Purpose

The purpose of this Quick Reference Guide (QRG) is to explain how to access and generate the NC Payroll Interface Reconciliation Report (RPT-RTR-164) in the North Carolina Financial System (NCFS) and how to identify and clear payroll suspense entries. This report contains the details of an agency’s payroll interface from the Integrated HR/Payroll System.

In NCFS, payroll files process the same day the file is received from the Integrated HR/Payroll System. Payroll (PI) transactions will process with an accounting date of the date the file was processed. Health Benefits (BI) transactions will process with an accounting date on the first day of the subsequent month. These journals will load to NCFS with that date as the accounting date but will not be approved or posted until that accounting period has been opened in the system.

To view the details of those interfaces, the agency can run RPT-RTR-164 for a single payroll, or for multiple payroll runs.

Payroll Suspense and Reconciliation

To navigate to the NC Payroll Interface Reconciliation Report, please follow the steps below after navigating to Reports and Analytics. There are 6 steps to complete this process.

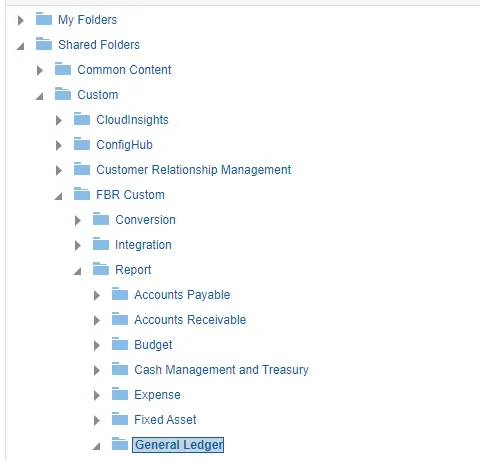

Step 1. Navigate to the General Ledger Section.

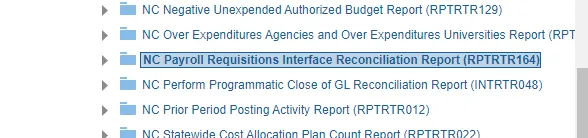

Step 2. Select the NC Payroll Requisitions Interface Reconciliation Report (RPTRTR164).

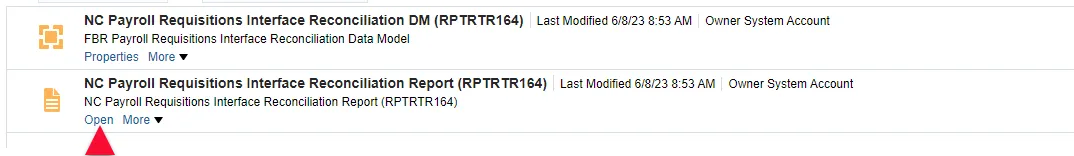

Step 3. Open the report.

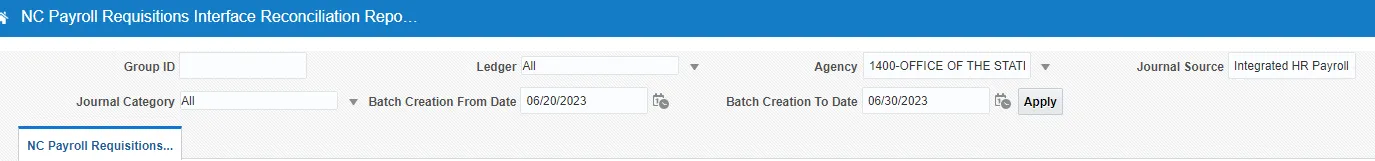

Step 4. Enter the parameters for your agency, then click Apply. Note that you must enter the Batch Creation Dates. Batch creation dates will be the date the payroll was processed in NCFS.

The report will be generated as an Excel document.

Step 5. Open the downloaded Excel document. The download may be in different locations on the screen based on the browser used.

