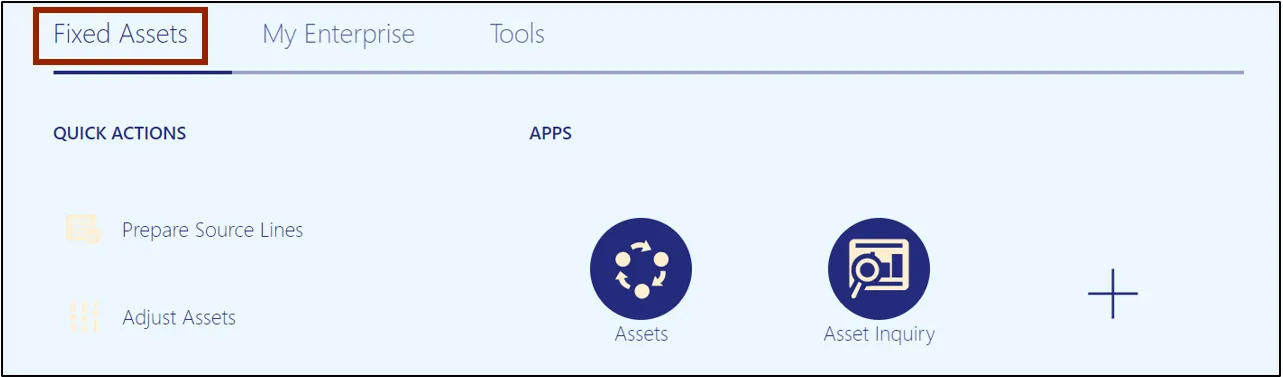

Step 2. On the Home page, click the Fixed Assets tab.

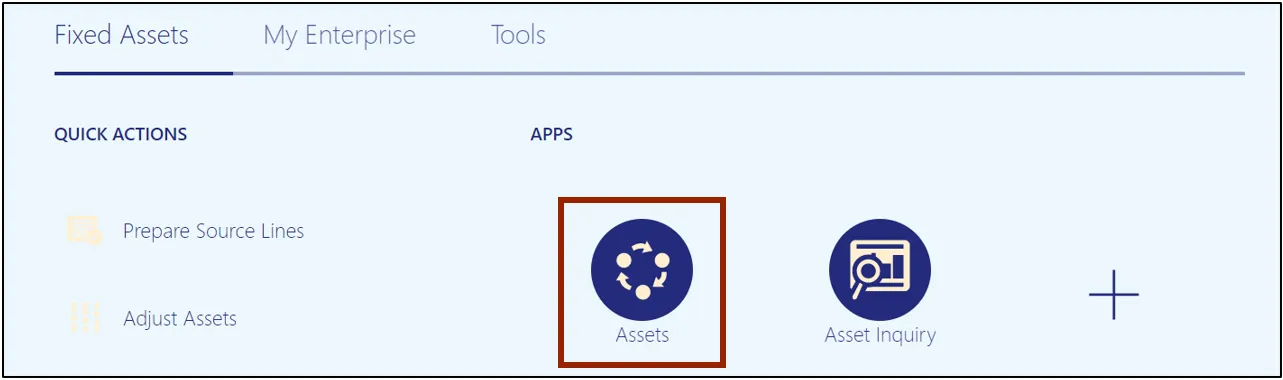

Step 3. Click the Assets app.

