Purpose

The purpose of this Business Process Procedure is to explain how to enter a recurring deduction or payment that is either deducted from an employee’s pay or paid to an employee in the Integrated HR-Payroll System.

Trigger

Use this procedure to enter a recurring deduction or payment that is either deducted from an employee's pay or paid to an employee.

Business Process Procedure

Use this procedure to enter recurring payments or deductions. Examples of this transaction would be:

- Cell Phone Supplement

- Parking

- Membership Dues

Access Transaction

Via Menu Path: SAP menu >> Human Resources >> Personnel Management >> Administration >> HR Master Data >> PA30 – Maintain

Via Transaction Code: PA30

Procedure

There are 13 steps to complete this process.

Step 1. Update the following required and optional fields.

| Field Name | Description | R/O/C | Values |

|---|---|---|---|

| Command | White alphanumeric box in upper left corner used to input transaction codes. | R |

Enter value in Command. Example: PA30 |

Step 2. Click Enter.

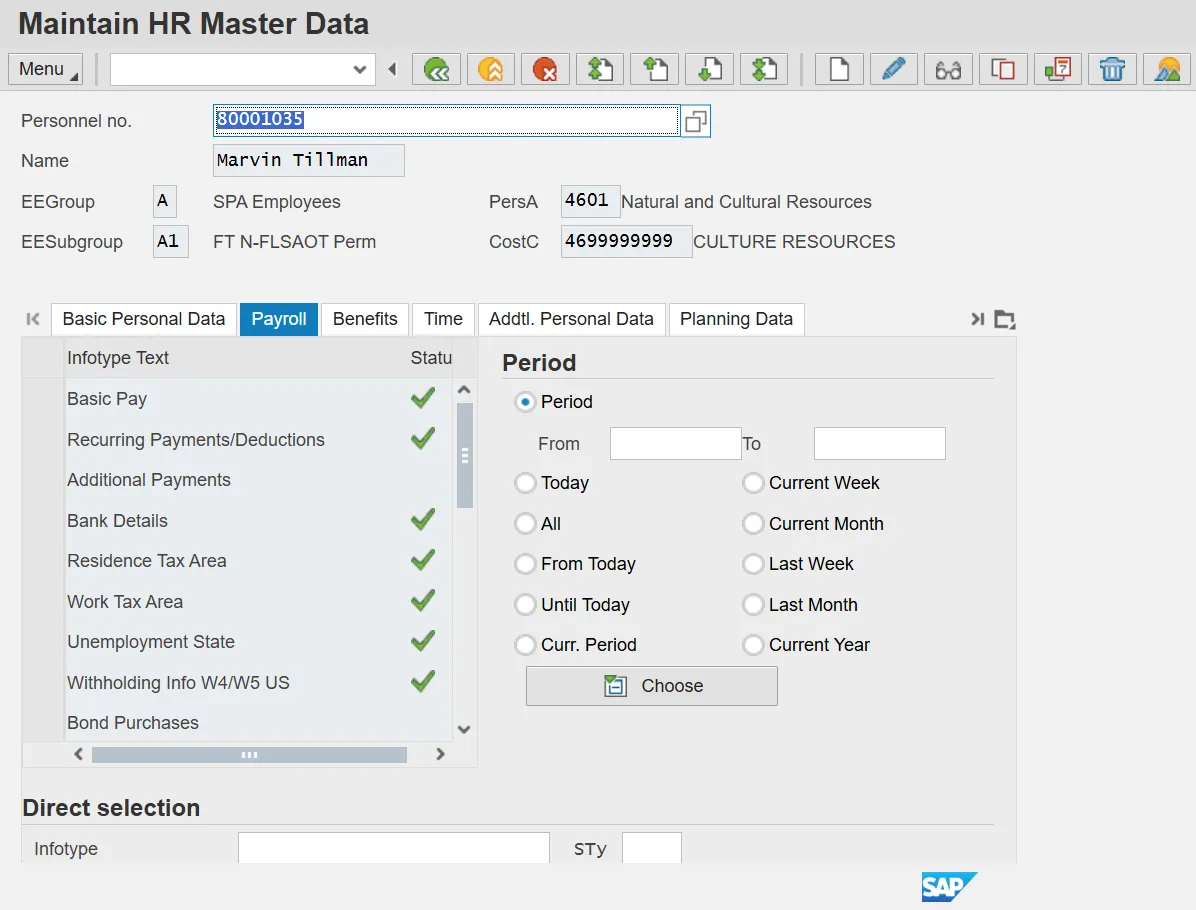

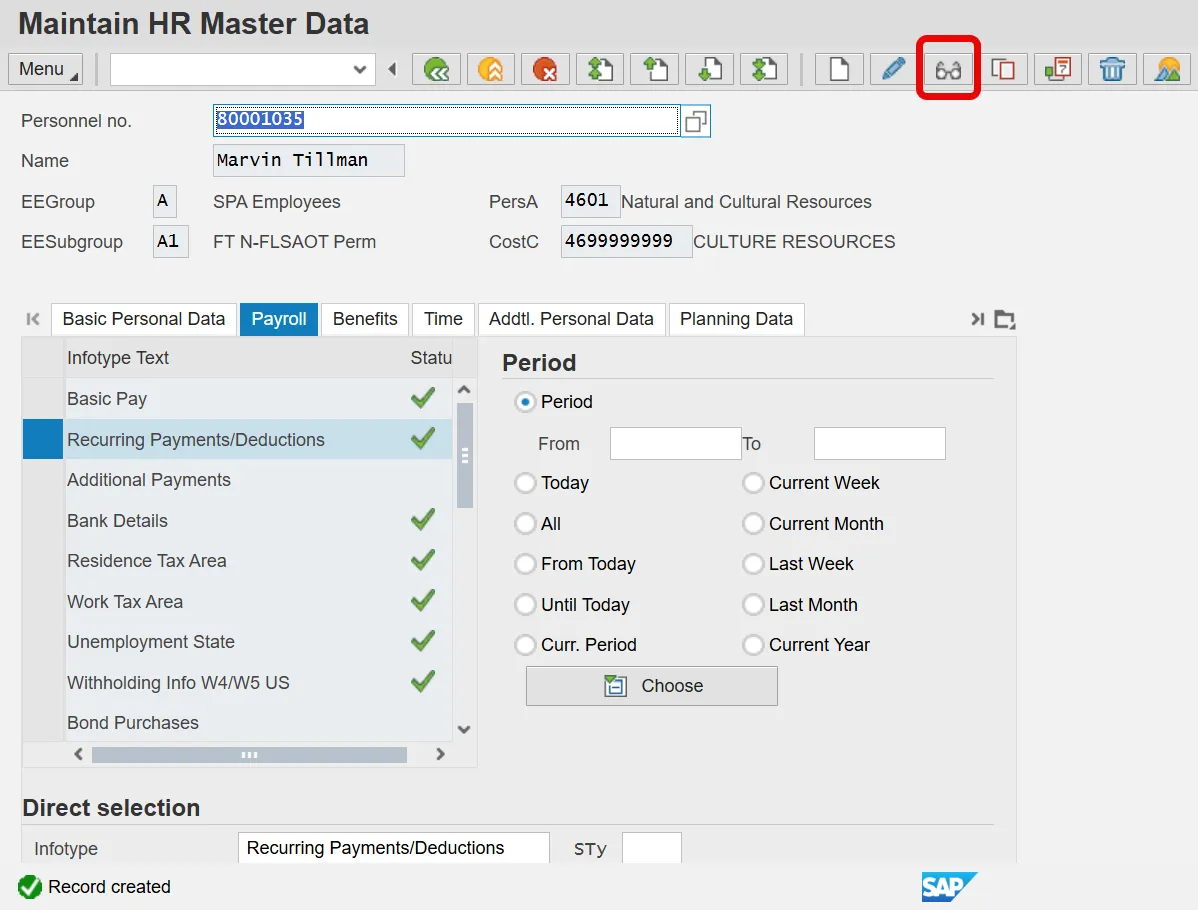

Maintain HR Master Data

Step 3. Update the following required and optional fields.

| Field Name | Description | R/O/C | Values |

|---|---|---|---|

| Personnel no. | Unique employee identifier | R |

Enter value in Personnel no. Example: 80001035 |

Information: Ensure the correct personnel number was entered.