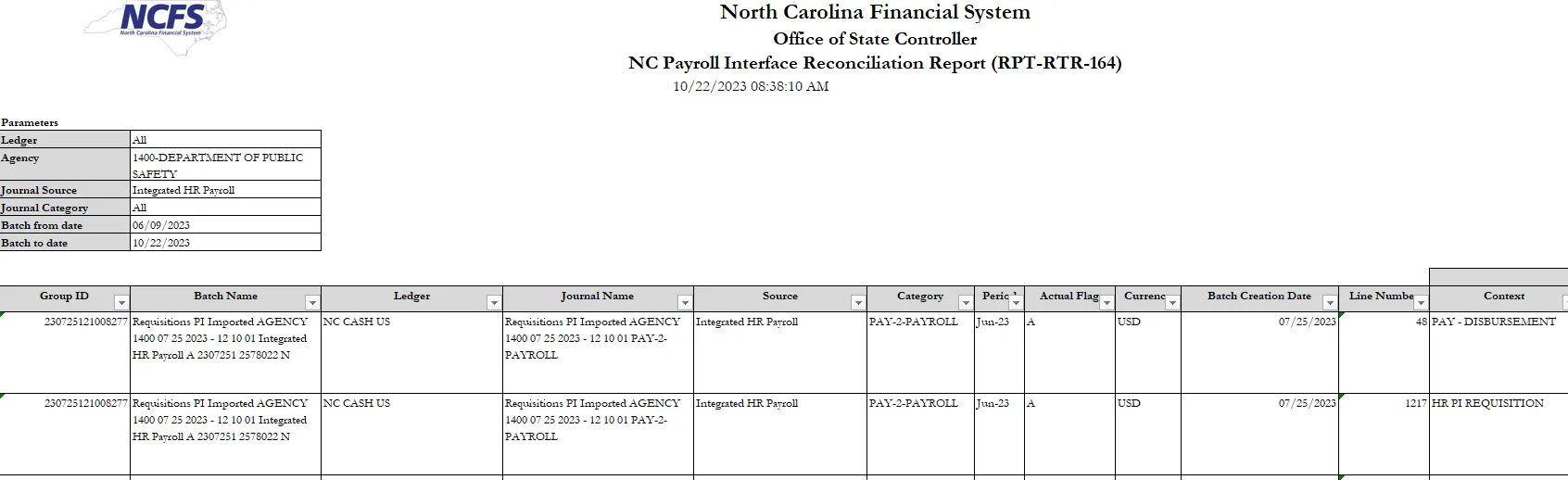

Step 6. The NC Payroll Interface Reconciliation Report is generated into Microsoft Excel.