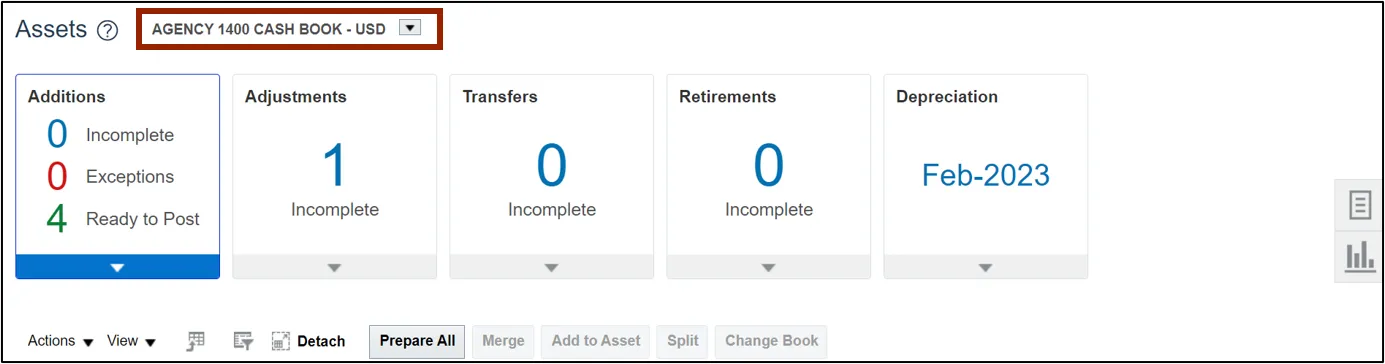

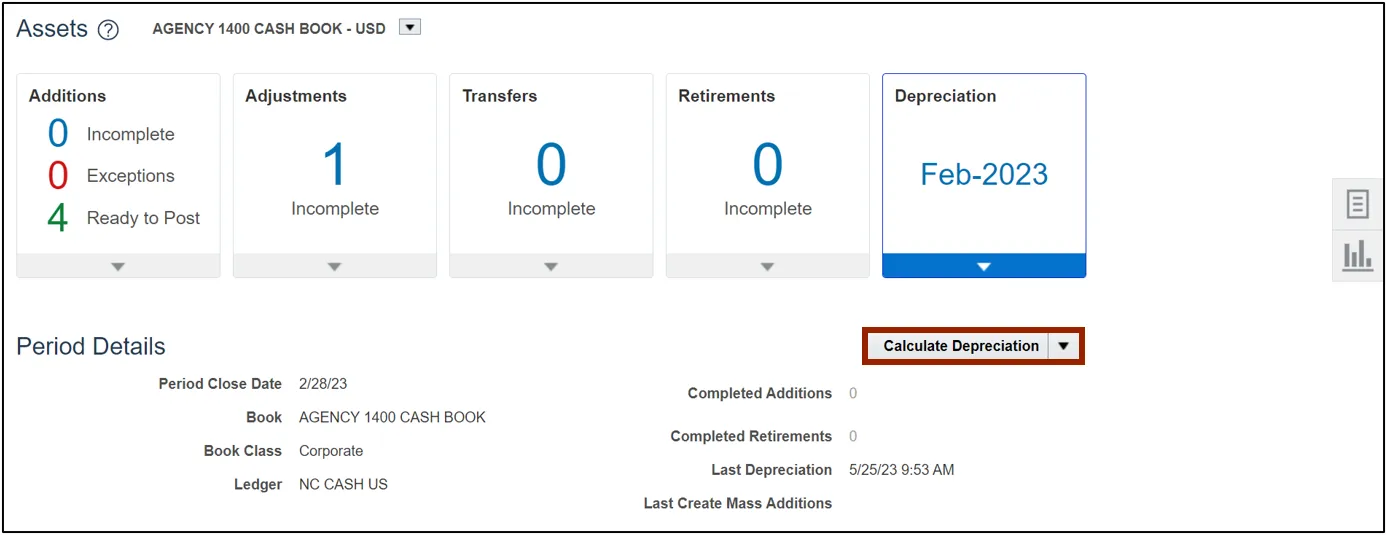

Step 4. Select the appropriate Asset Book by clicking the drop-down choice list icon.

In this example, we choose AGENCY 1400 CASH BOOK.

