Purpose

The purpose of this Business Process Procedure is to explain how to report employee daily meals expense compensation in the Integrated HR-Payroll System.

Per IRS Publication 5137 – Fringe Benefit Guide, reimbursements received by an employee who travels on business outside of the area of his/her tax home (defined in IRS Publication 5137) may be excludable from wages. Qualifying expenses for travel are excludable if they are incurred for temporary travel on business away from the general area of the employee’s tax home. To be excludable as reimbursements, the travel must be temporary and be substantially longer than an ordinary day's work, requiring an overnight stay or substantial sleep or rest.

- For a reimbursement of an expense for business travel to be excludable from income, including meals and lodging, a taxpayer must travel "away from home" in the pursuit of business on a temporary basis. The statutory phrase "away from home" has been interpreted by the U.S. Supreme Court to require a taxpayer to travel overnight, or long enough to require substantial "sleep or rest"). Thus, merely working overtime or at a great distance from the taxpayer's residence does not create an exclusion for reimbursements for travel expenses if the taxpayer returns home without spending the night or stopping for substantial "sleep or rest."

Effective 7/1/2018, State agencies must follow the Travel Policies for State Employees outlined in the State Budget Manual to reimburse/pay employee travel expenses. If the Department Secretary or Agency Head elects to allow employee reimbursement of breakfast and/or dinner meals for day travel when employees are not in overnight travel status, these reimbursements MUST be processed through the State’s payroll system to ensure withholding of taxes for meal compensation.

Please use the following directions for further guidance:

- Any daily meal compensation associated with non-overnight travel and that is permissible to be reimbursed, must be entered in the Integrated HR-Payroll system using wage type 2535. This wage type will pay the employee the authorized meal reimbursements per the approved taxable expense reimbursement form and withhold the appropriate taxes.

- Any taxable daily meals reimbursed, in error, through the accounts payable system must be processed using the wage type 2535 – Meals taxable, non-reimbursable in the Integrated HR-Payroll System. These meals are subject to employment tax withholding and reporting. The wage type 26AC (agency check) needs to be entered for the same amount as the taxable meals. This wage type will reimburse the agency the amount of the taxable meals. The wage type 26AC will post to Salary and Wages. The agency will need to create a journal entry to move the entry to the account that the meals were paid from. The entry of wage type 26AC will also prevent the employee from receiving additional compensation. Appropriate taxes for the meals will be withheld from the employee’s earnings.

Procedure

There are 7 steps to complete this process.