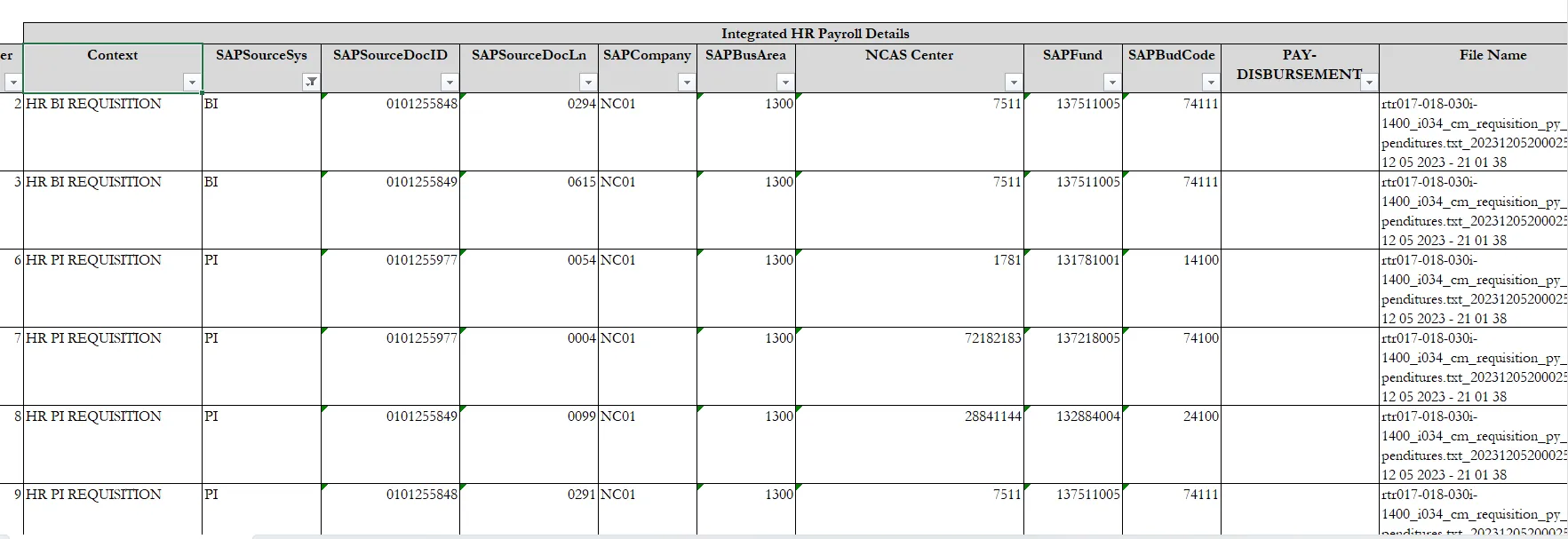

Agencies can use the report to see all the postings made by the Integrated HR/Payroll System interface into NCFS.

This recon report contains data from the payroll file sent to us from the Integrated HR/Payroll System that allows the user to trace the NCFS transactions back to the source documents in the payroll system.

Identifying and Clearing Payroll and Health Benefits Suspense

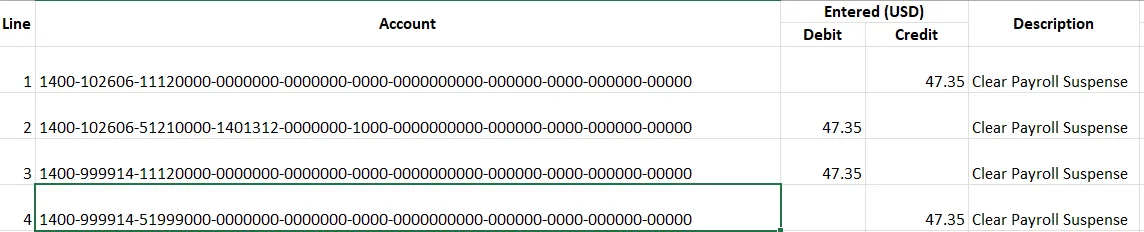

When payroll costs interface in and there is not a valid NCFS combination for the expenditures to post to, these transactions, along with the associated cash, will post to the payroll suspense budget fund and account. The suspense account for Payroll (PI) transactions is 51999000 and the suspense account for Health Benefits (BI) is 51998000. A list of the suspense budget funds can be found below.

To identify these, the user can filter the payroll recon report for the suspense budget fund. There are 6 steps to complete this process.

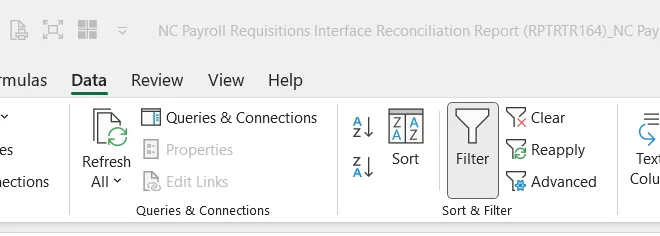

Step 1. From the Data tab in Excel, Add the Filter function to the body of the report.

