This message is for informational purposes only. Nothing in this message is intended to constitute, nor should it be construed or relied upon, as tax advice.

On July 4, 2025, Congress enacted US Public Law 119-21, also known as the One Big Beautiful Bill Act. In that law, there is a provision called “No Tax on Overtime.”

Under this law, for tax years 2025 through 2028, individuals who receive qualified overtime compensation may deduct the pay that exceeds their regular rate of pay, or "Overtime Premium" (generally, the “half” portion of “time-and-a-half” compensation) that is required by the Fair Labor Standards Act and reported on a Form W-2.

- Maximum annual deduction is $12,500 ($25,000 for joint filers).

- Deduction phases out for taxpayers with modified adjusted gross income over $150,000 ($300,000 for joint filers).

The deduction is available for both itemizing and non-itemizing taxpayers.

For more information, refer to the IRS guidance: Treasury, IRS provide guidance for individuals who received tips or overtime during tax year 2025.

Frequently Asked Questions

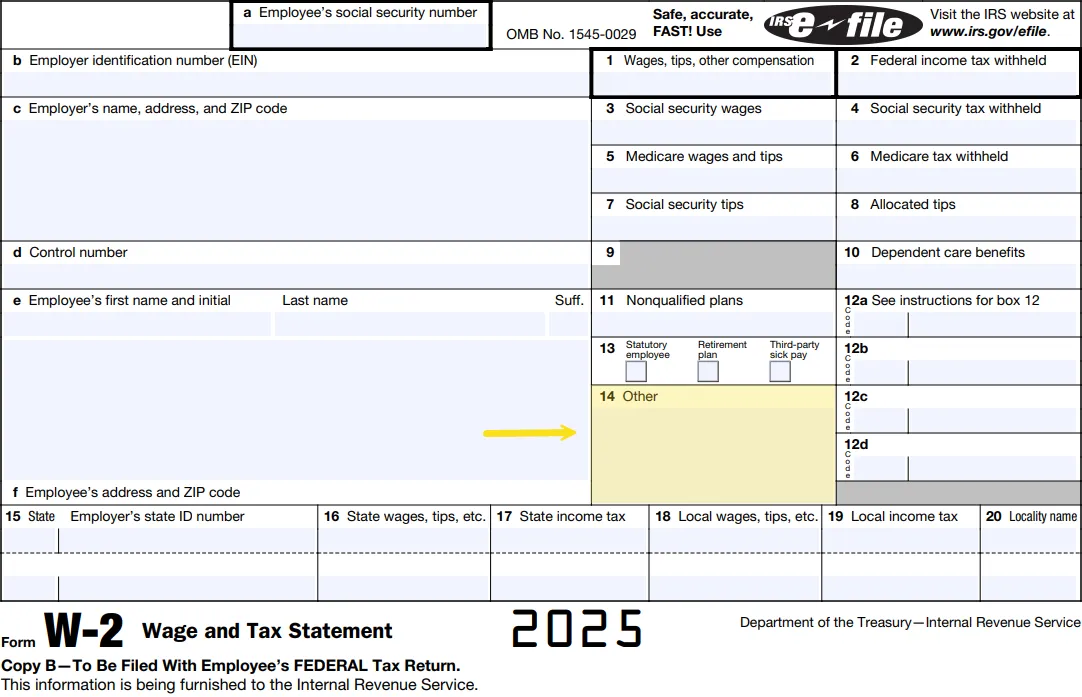

How will this information appear on my Form W-2?

In Tax Year 2025, your Form W-2 will include a separate code “FLSA OT Prem” in Box 14 showing your total qualified overtime compensation for the year. This amount will help you determine whether you can take the new federal deduction. Employees who have qualified overtime in Box 14 will receive an email prior to distribution of W-2 statements with more information.

What will be reported in Box 14 of an employee’s W-2?

- Qualified overtime compensation will be reported in Box 14 of the W-2 as “FLSA OT Prem”

- Qualified overtime compensation includes only the premium (half) portion of the following wages paid to an employee while subject to the requirements of FLSA.

- Overtime

- Comp Leave

- Comp Leave Payout

What if Box 14 shows no “FLSA OT Prem”?

Employees that do not have “FLSA OT Prem” in Box 14 of the W-2 did not earn any qualified overtime compensation

- The following wages are excluded (not reported in Box 14) if paid to an employee while NOT Subject to the requirements of FLSA.

- Comp Leave

- Comp Leave Payout

Who can answer my questions about the calculation of my overtime?

Your agency human resources office should be able to respond to any questions which you have regarding your premium overtime calculation.

Where can I find federal publications on this new law?

- Treasury, IRS provide guidance for individuals who received tips or overtime during tax year 2025

- Guidance for Individual Taxpayers who received Qualified Tips or Qualified Overtime Compensation in 2025

- Wages and the Fair Labor Standards Act

- Fact Sheet #22: Hours Worked Under the Fair Labor Standards Act (FLSA)

- Fact Sheet #8: Law Enforcement and Fire Protection Employees Under the Fair Labor Standards Act (FLSA)