Purpose

The purpose of this Quick Reference Guide (QRG) is to provide a step-by-step explanation of how to Audit Expense Reports in the North Carolina Financial System (NCFS).

Introduction and Overview

This QRG covers the audit of expense reports in NCFS which will enable you to confirm if all expenses are within policy and that required receipts are provided and valid for the underlying expense.

Audit Expense Reports

To Audit Expense Reports in the NCFS, please follow the steps below. There are 16 steps to complete this process.

Step 1. Log in to the NCFS portal with your credentials to access the system.

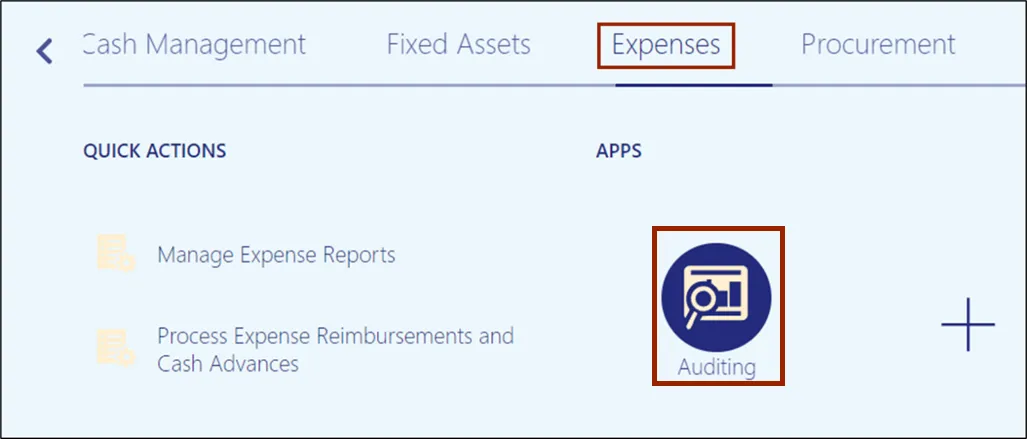

Step 2. On the Home page, click the Expenses tab and click the Auditing app.

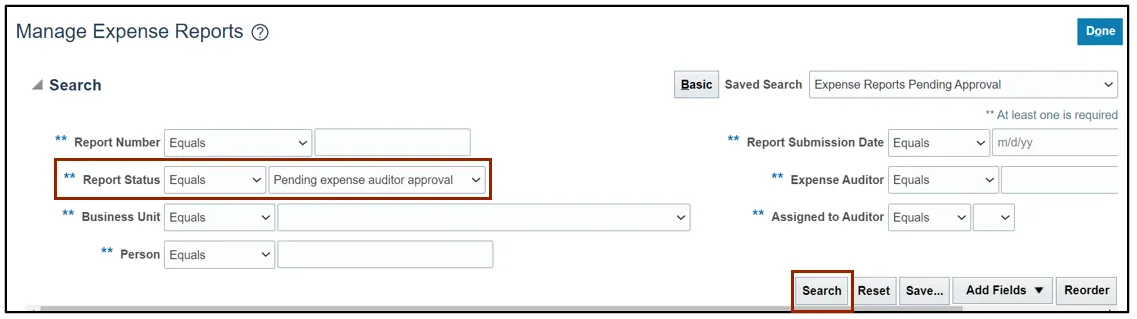

Step 3. Click the Tasks icon and select Manage Expense Reports.

Step 4. On the Manage Expense Reports page, the Search results default to Expense Reports “Pending expense auditor approval”. Click the Search button.

