Purpose

The purpose of this Quick Reference Guide (QRG) is to provide a detailed description of the Month End Reconciliation process for Indirect Organizations in the North Carolina Financial System (NCFS).

The Month End Reconciliation process is broken down into eight major tasks:

- Confirm Processing of Interface File

- Review Output of Interface Report INT-RTR-013

- Run and Review Output of the Reconciliation Report RPT-RTR-171

- Manually Enter a Clearing Journal

- Run and Review Output of the Reconciliation Report RPT-RTR-171 (again)

- Notify OSC of Readiness to Post

- Run and Review Output of Month End Reports

- Notify OSC of Readiness to Certify

Confirm Processing of Interface File

You will receive an email indicating your INT-RTR-013 interface processed into NCFS. The email comes from the email NCFS@ncosc.gov and will either be a Warning or a Recon report. If the email is a warning, the zip file will contain a text file containing details of the error. If you receive a warning, the interface has not processed. Corrections to the interface file will need to be made and the file resubmitted.

If the email contains a Recon report, the subject will contain the Interface name INT-RTR-013 and the name of the file processed. The name of the interface process is FBR NCFS RTR-013 Import GL Balances from Agency. An output report is generated for you.

The way INT-RTR-013 works is, when you send in detailed transactions, the interface has logic that will create clearing budget fund reversing amounts based on the detailed amounts in the interface file. This is to prevent duplicating amounts in the system. A successful interface will mean the detailed revenues, expenditures, cash, etc., match in summary to what you have done on a daily basis in NCFS.

For example, if you interface in $100 in revenue account for a fund in budget code 16090, the interface will create a negative $100 in the revenue clearing account (00004000) for clearing fund 016090. It does the same for expenditures, cash, appropriations, etc.

Review Output of Interface Report INT-RTR-013

There are 3 steps to complete this process.

Step 1. If the report output is attached to the email, open it for review (and skip Step #2 below).

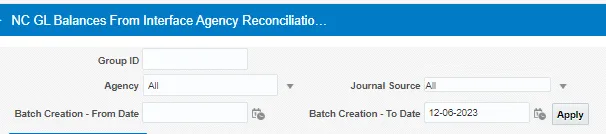

Step 2. If you do not receive an email, you can log into NCFS to generate this INT-RTR-013 report using the following navigation path:

Tools > Reports and Analytics > Browse Catalog > Shared > Custom > FBR Custom > Report > General Ledger > NC GL Balances From Interface Agency Reconciliation Report (INT-RTR-013)

Parameters:

- Group ID: leave blank

- Agency: select your Agency code

- Journal Source: select Univ Financial Interface

- Batch Creation – From Date: date interface was processed

- Batch Creation – To Date: date interface was processed

Note: For Journal Source, the following sources are applicable:

- Univ Financial Interface – universities

- NCEL Financial Interface – NC Education Lottery

- NCHFA Financial Interface – NC Housing Finance Authority

- DOT Financial Interface – DOT, State Ports, and Global Transpark

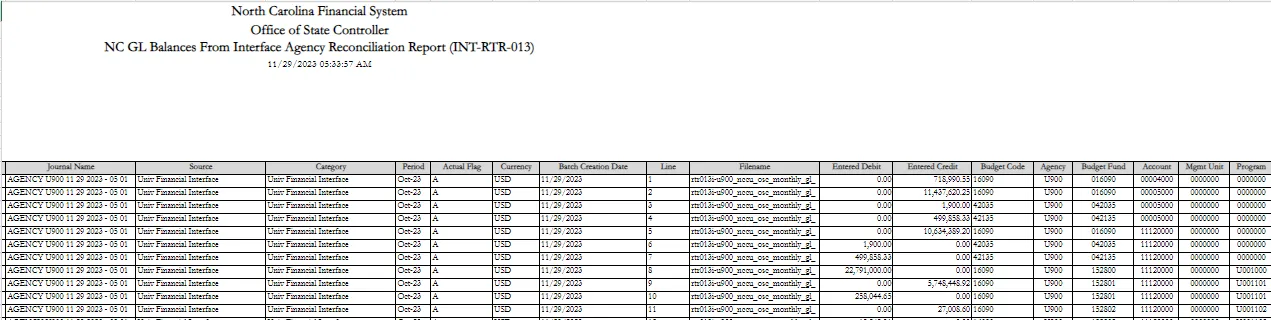

Sample Output:

Step 3. Review the contents, keeping the following in mind:

- A single batch, containing a single journal is displayed. Both have the same exact name.

- Journal Source = Univ Financial Interface

- Journal Category = Univ Financial Interface

- The interface has created clearing budget fund reversing amounts

Review the Output of the Reconciliation Report RPT-RTR-171

There are 8 steps to complete this process.