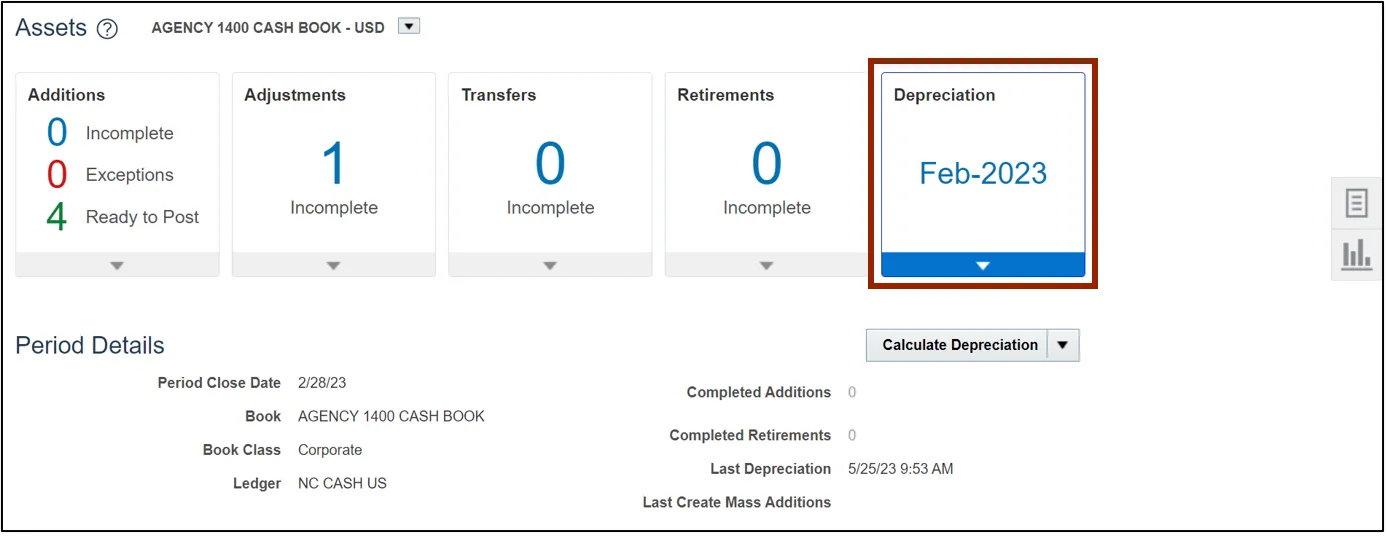

Step 5. Select the Depreciation info tile.

Step 6. Click the Calculate Depreciation button.

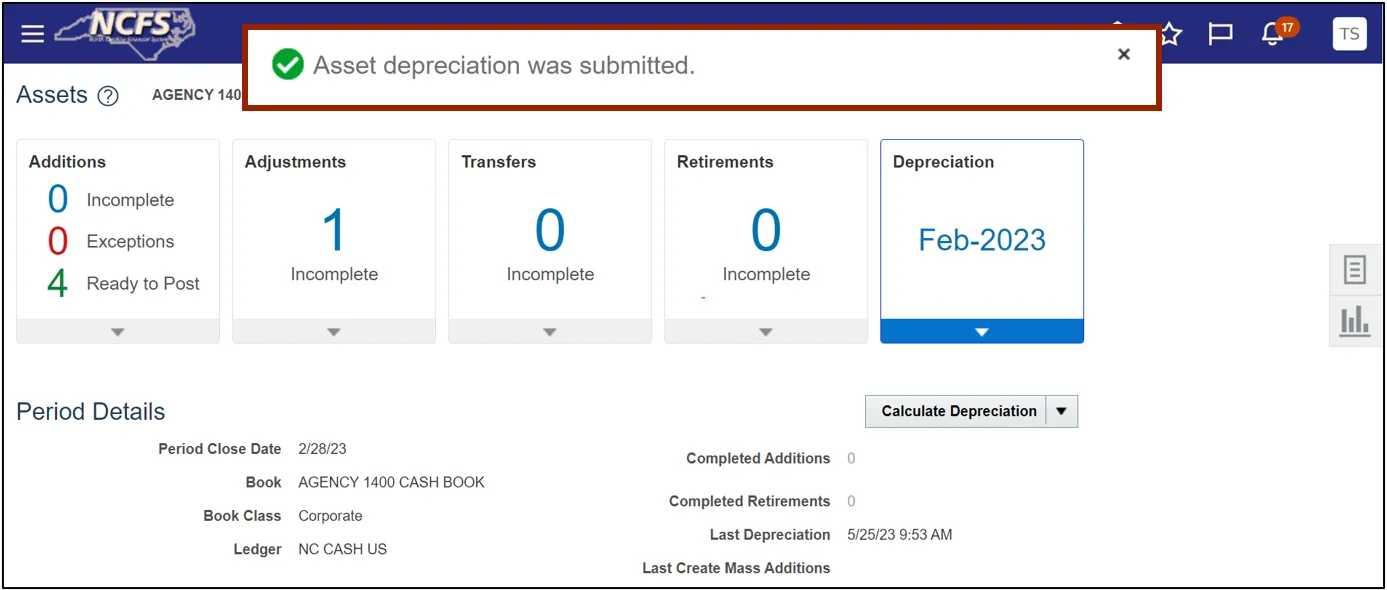

Step 7. A Confirmation pop-up appears, which indicates that the asset depreciation is successfully submitted.

Method 2: All Books Close

Step 1. Log in to the NCFS portal with your credentials to access the system.

