Purpose

The purpose of this Quick Reference Guide (QRG) is to provide an understanding of how and why the Interfund Segment is used in the North Carolina Financial System (NCFS).

Introduction and Overview

In NCFS, the Interfund segment is a new segment in the chart of accounts that allows for the linking of transfers and due to/due from transactions. This linkage allows for transparency and traceability regarding these transactions.

In NCFS, it is important that agencies provide the correct interfund value that represents the other side of the transaction.

The NCFS Interfund segment is a mirror of the Budget Fund segment. Every value in the Budget Fund segment is also in the Interfund segment. Just like Budget Fund, each Interfund value (except for the default Interfund) is linked to a GASB fund number.

This relationship is what ultimately makes the Interfund segment so valuable. By using the correct Interfund segment to represent where transfers are going to or being received from, the agency, and ultimately OSC can match up transfers in and out by GASB to determine what should be consolidated and eliminated and what should remain.

Background

In NCAS, transfer accounts contained information in the account title that would allow users to have some idea where funds went to or came from. However, each account could contain different levels of detail such as just an agency name or a Budget Code, or possibly a Budget Code and fund. The inconsistent level of detail from agency to agency, account to account, made it difficult to review and reconcile transfers between Budget Codes and between agencies throughout the year, and at year end. This was uniquely apparent at year end when agencies were asked to review and balance transfers in and transfers out, so the OSC Statewide Accounting Division-Financial Reporting team could eliminate transfer amounts on a statewide level to produce the Annual Comprehensive Financial Report (ACFR).

To a lesser extent, year-end accruals for Due From (receivables), and Due To (payables) also had to be reconciled and balanced between agencies.

The Interfund segment was designed to assist with both scenarios. Additionally, the Interfund segment can be used with any account an agency chooses.

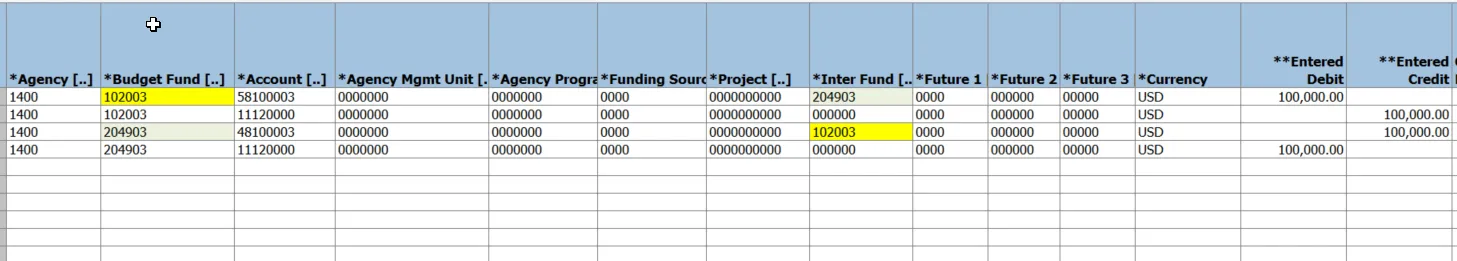

Intragency (Internal) Transfer Example

Internal agency transfer example: OSC is transferring $100,000 from Budget Code 14160 to Budget Code 24160. If the transfer is coming from Budget Fund 102003 OSC 1022 STATE FISCAL RECOVERY BC 14160 and going to Budget Fund 204903 OSC 2401 BEACON-HR PAYROLL BC 24160, while the agency would process this transaction through the Intercompany module, the accounting for this transaction would look like this: (this example does not contain specific values for AMU, Agency Program, Funding Source or Project, but the actual agency entry could).

As you can see from this example, the Budget Fund from the transfer-out line, becomes the Interfund on the transfer-in line.