Step 1. Run the RPT-RTR-171 Reconciliation Report using the following navigation path:

Tools > Reports and Analytics > Browse Catalog > Shared > Custom > FBR Custom > Report > General Ledger > NC Interface Agency Reconciliation Report (RPT-RTR-171)

Parameters:

- Ledger: NC CASH US

- Agency: select your Agency code

- Accounting Period: period being closed

Step 2. Take note of the two tabs at the bottom:

- NC Pre-Valid Report

- NC Budget Code Cash Summary

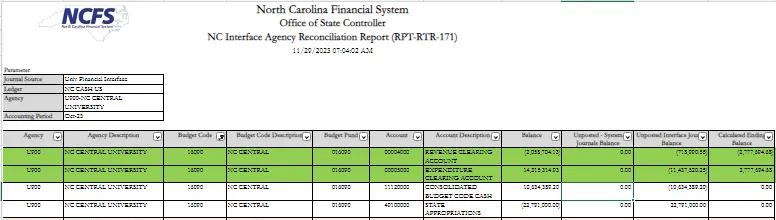

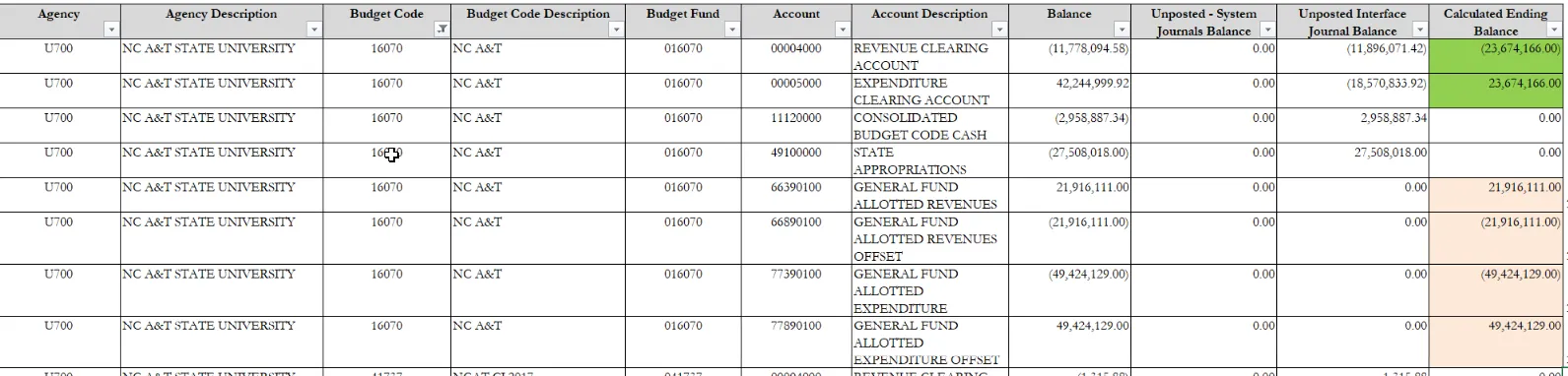

NC Pre-Valid Report (sample output):

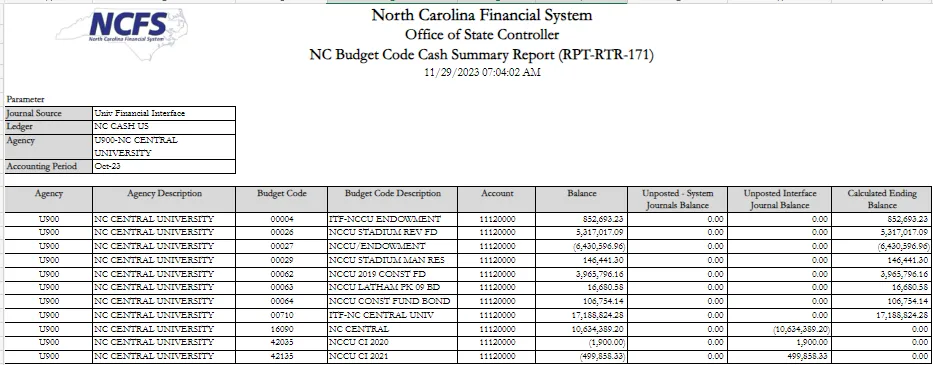

NC Budget Code Cash Summary tab (sample output):

Step 3. For the NC Pre-Valid Report tab, filter out STIF Budget Codes since they are on the report, but not part of the month end interface.

Step 4. Review the report output, taking the following into consideration:

- The Balance column shows you the balance in NCFS for the month in the clearing budget funds, where you have performed your daily NCFS transactions (deposits, requisitions, transfers, etc.).