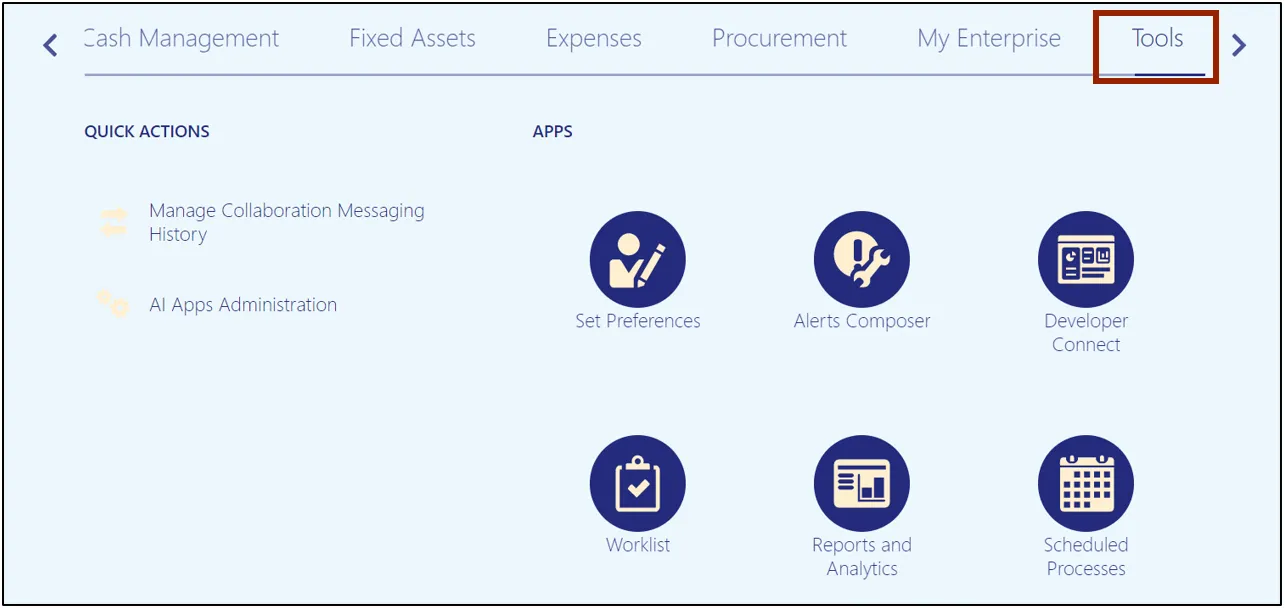

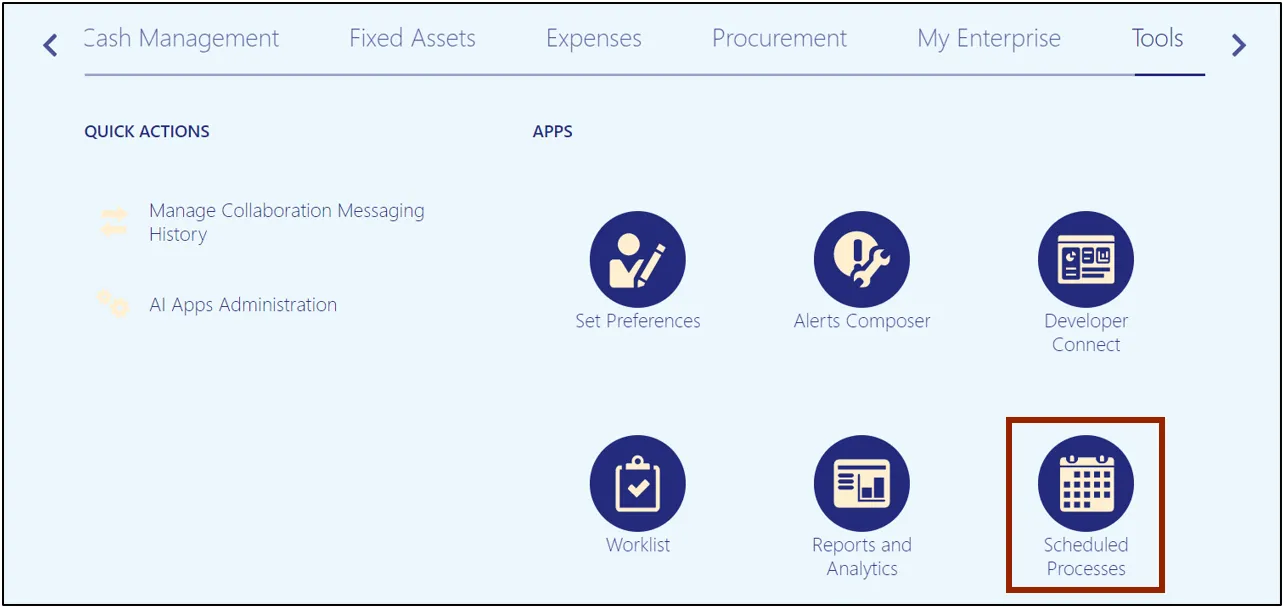

Step 2. On the Home page, click the Tools tab.