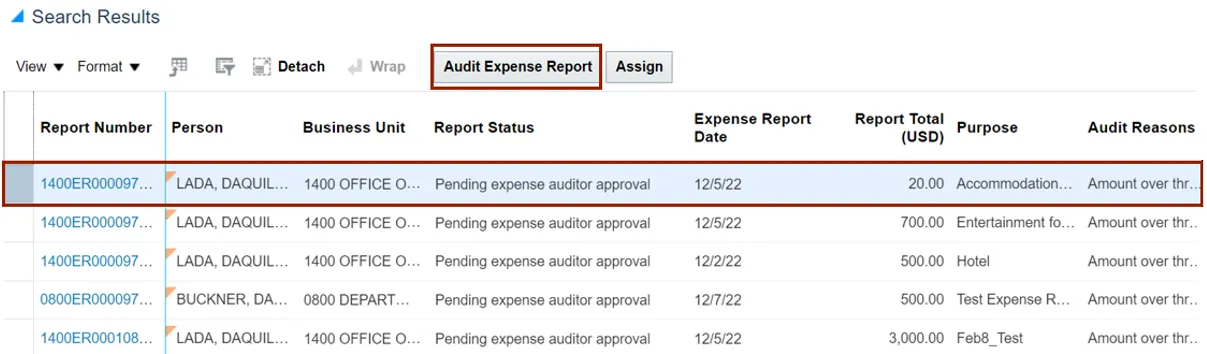

Step 5. Under the Search Results section, highlight the Expense Report to be audited and click the Audit Expense Report button.