- The Unposted-System Journal Balance column will show any unposted journal in the system for the period that affects the clearing budget funds that is NOT the interface INT-RTR-013.

- The Unposted Interface Journal Balance column shows the results of the interface you sent in.

- The Calculated Ending Balance column shows the ending balance, assuming any unposted journals were to be posted.

Step 5. Verify that cash (11120000) zeros out in the Calculated Ending Balance column for the clearing budget fund for each of the interfaced budget codes. If they do not, this means the detailed interface file does not contain an equal amount of cash that is currently in NCFS for the period. You need to determine why there is a difference, take corrective action and potentially need to resubmit your interface.

Step 6. Review the remaining balances in the Calculated Ending Balances column. These amounts should net to zero at the budget code level. You need this information to prepare the manual clearing entry.

Step 7. The RPT-RTR-171 Calculated ending balance column may contain two types of balances.

a. Balances that net against each other such as revenue and expenditure clearing. In the event these net against each other, the entry can simply be an appropriate debit and credit in the clearing budget fund.

b. Balances that need to be reclassified from the clearing budget fund to a detailed budget fund. Examples of this are Allotted Revenues (66390100/66890100) and Allotted Expenditures (77390100/77890100). If there are balances remaining here, they should be reversed from the clearing budget fund and posted to the control budget fund in the General Fund budget code.

Note: If the Calculated Ending Balance column is a negative amount, you will need to key a debit to clear. If it is a positive amount, you will need to key a credit to clear.

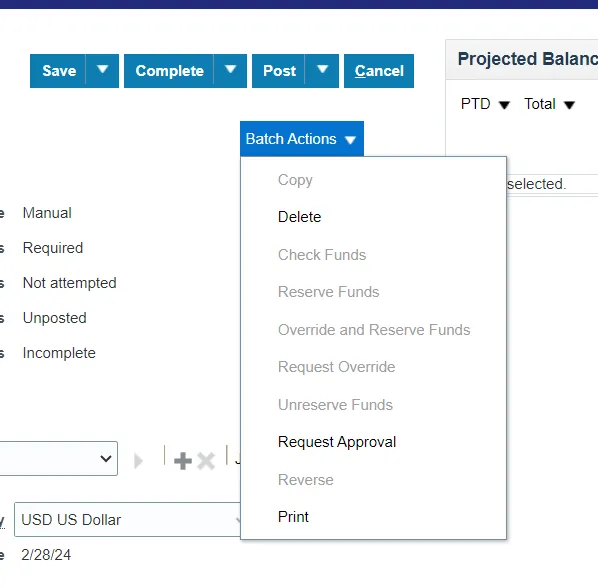

Step 8. If the batch has errors, Delete it under the Batch Actions.

Manually Enter Clearing Journal

There are 4 steps to complete this process.

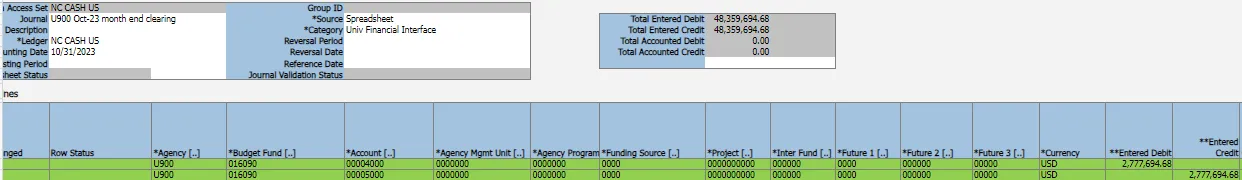

Step 1. Enter a new journal, using either method (Create Journal page or ADFDI Spreadsheet).

- Journal Batch name should begin with your 4-digit agency code (ex: U900) followed by some verbiage that makes sense to you but identifies the period and what is being done.

- Journal Category: Select ‘Univ Financials Interface’ (or the appropriate interface category for your agency).

Sample Clearing Journal (ADFDI):

Step 2. Be sure to enter 2 journal lines for each unique Budget Fund, including CIs but excluding STIF. Each budget fund must be in balance.

For EACH Budget Fund:

- Debit to Revenue Clearing: Budget Fund 0xxxxx / Account 00040000

- Credit to Expense Clearing: Budget Fund 0xxxxx / Account 00050000

Step 3. For the balances that need to be reclassified to a detailed fund, each row on the RPT-RTR-171 report will require 2 lines. One to reverse the existing balance, and a second line to post the existing balance to a detailed budget fund.

Step 4. Save and complete your journal. Do NOT request approval yet.

Run and Review Output of Reconciliation Report RPTRTR171 (again)

There are 7 steps to complete this process.