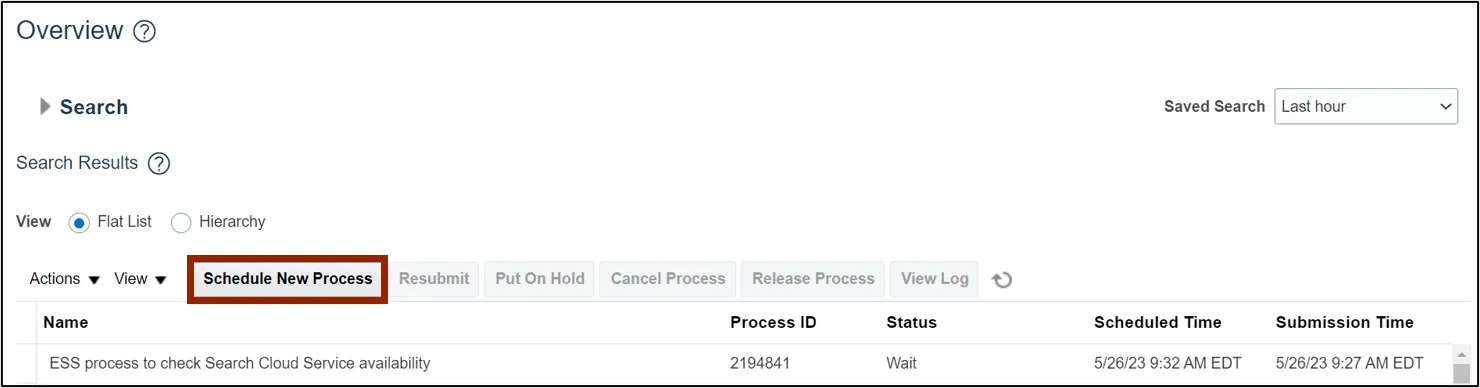

Step 3. Click the Scheduled Processes app.

Step 4. Click the Schedule New Process button.

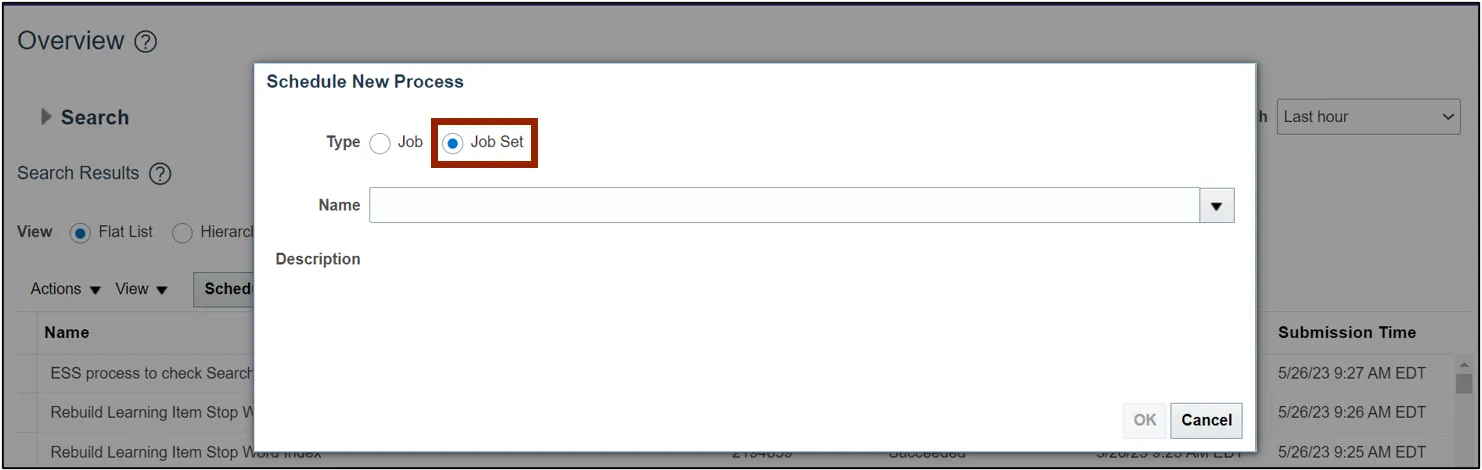

Step 5. Select the Job Set radio button.