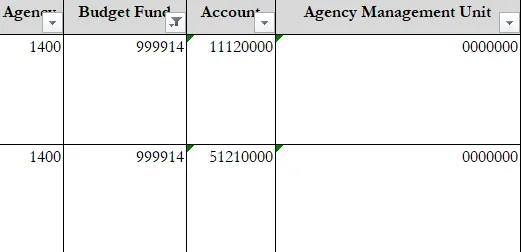

Step 2. Filter on the Budget Fund field for the suspense fund for your agency. Note: the suspense fund will begin with 9999 and end with the agency number. Example 999914.

Step 3. Review the report and compare it with the Integrated HR-Payroll system Financial Report for Payroll Processing (SAP Transaction ZFIR018) or the Payroll Financial Postings Analysis (BOBJ report B0028).

Step 4. Determine the proper posting of the amounts that suspended in the payroll interface.

Note: the suspense fund is in the general fund budget code or the main operating budget code of the agency if the agency has no general fund.

a. If the suspended payroll items are in the main operating budget code of the agency, create a journal to clear suspense using the Journal Category of “NC AGY INTERNAL BC ENTRY”. Note that you must post an entry to the cash account in the suspense fund and the offsetting fund to which the suspense was cleared.

Approve the journal.

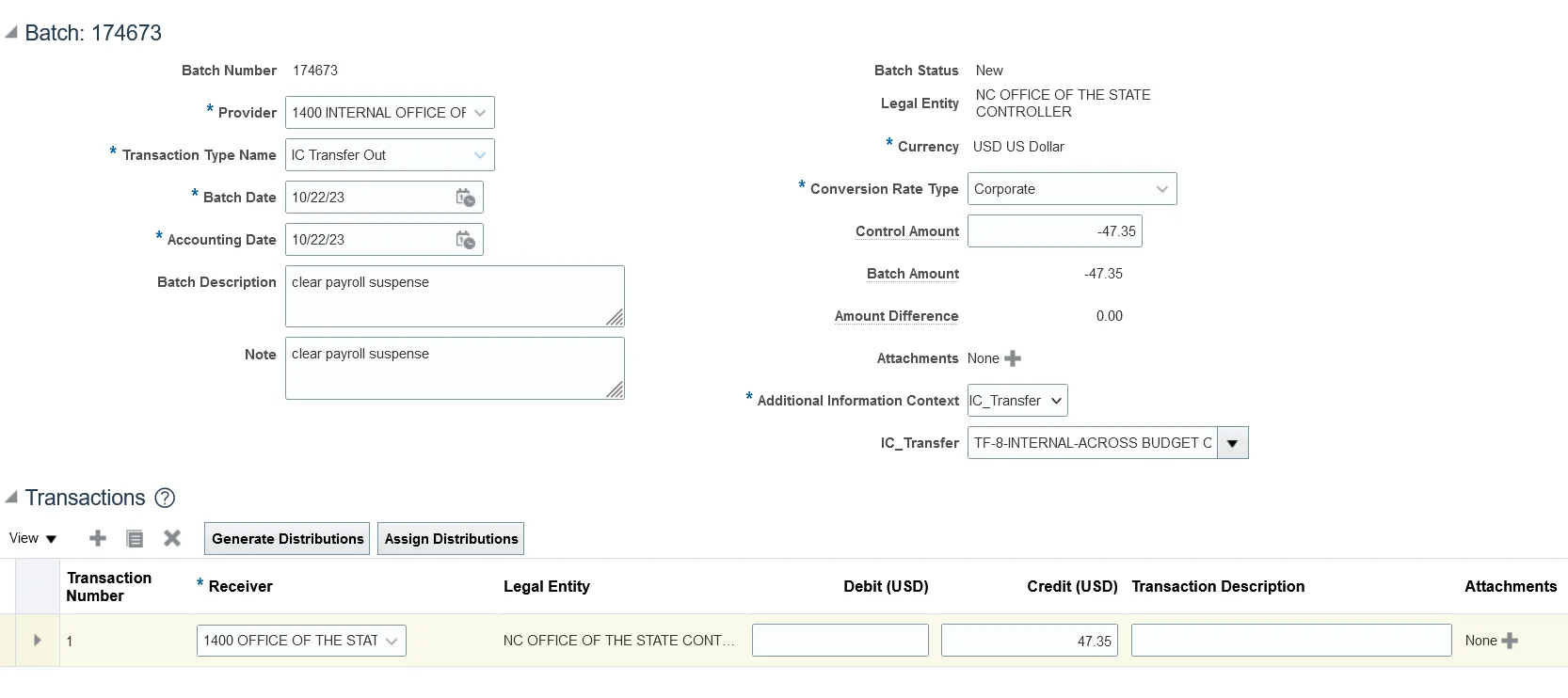

b. If the suspended payroll items are for a budget code different from the main operating budget code, the agency must Create an Intercompany Batch using the IC_Transfer type of TF-8-INTERNAL-ACROSS BUDGET CODE. The agency will not need to enter the cash lines for the intercompany batch since those are automated in the intercompany module.

Follow the Intercompany Batch procedures for agency internal budget code transfer.

Suspense Budget Funds

A suspense budget fund has been established in NCFS for each agency that uses the Integrated HR/Payroll System. These budget funds are associated with an existing budget code. Below is a list of those budget funds and the budget codes they are attached to.