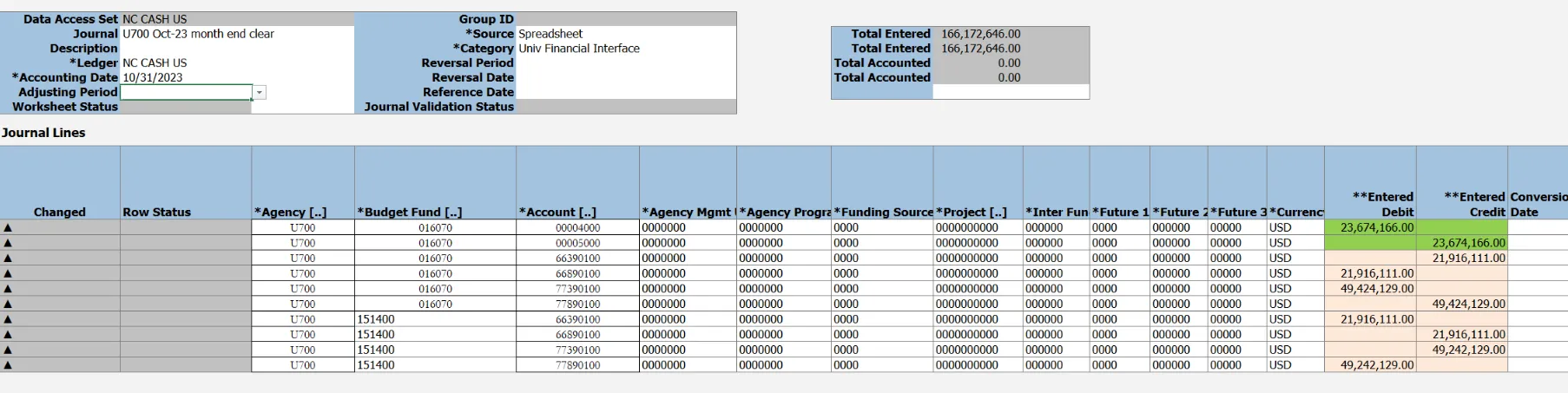

Step 1. Rerun the RPT-RTR-171 report to ensure the ending balances are now zero.

Step 2. Verify that the manually created journal you just keyed shows up in the Unposted - System Journals Balance column.

Step 3. Verify that the automatically created interface journal shows up in the Unposted - Interface Journals Balance column.

Step 4. Verify that the final column of Calculated Ending Balance now contains all zeros.

Step 5. Using the Manage Journals page, find both your journals:

- Interfaced Journal

- Manual Clearing Entry

Step 6. For your interfaced journal, Request Approval via the Batch Actions dropdown menu.

Step 7. For your manual clearing journal, Request Approval via the Batch Actions dropdown menu.

Notify OSC of Readiness to Post

Submit an OSC Contact Center ticket (NCFS@ncosc.gov) saying you have completed your review and entered all clearing journals, and you request approval on both journal batches.

Note: OSC staff will review and if all looks good, will approve the journals. Once approved, your journals will get picked up in the 1 p.m. Autopost. Once posted, you can then go run the month end reports (701, 702, 704, 725) and review them.

Run and Review Month End Reports (Posted Balances)

| NCFS Report Number | NCAS Equivalent | NCFS Title | Notes/Comments/Tips | |

| BE-012 | BD702 | NC Allotments to Cash Availability (702) Report (RPTBE012) |

|

|

| BE-006 | BD701 Certified | NC Budget to Actual (701) Certified Report (RPTBE006) |

|

|

| RTR-152 | BD701 Org Mask | NC Budget to Actual (701) Detailed Report (RPTRTR152) |

|

|

| RTR-019 | BD701 Excel | NC Budget to Actual (701) Excel Report (RPTRTR019) |

|

|

| RTR-014 | BD725 Detailed | NC Capital Improvements (725) Detail Report (RPTRTR014) |

|

|

| RTR-137 | BD725 | NC Capital Improvements (725) Report (RPTRTR137) |

|

|

| RTR-015 | BD704 | NC Cash Receipts Disbursements and Balance by Budget Fund (704) Report (RPTRTR015) |

|

Notify OSC of Readiness for Certification

There are 2 steps to complete this process.

Step 1. Once you have reviewed all reports and are ready to certify the month, complete the month end certification form on the OSC website.

Office of the State Controller Month End Certification

Step 2. OSC staff will review your reports and if you are deemed in balance, you will be marked as certified for the period.

Additional Materials

Related QRGs

- GL-02 Create Journals

- GL-03 Create Journals Through Spreadsheet

- GL-09 Run Custom Pre-Built Reports

- GL-32 Month End Reports

Submitting a Ticket to the OSC Contact Center

If additional assistance is needed, please send your request to: ncfs@ncosc.gov.