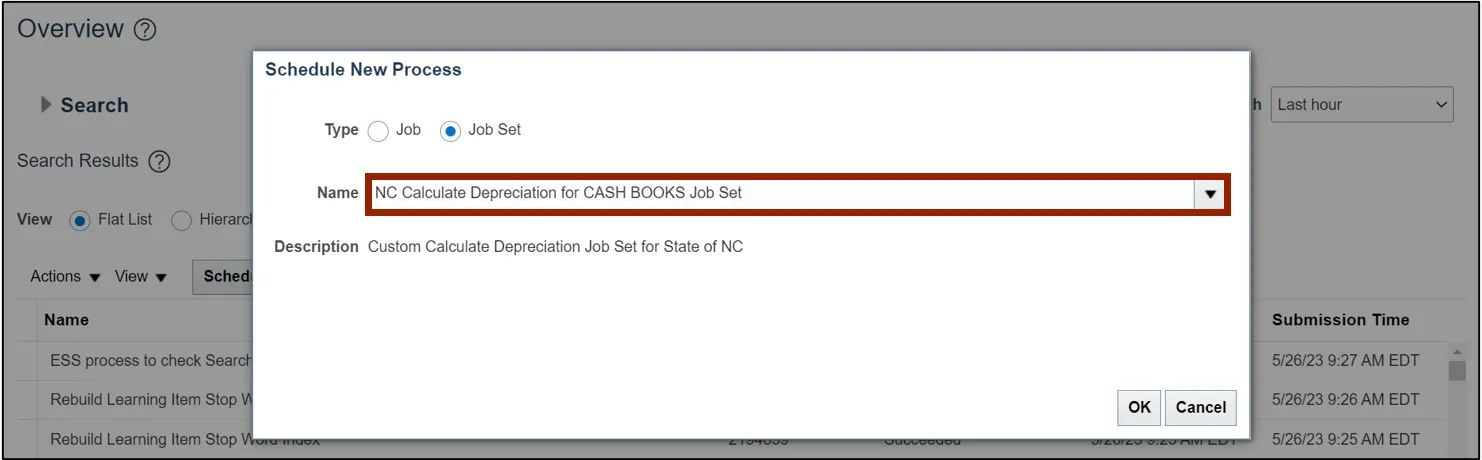

Step 6. On the Name field, select NC Calculate Depreciation.

In this example, we choose NC Calculate Depreciation for CASH BOOKS Job Set.