|

Agency |

Budget Code |

Suspense Budget Fund |

|

|

0200 |

|

12000 |

999902 |

|

0300 |

|

13000 |

999903 |

|

0400 |

|

13100 |

999904 |

|

0500 |

|

13200 |

999905 |

|

0600 |

|

13300 |

999906 |

|

0700 |

|

13410 |

999907 |

|

0800 |

|

13510 |

999908 |

|

0900 |

|

13600 |

999909 |

|

1000 |

|

13700 |

999910 |

|

1100 |

|

13800 |

999911 |

|

1200 |

|

13900 |

999912 |

|

1300 |

|

14100 |

999913 |

|

1400 |

|

14160 |

999914 |

|

1500 |

|

84210 |

999915 |

|

1600 |

|

14300 |

999916 |

|

1700 |

|

14350 |

999917 |

|

1900 |

|

14550 |

999919 |

|

2000 |

|

14410 |

999920 |

|

2100 |

|

14411 |

999921 |

|

2200 |

|

14420 |

999922 |

|

2400 |

|

14440 |

999924 |

|

2500 |

|

14445 |

999925 |

|

2600 |

|

14450 |

999926 |

|

2700 |

|

14470 |

999927 |

|

2800 |

|

14480 |

999928 |

|

2A00 |

|

24481 |

99992A |

|

2B00 |

|

14430 |

99992B |

|

2D00 |

|

14435 |

99992D |

|

3000 |

|

14460 |

999930 |

|

3900 |

|

24465 |

999939 |

|

4000 |

|

13050 |

999940 |

|

4100 |

|

14660 |

999941 |

|

4300 |

|

14600 |

999943 |

|

4500 |

|

14700 |

999945 |

|

4600 |

|

14800 |

999946 |

|

4900 |

|

15020 |

999949 |

|

5000 |

|

16800 |

999950 |

|

5200 |

|

15010 |

999952 |

|

6000 |

|

18025 |

999960 |

|

6100 |

|

54670 |

999961 |

|

6700 |

|

18210 |

999967 |

|

8700 |

|

16094 |

999987 |

|

B000 |

|

28101 |

9999B0 |

|

B100 |

|

28102 |

9999B1 |

|

B200 |

|

28103 |

9999B2 |

|

B300 |

|

28104 |

9999B3 |

|

B500 |

|

28106 |

9999B5 |