Purpose

The purpose of this Quick Reference Guide (QRG) is to provide the step-by- step process regarding NCFS Accounts Payable Year-End Accrual Process.

Introduction and Overview

This QRG covers how to create and manage an invoice for NCFS Accounts Payable Year-End Accrual Process.

Creating a New Invoice

There are 6 steps to complete this process.

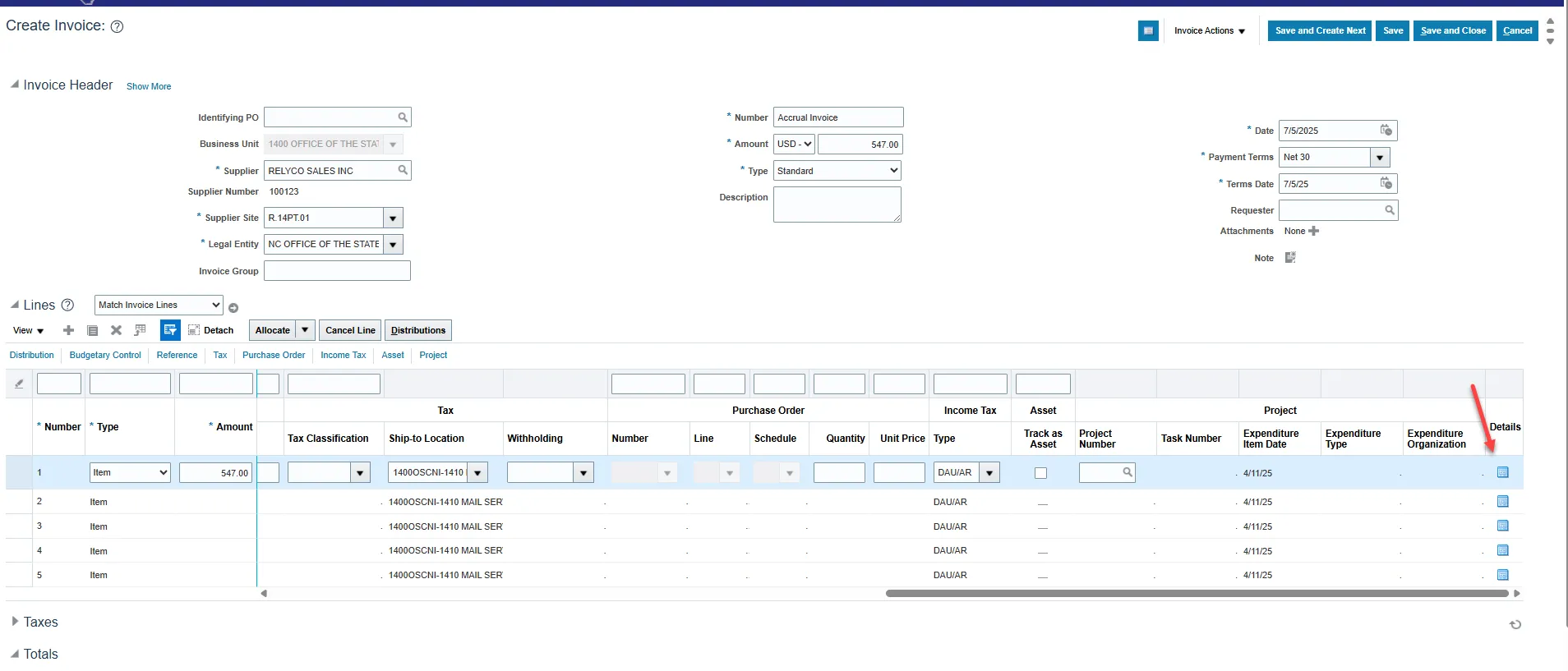

Step 1. When creating an invoice, scroll to the end of the invoice line and click on the Details button.