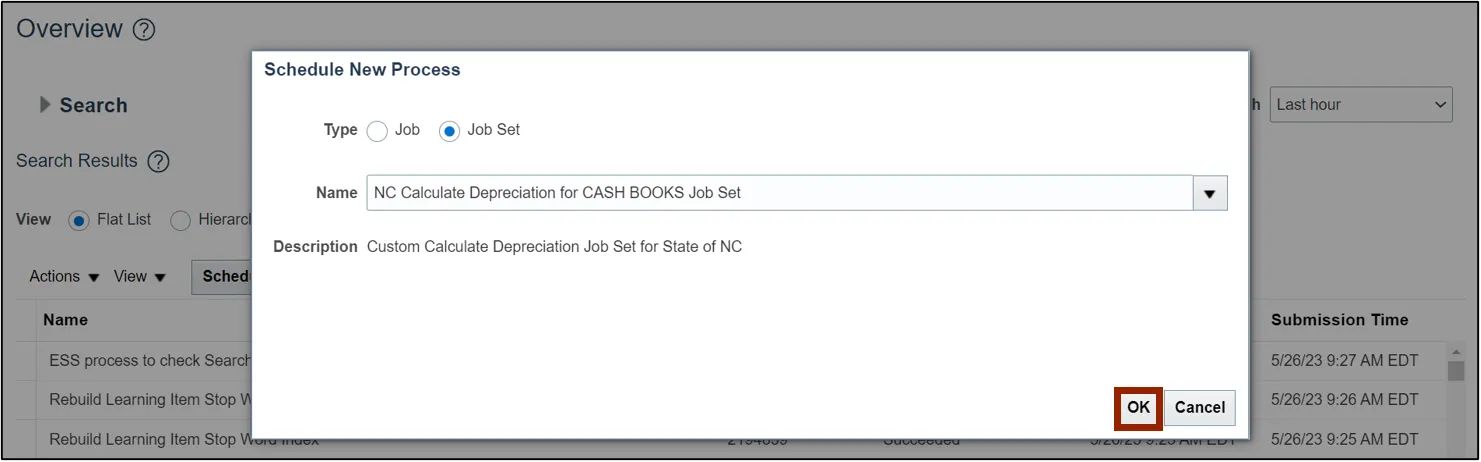

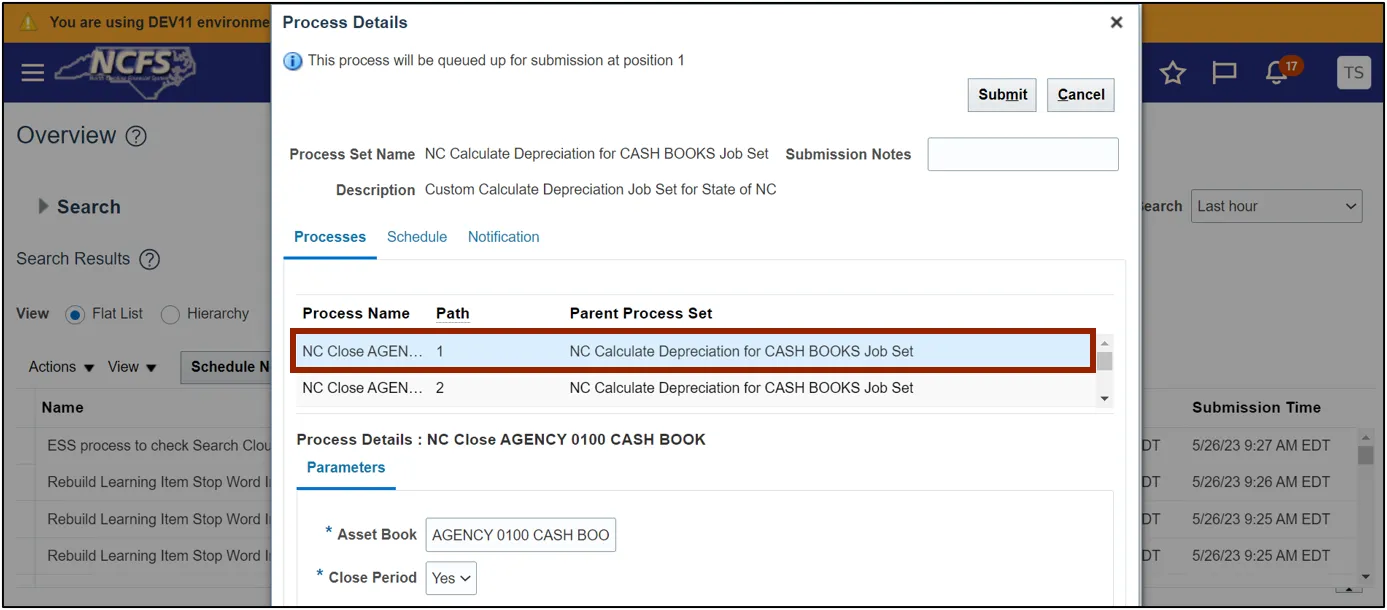

Step 7. Click the OK button.

Step 8. Select the required Process Name.

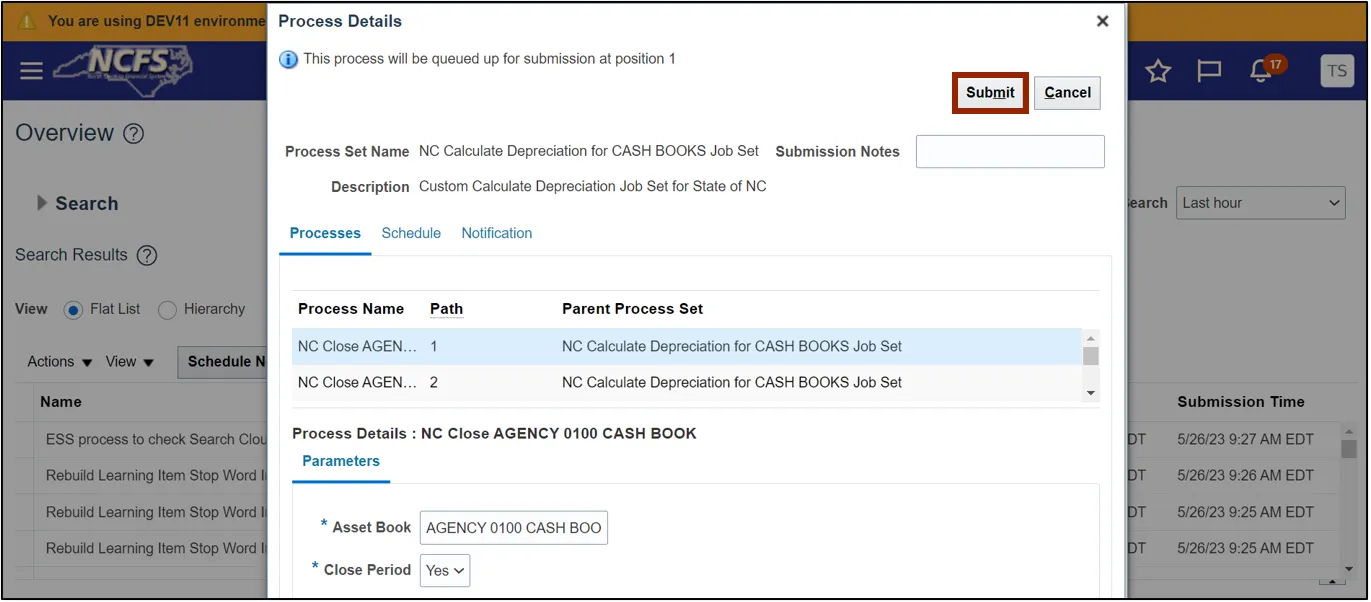

Step 9. Click the Submit button.