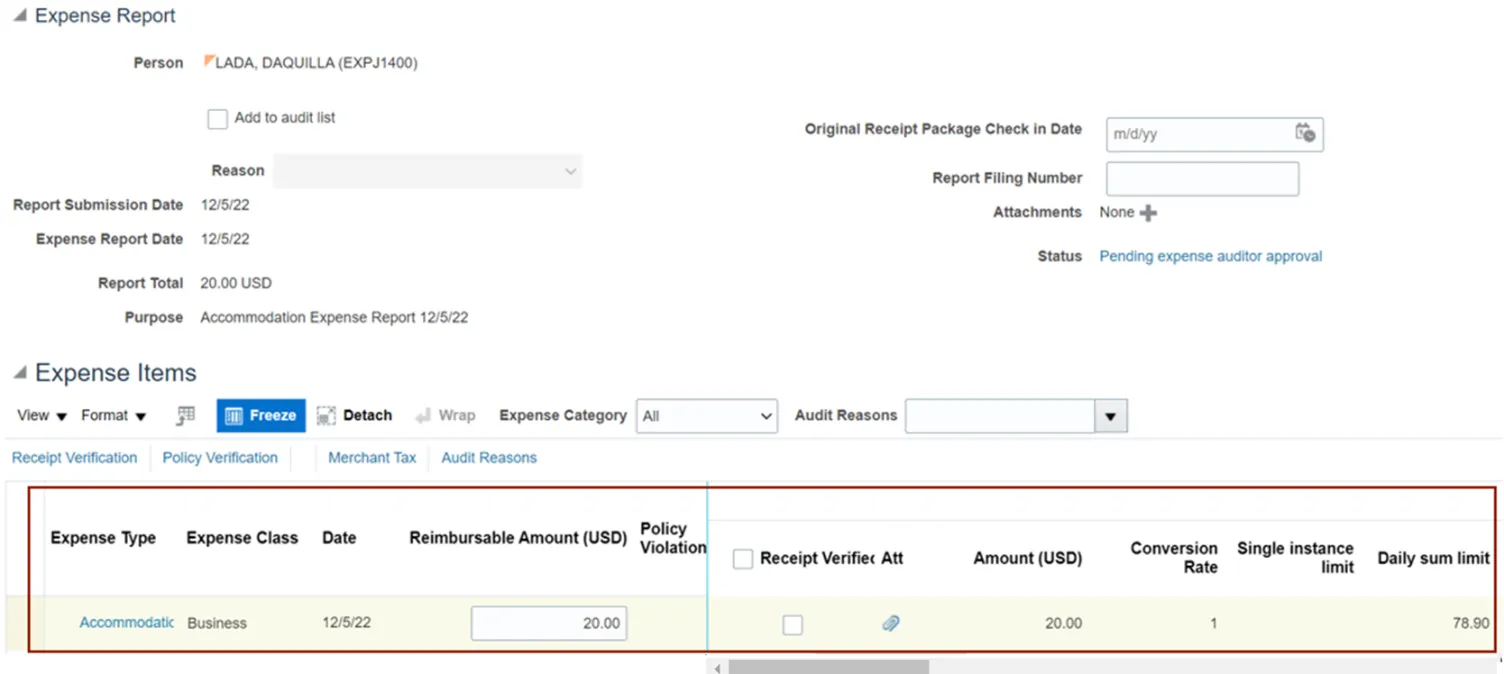

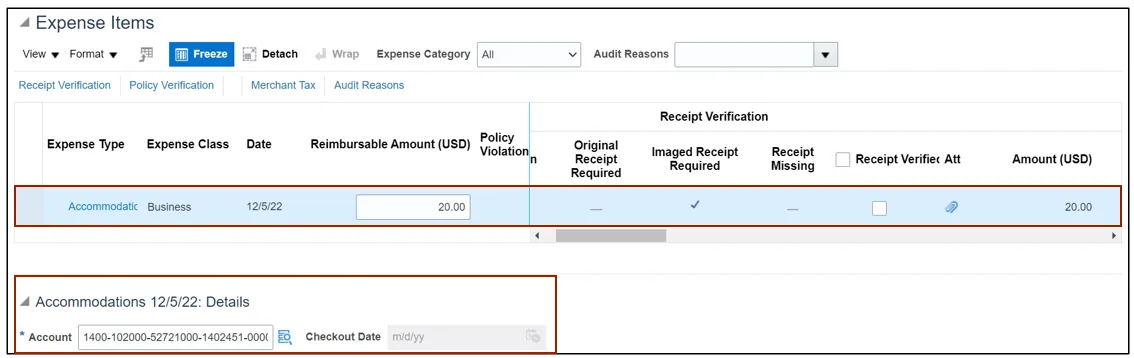

Step 6. On the Audit Expense Report page, review the Expense Items details including Expense Types, Reimbursable Amounts, Receipt Attachments columns, and other Expense Report submission/approval comments.

Note: you can scroll to the right to view more columns.

Step 7. Click the Expense Type row to view additional details of the expenses.

In this example, we choose Accommodation. The details are displayed below.

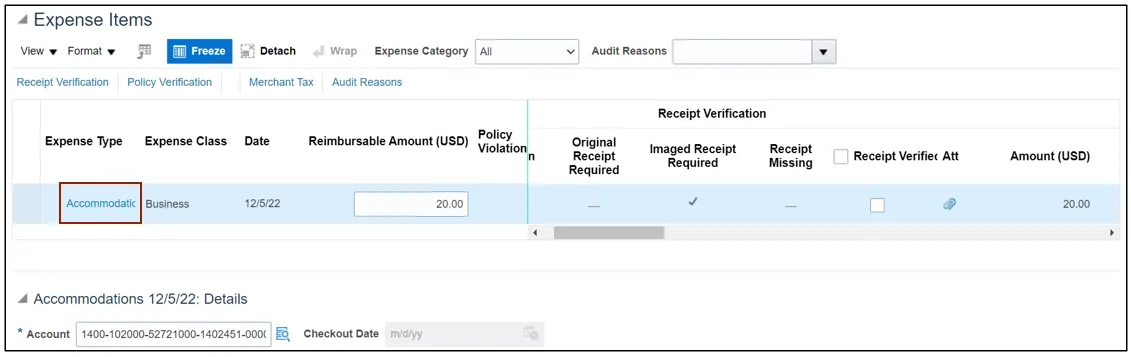

Step 8. Click the Expense Type link to view all the report details.

In this example, we choose Accommodation.