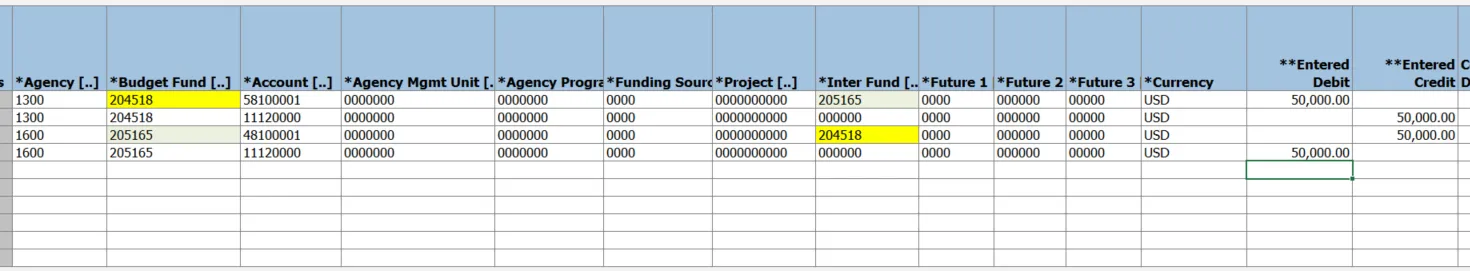

InterAgency (External) Transfer Example

Interagency transfer example (External): DOA is transferring $50,000 from fund 204518 DOA 2469 DOE SPECIAL GRANTS BC 24100 to DEQ to assist with an initiative. DEQ is receiving the funds into fund 205165 DEQ 2406 NRG -WEATHERIZATION PROG BC 24300. The accounting for this transaction would look like this:

Note: This example does not contain specific values for AMU, Agency Program, Funding Source or Project, but the actual agency entry could.

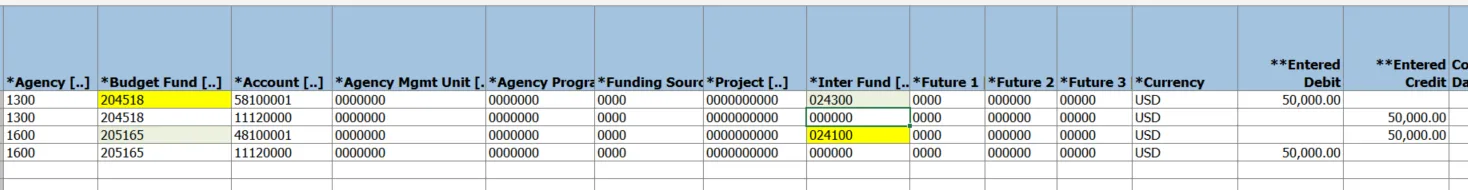

For interagency transfers (external), the sending agency needs to know the Budget Fund the receiving agency will receive the funds into, or at a minimum, the Budget Code. If only the Budget Code is known, the sending agency can use the Budget Code’s clearing Budget Fund. The clearing Budget Fund is the Budget Code number with a 0 in front. For example, the clearing Budget Fund for Budget Code 24100 is 024100 DOA 24100 CLEARING.

Note: If the transfer involves a 5 type or 7 type Budget Code; these Budget Codes contain Budget Funds related to separate GASB codes, so it is imperative the actual Budget Fund number be used to ensure the transfer is related to the correct GASB code.)

An example of an interagency transfer using the clearing Budget Fund as the Interfund would look like this:

Account Ranges Requiring a valid Interfund

The following account ranges of accounts require the use of a valid Interfund segment value that is not the default of 000000. In these cases, a fatal error will be displayed when the Interfund default of 000000 is used.

Transfer Accounts:

- 48000000-58099999

- 48100000-48199999

- 58100000-58199999

- 48400000-48499999

- 58400000-58499999

- 48C00000-48C99999

- 58C00000-58C99999

- 48F00000-48F99999

- 58F00000-58F99999

- 48S00000-48S99999

- 58S00000-58S99999

- 48T00000-48T99999

- 58T00000-58T99999

- 48U00000-48U99999

- 58U00000-58U99999

- 48P00000-48P99999

- 58P00000-58P99999

Due To/Due From Accounts:

- 11430000-11439999

- 11440000-11449999

- 21230000-21239999

- 21240000-21249999

Exceptions:

Interfund values are not required for accounts beginning with:

- 583 Reimbursements

- 588 Federal Transfers

- 488 Federal Transfers

- 582 Reimbursements

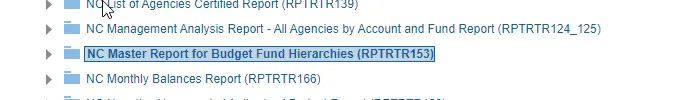

Report Listings of Interfund values

To obtain a list of Interfund values, agencies have two options.