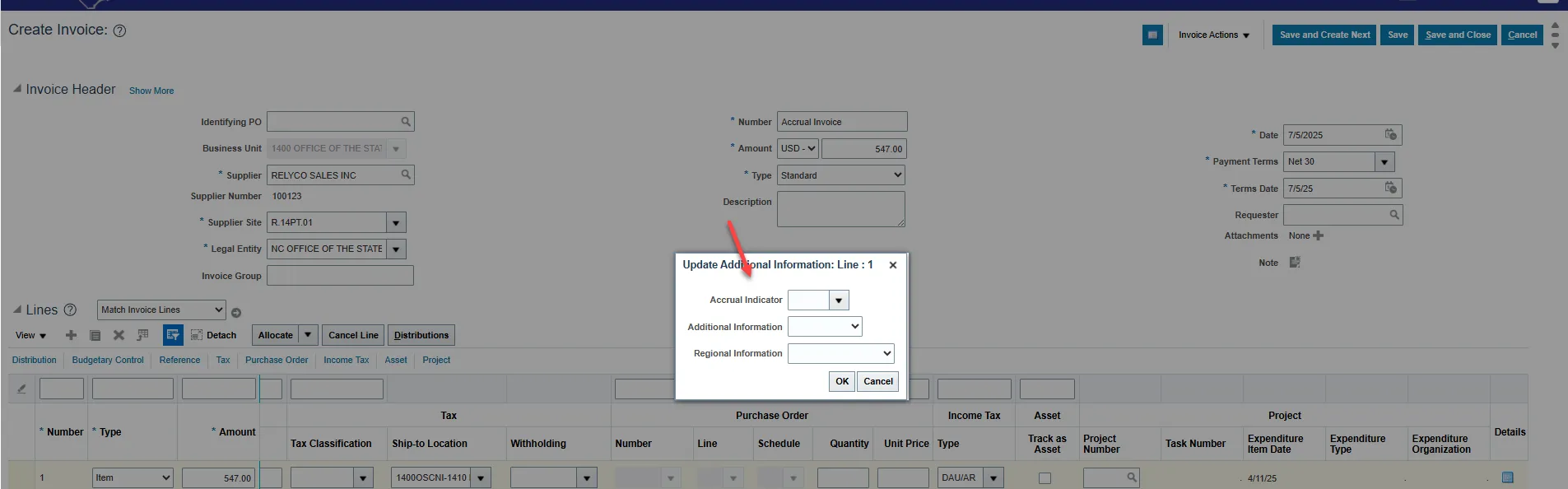

Step 2. Click on the Accrual Indicator drop box.