Step 4. Click Enter.

Step 5. Click the Payroll tab.

Step 6. Select the Recurring Payments/Deductions infotype.

Information: Select the appropriate Infotype to display. Infotype records can be accessed through the various /Tabs/ or through the /Direct Selection/ section of the screen. Infotypes listed within the Tabs with a corresponding green checkmark indicate that the infotype record is populated with data. Infotypes without a green checkmark may not be populated at this time.

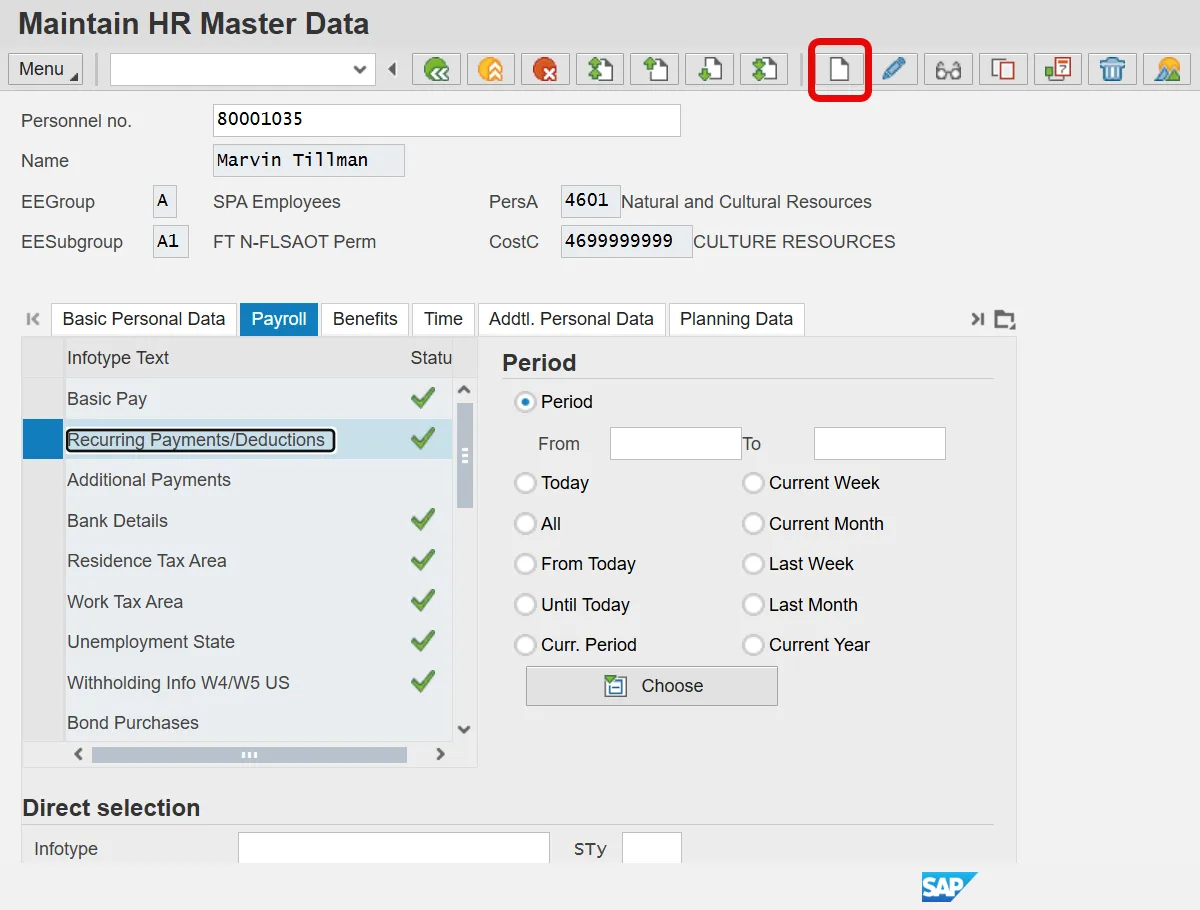

Step 7. Click Create (F5) button.