- NC Master Report for Budget Fund Hierarchies (RPTRTR153)

- NC Agency Chart of Account Values Report (RPTRTR135)

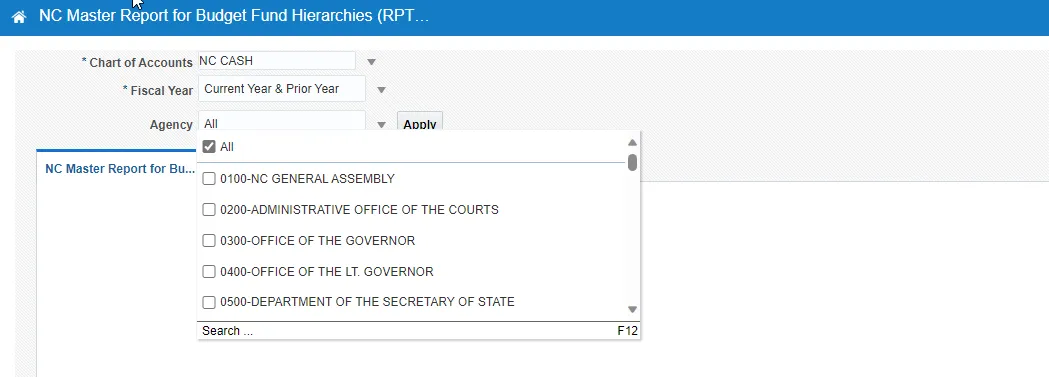

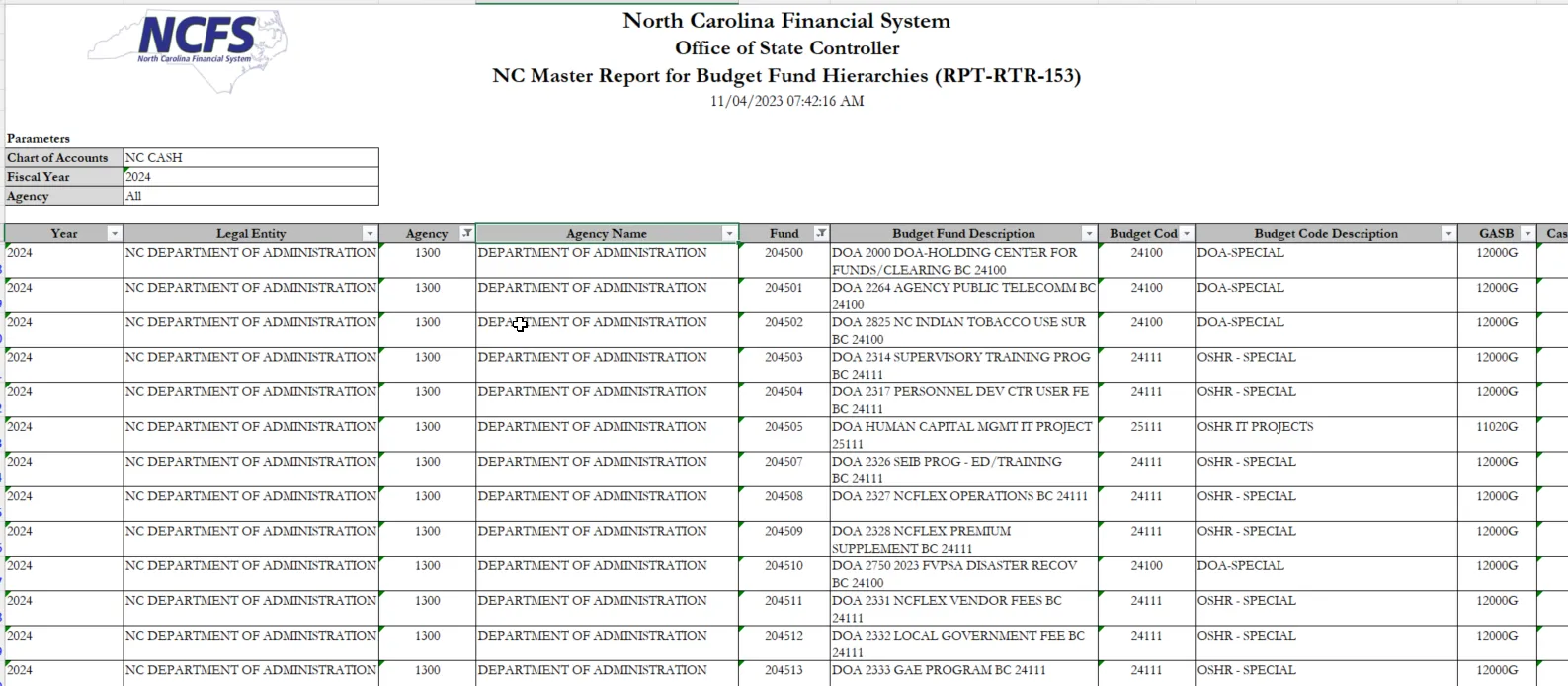

Option #1 - Because Interfund segments are also Budget Funds, a user can run the NC Master Report for Budget Fund Hierarchies (RPTRTR153).