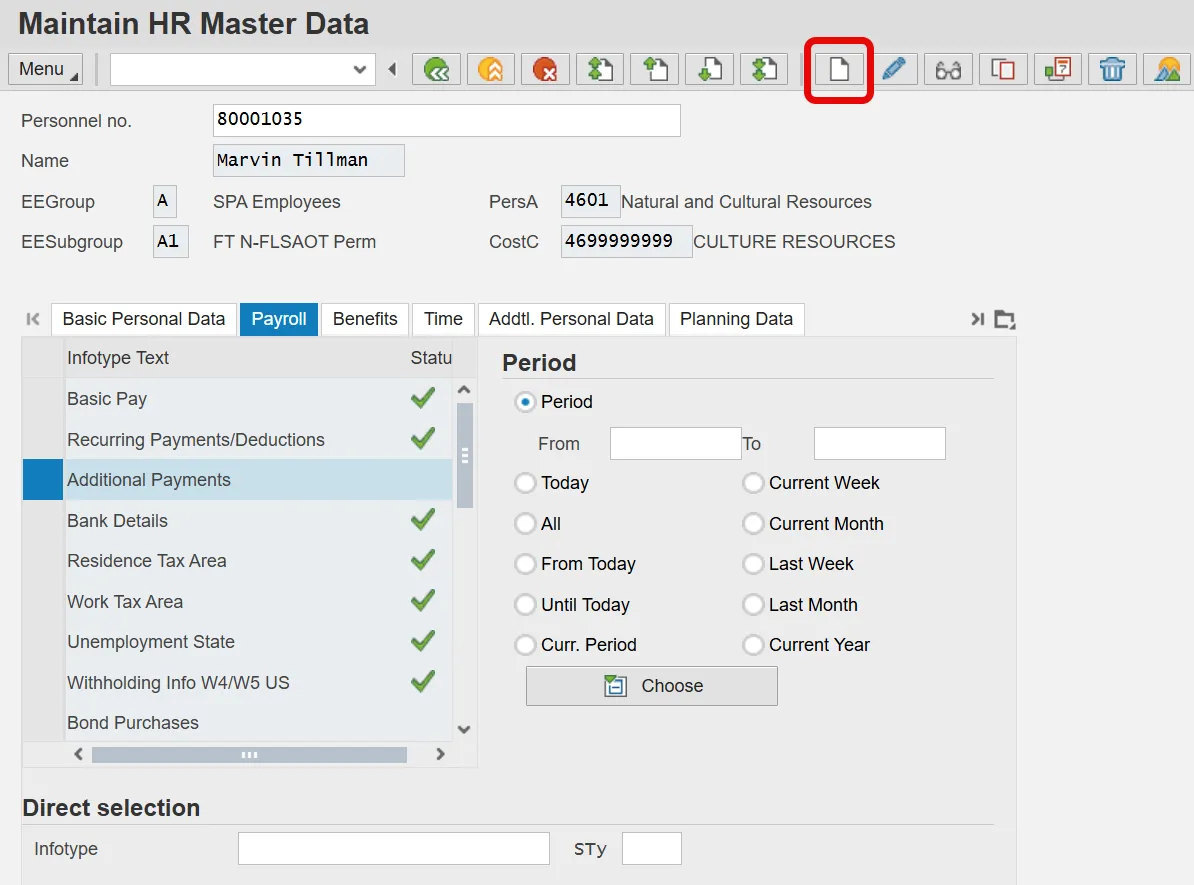

Step 1. Go to transaction PA30 (Maintain Master Data File).

Step 2. Enter Employee Identification Number (PERNR).

Step 3. Select Additional Payments Infotype (IT0015) under the Payroll Tab.

Step 4. Click the Create (F5) button. The Additional Payments screen displays.

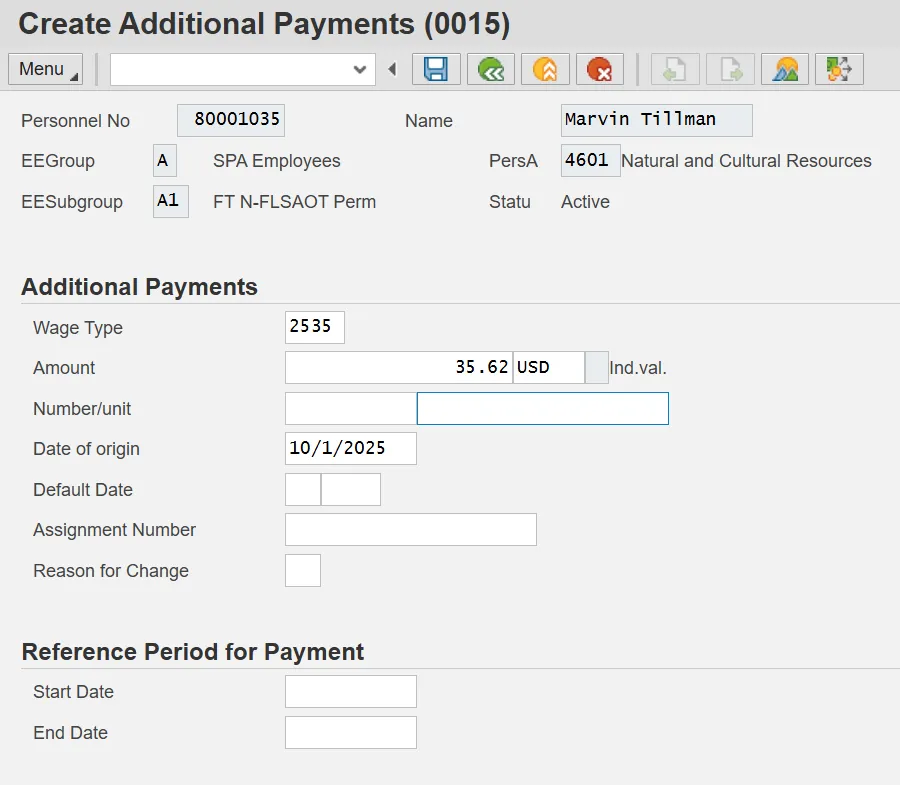

Step 5. Complete Infotype IT0015 (Additional Payments). Enter the following data:

- Wage type

- Dollar amount

- Date of origin

Step 6. Click Save to return to the initial screen.

Step 7. Repeat process for additional wage types if necessary.

The meals expense amounts display in the Total Other Pay section of the remuneration statement.

Note: For additional assistance in keying data in IT0015, reference the PY-24 Maintain One Time Payment Deduction 0015 BPP.