Step 8. The table below provides the descriptions for each field in Infotype 0014.

| Field | Description |

|---|---|

| Wage Type | Type of deduction/payment for the employee per pay period. |

| Amount | Amount of deduction or payment. |

| Reason for Change | In this field, you enter the reason for change in the data in the infotype. |

| Payment model | The payment model defines a time pattern in which deductions are withdrawn and payments made. |

| 1st payment period | In the FIRST PAYMENT PERIOD field, you can enter the first period in which the recurring payment or deduction is to be made. |

| 1st payment date | Enter the first payment date. This date defines the payroll period in which the recurring payment or deduction is to be made the first time. |

| Interval in periods | Enter the number of periods that should lie between two consecutive payments. |

| Interval/Unit | This field together with the UNIT field defines the interval between recurring payments and deductions. |

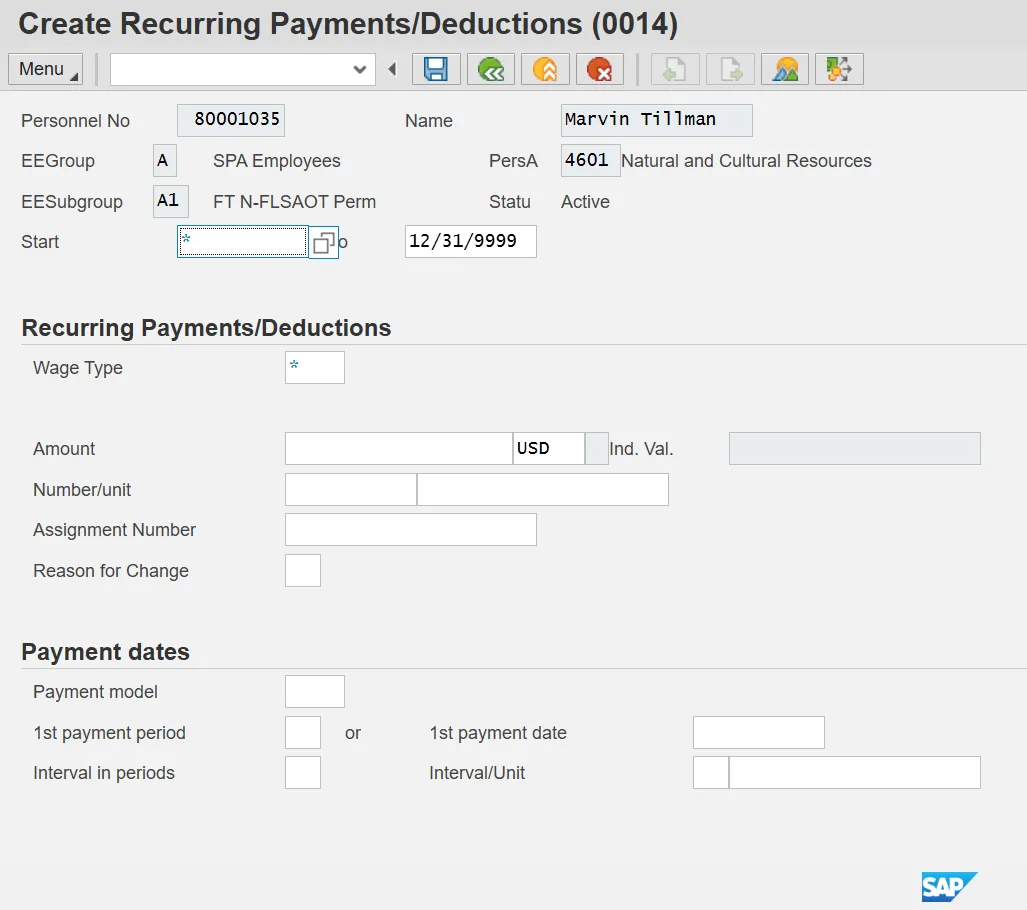

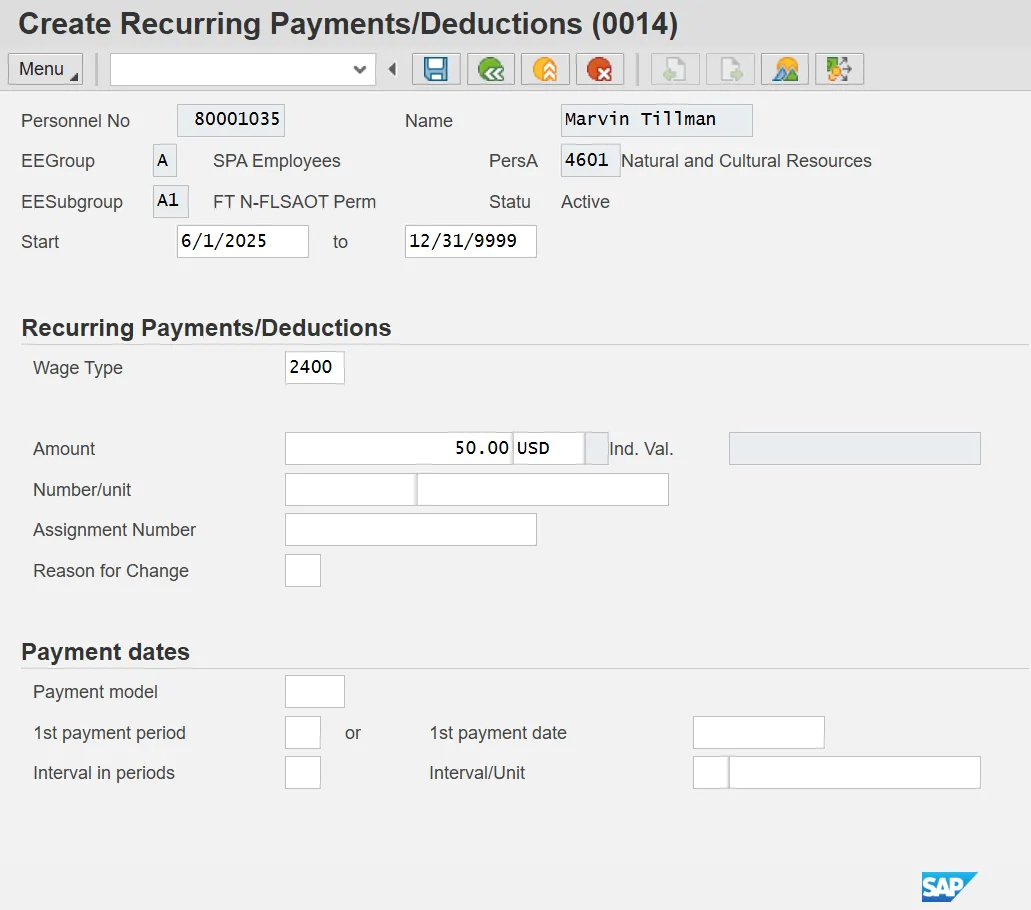

Create Recurring Payments/Deductions (0014)

Step 9. Update the following required and optional fields.

| Field Name | Description | R/O/C | Values |

|---|---|---|---|

| Start | Beginning date of the specified date range. | R |

Enter value in Start. Example: 06/01/2025 |

| Wage Type | Type of deduction/payment for the employee per pay period. | R |

Enter value in Wage Type. Example: 2400 |

Information: If you know the wage type code number you want to enter, type it directly into the wage type field. If you do not know the code number you want to enter, click the drop-down menu on the right of the wage types field (after single-clicking the field). This will give you the codes and descriptions of the available wage types for the employee being processed.