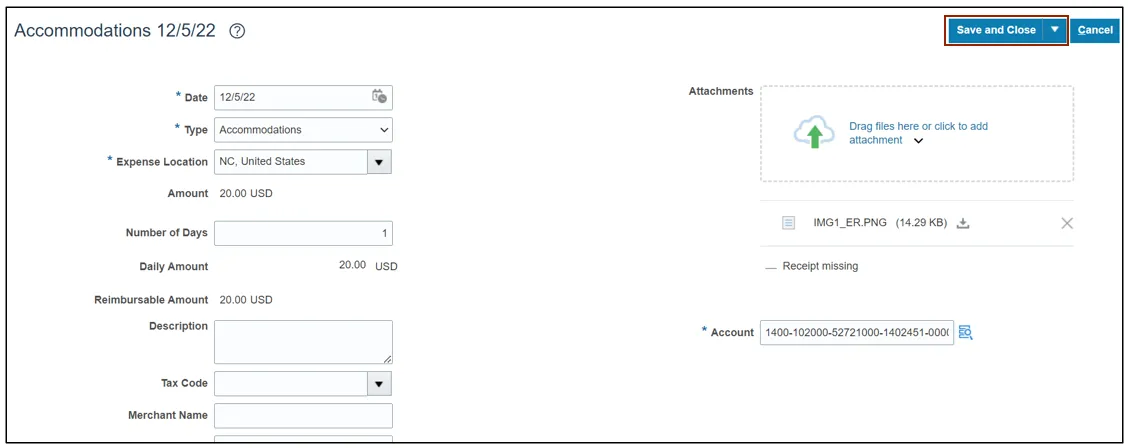

Step 9. The Expense Item Detail page opens. Review and validate the Expense Item details and any attachments, and then click the Save and Close button.

Note: If a specific Expense Type is not eligible for reimbursement it would need to be Short Paid.

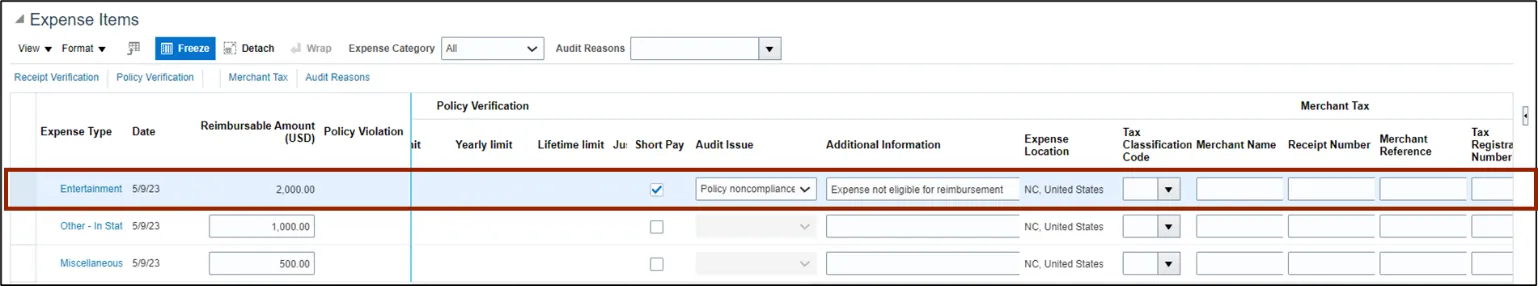

Step 10. Select the Expense Type not eligible for reimbursement.

In this example, we choose Entertainment.