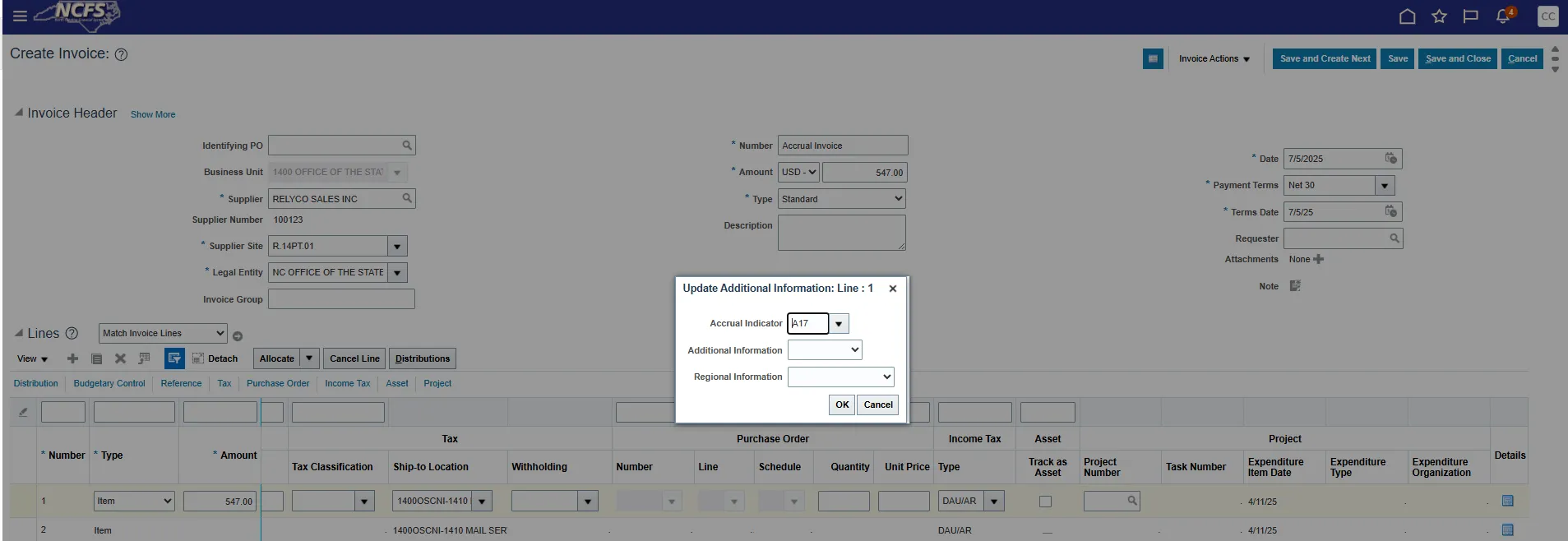

Step 3. Select the appropriate Accrual Indicator for the invoice line.

Step 4. Click OK.

Step 5. Click Save.

Step 6. Continue to process the invoice to add more lines or to validate and approve.

Managing Invoice to Add Accrual Indicator

There are 4 steps to complete this process.

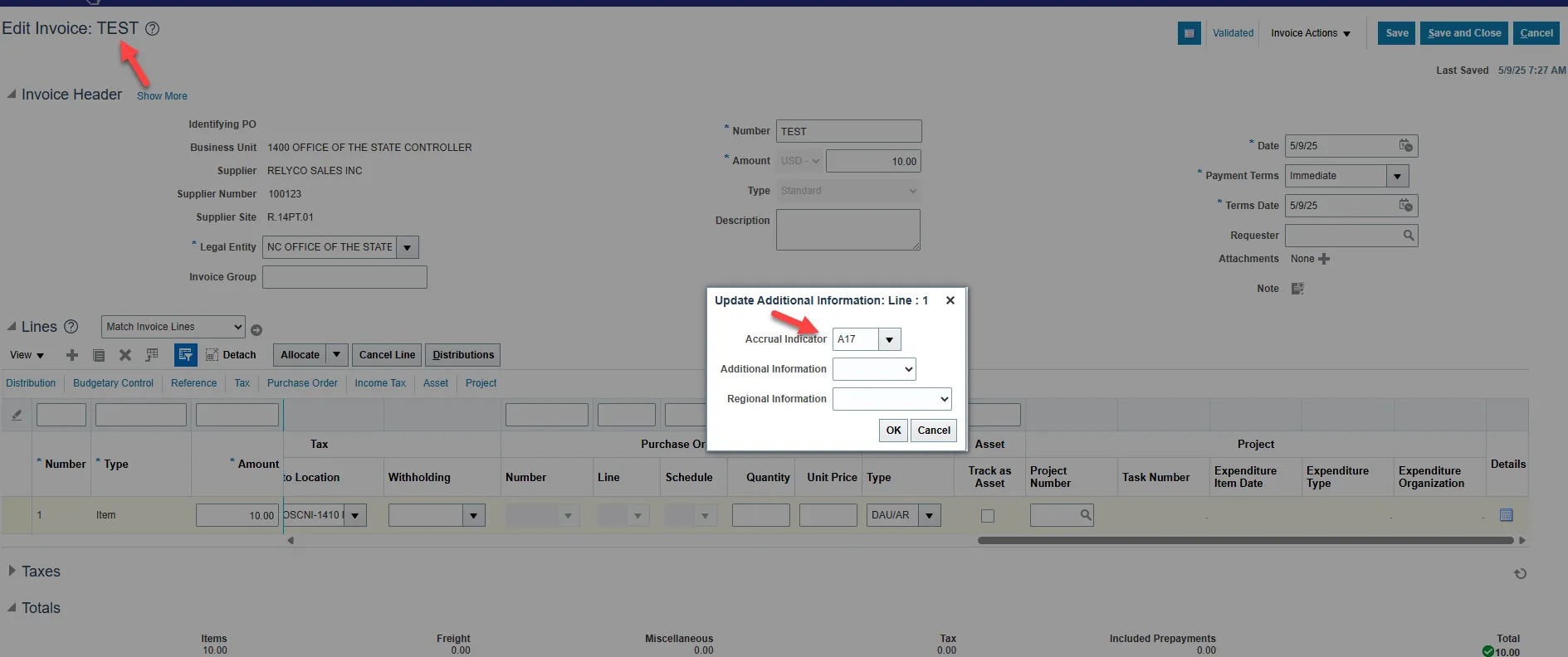

Step 1. Under Edit Invoice, click the Details button to add the Accrual Indicator.