In this demonstration, we are using wage type 2400 SECU.

Step 10. Update the following required and optional fields.

| Field Name | Description | R/O/C | Values |

|---|---|---|---|

| Amount | Amount of deduction/payment. | R |

Enter value in Amount. Example: 50.00 |

Step 11. Click Save (Ctrl+S).

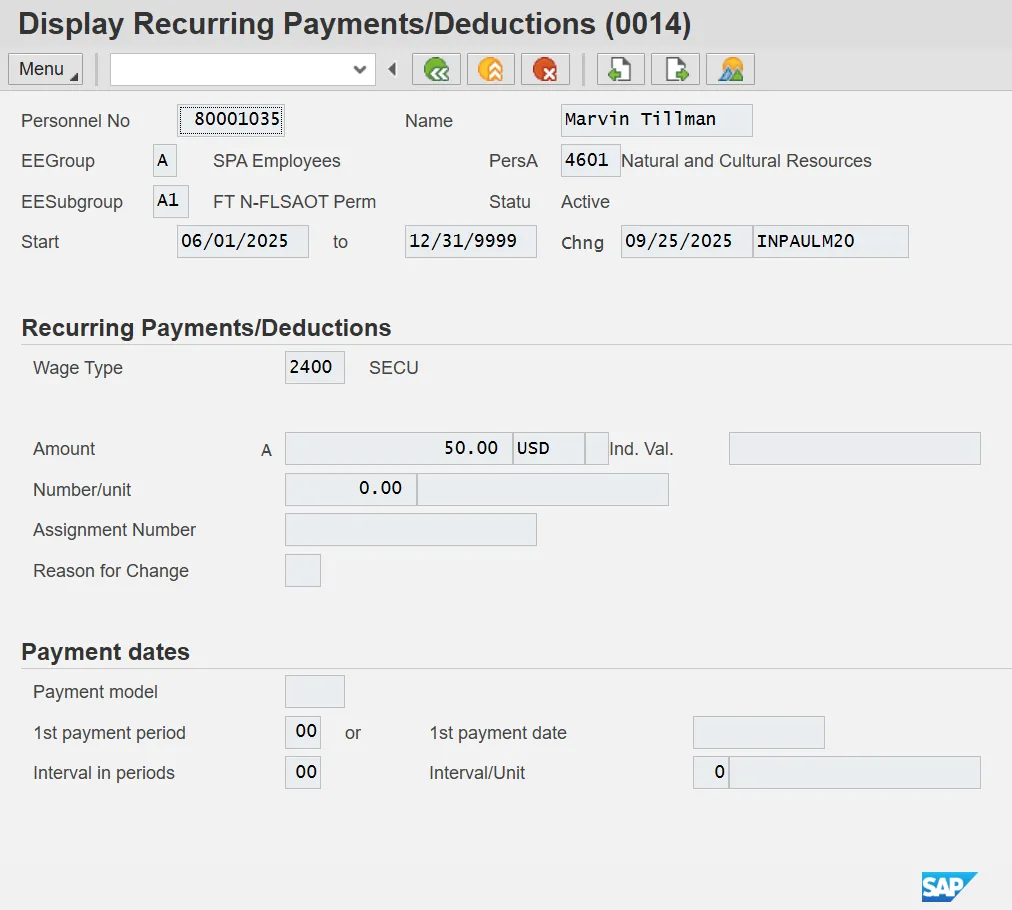

Step 12. To view the Recurring Payments/Deductions, Click the Display (F7) button.

Critical: When processing a deduction wage type, confirm there is an 'A' to the left of the amount field. If an 'A' exists, you are processing a deduction wage type. If an 'A' does not exist, you are processing a payment wage type.

Step 13. The system task is complete.