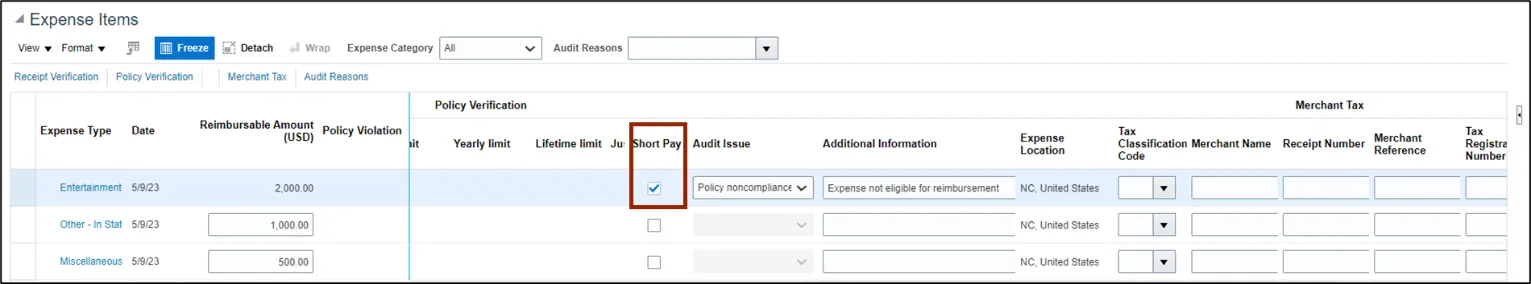

Step 11. Click the Short Pay checkbox for Expense Type not eligible for reimbursement.

In this example, we choose Entertainment.

Note: If an item is selected as ‘Short Pay’, that item is completely removed from the Expense Report and goes back to the Expense Preparer.

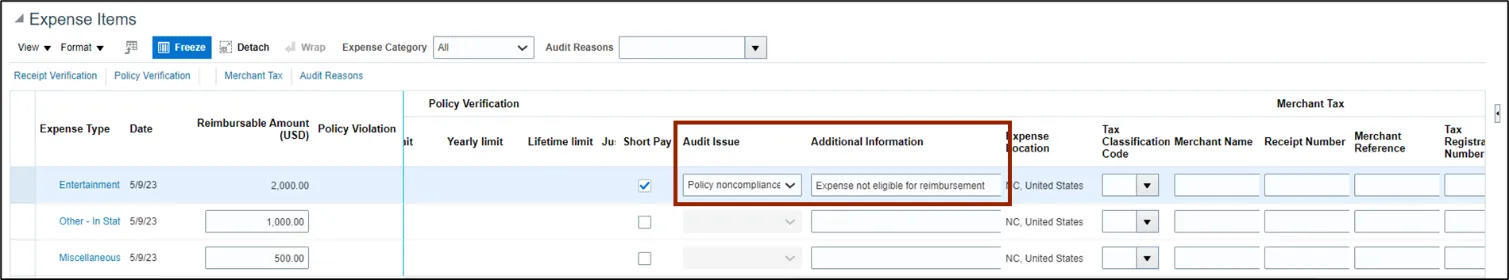

Step 12. Enter Audit Issue and Additional Information as required to show why the Expense Type is not eligible for reimbursement.

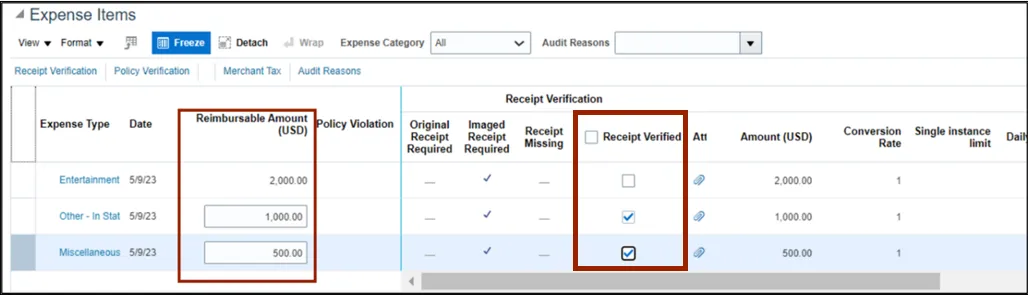

Step 13. Alternatively, if the full amount of an expense line item is not eligible for reimbursement, then update the Reimbursable Amount to the correct eligible amount. Validate the other Expense Items and then click the Receipt Verified checkbox to validate the expense.