Step 2. Click OK.

Step 3. Click Save.

Step 4. Continue to process the invoice to add more lines or validate and approve.

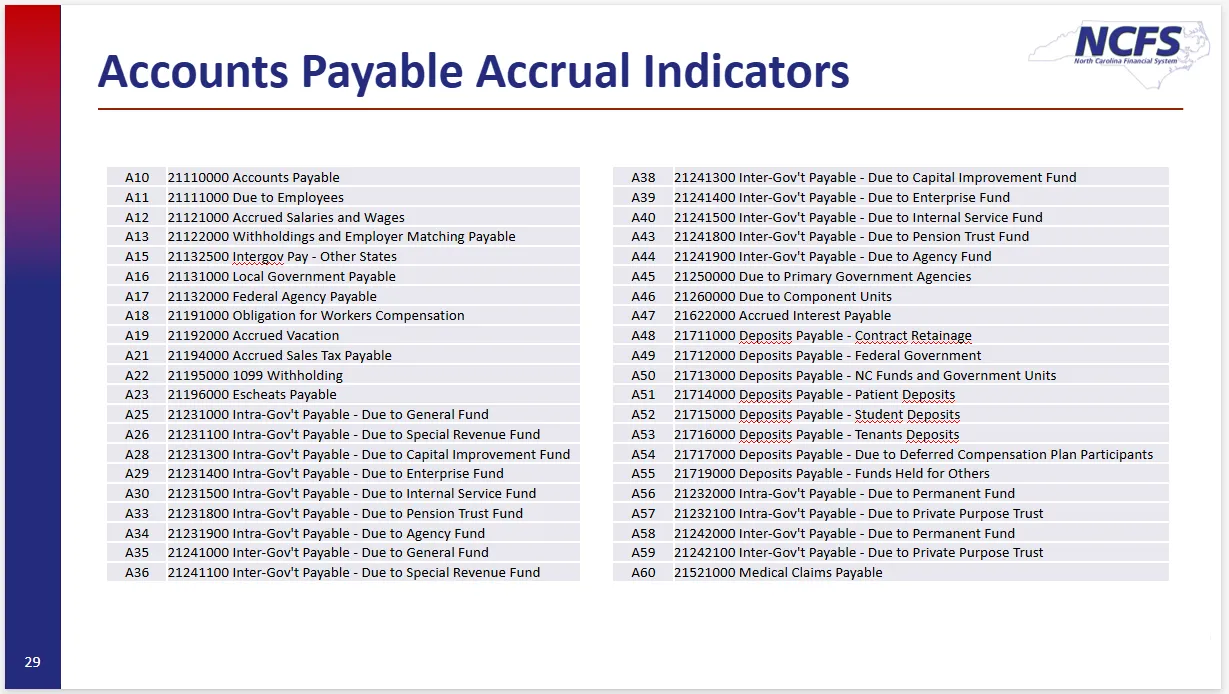

Accrual Indicators

Reports

- RPT-RTR-172 - NC AP Accrual Reclass Report

- Used to review AP invoices keyed through June to verify accruals.

- RPT-RTR-177 - NC AP Accrual Injections Report

- Used in July to review invoices and it contains two tabs:

- Tab 1 – Displays detailed invoice information for all invoices entered in July.

- Tab 2 – Summarizes accrual invoices by account combination and liability account to use for Journal upload.

- Used in July to review invoices and it contains two tabs:

Wrap-Up

Provides answers regarding how to create and manage an invoice for NCFS Accounts Payable Year-End Accrual Process.