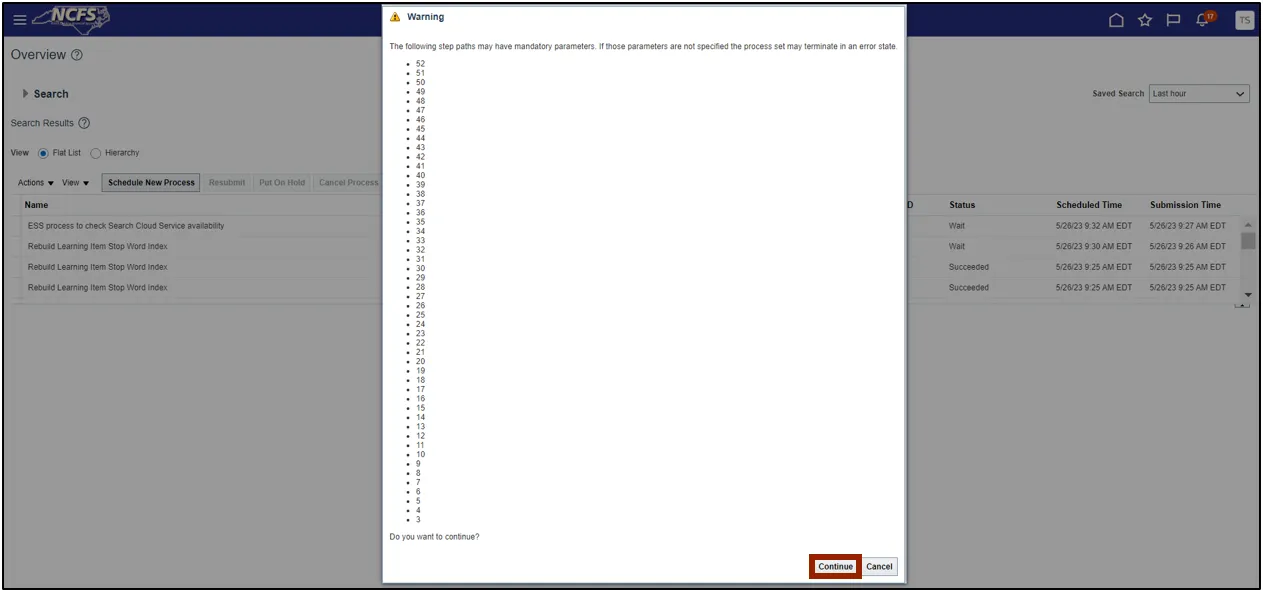

Step 10. A Warning pop-up appears. Click the Continue button.

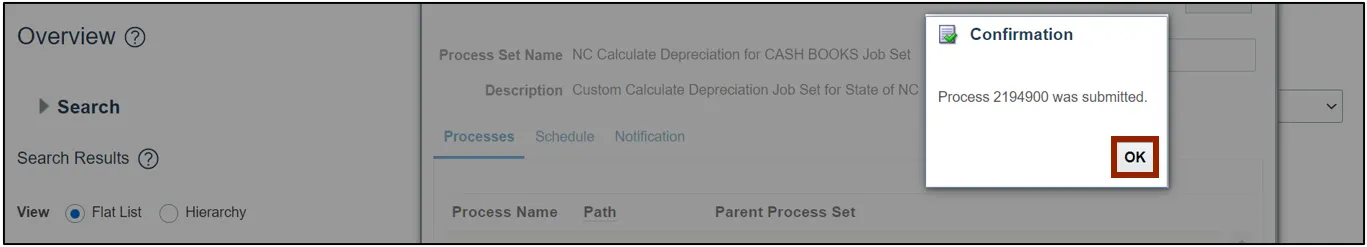

Step 11. The Confirmation pop-up appears. Click the OK button.

User Tip

Repeat the same process to run depreciation for GASB Books by selecting NC Calculate Depreciation for GASB BOOKS Job Set in Step 6 of Method 2.

Wrap-Up

Run depreciation for assets and close asset books by following the steps above.

Additional Resources

- Virtual Instructor-Led Training (vILT)