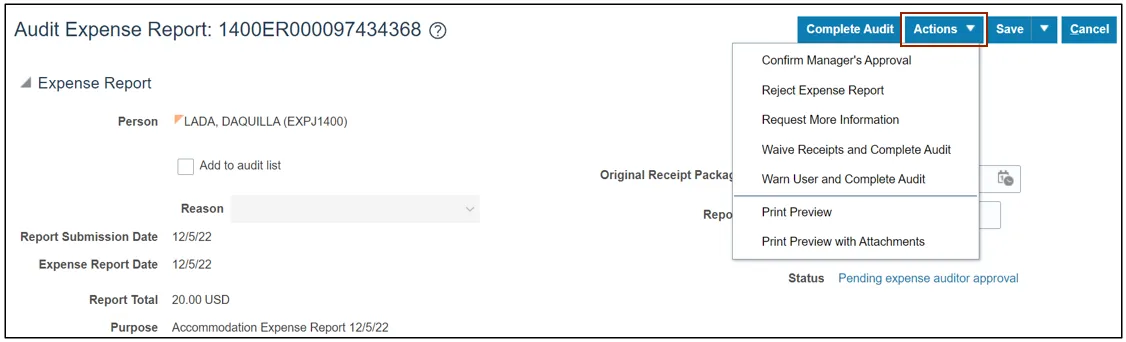

Step 14. For taking any other action based on the review, click the Actions button and select the required option from the drop-down choice list.

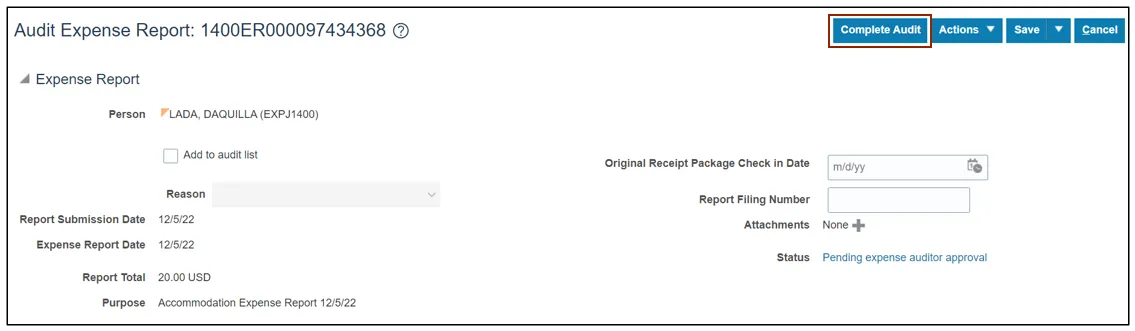

Step 15. If all the expenses incurred are in compliance with NC Policies, click the Complete Audit button.

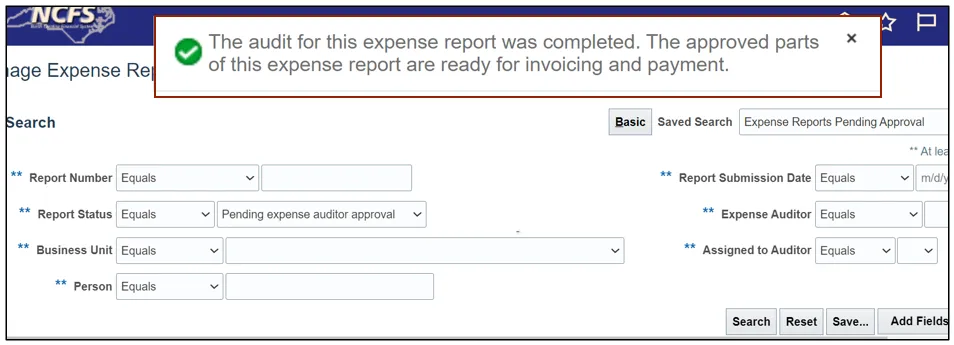

Step 16. A Confirmation pop-up appears.

Wrap-Up

Audit Expense Reports using the steps above, to view the Complete, Accept, or Reject an Audit.

Additional Resources

- Virtual Instructor-Led Training (vILT)