This report can be run for a particular agency, or all agencies.

Notes:

- This report can be filtered for Agency, Budget Code, and detail Budget Fund.

- This report contains a column showing the GASB code.

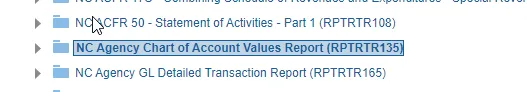

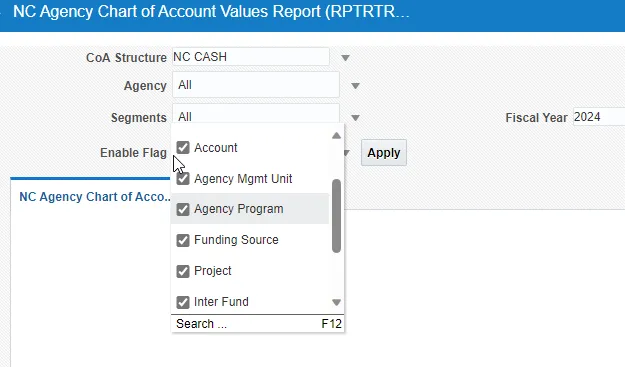

Option #2: Users can also run the NC Agency Chart of Account Values Report (RPTRTR135).

This report is designed to be run for all agency chart segments, or for individual ones. While some of the segments are agency-specific, the Interfund segment, however, shows all Interfund values for all agencies.

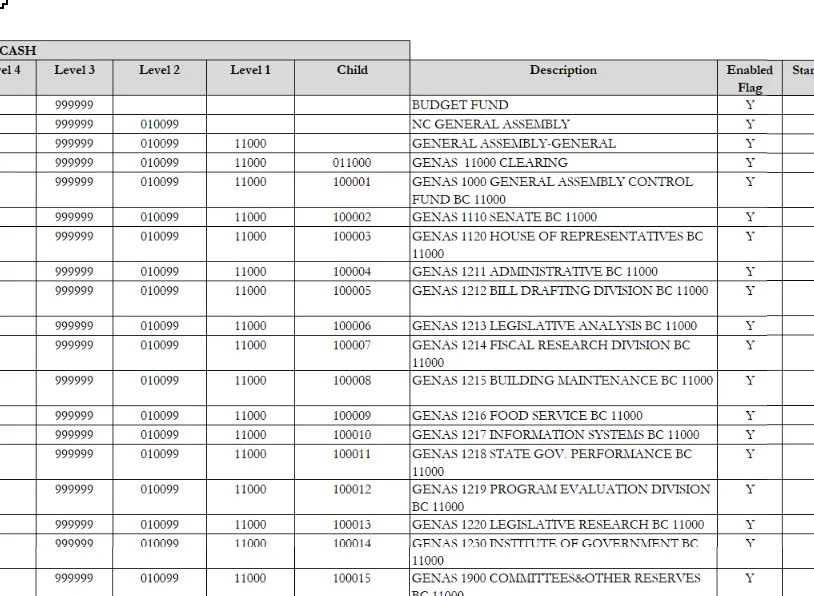

When this report is run for the Interfund, it will look like this example:

Notes:

- Child value is the Interfund value

- Level 1 is the Budget Code

- Level 2 is the agency parent (agency number with 99 on the end)

- Users can add a filter, allowing them to select specific Agency or Budget Code information

- Unlike RPT-RTR-153, this report will not show the GASB fund associated with the Interfund value

Interfund and Balance Sheet Accounts

Transfers initiated through the Intercompany module will apply the exact Interfund values for the transaction on the cash line. This will show cash balances to be distributed across various Interfund segments. When OSC prepares to close an accounting period, an interface will be run that will prepare an entry to move the balances from the cash lines containing Interfund values, back to the cash line with the default Interfund value.

Wrap Up

The Interfund segment is a vital part of the NCFS chart of accounts. It contains all Budget Fund values set up in the system for use when a valid interfund value is required. It allows for linking of funds transferred between Budget Funds within an agency or between agencies. It provides much greater certainty than natural account titles. It allows for more efficient reconciliation at any point in time.

Additional Resources

- Virtual Instructor-Led Training (vILT)

- Web-Based Training (WBT)