Purpose

The purpose of this Quick Reference Guide (QRG) is to provide an overview and steps on how to Run the 1099 Invoice Maintenance Report and Update 1099 codes after the invoice has been paid in the North Carolina Financial System (NCFS).

Introduction and Overview

To be able to run the 1099 report, the user needs to get access to the new NC AP Tax Reports role. Please work with your agency’s Security Administrator to secure this role for agency staff who will be running the custom 1099 Maintenance Report and the Printing the 1099 forms. There is no course requirement for this role currently.

Report Overview

The NCFS 1099 Maintenance Report can be found in this location -> Shared Folders > Custom > FBR Custom > Report > Accounts Payable > Tax Reports

This report contains Tax ID information for suppliers, keep this report secure.

Validate NCFS 1099 invoice lines that are marked at the invoice distribution level (Column R on the report).

Parameters to run the report:

- Select agency Legal Entity

- Select agency Business Unit

- From Payment Date = 1/1/20XX

- To Payment Date = 12/31/20XX

- Natural Account - Optional

- Supplier Number - Optional

Report will create a Detail and Summary Tab:

- Use the summary tab to see the Subtotal by Supplier TIN and Tax Code Type.

- Use the detail tab for invoice line distribution tax code validation.

See sample report for additional information.

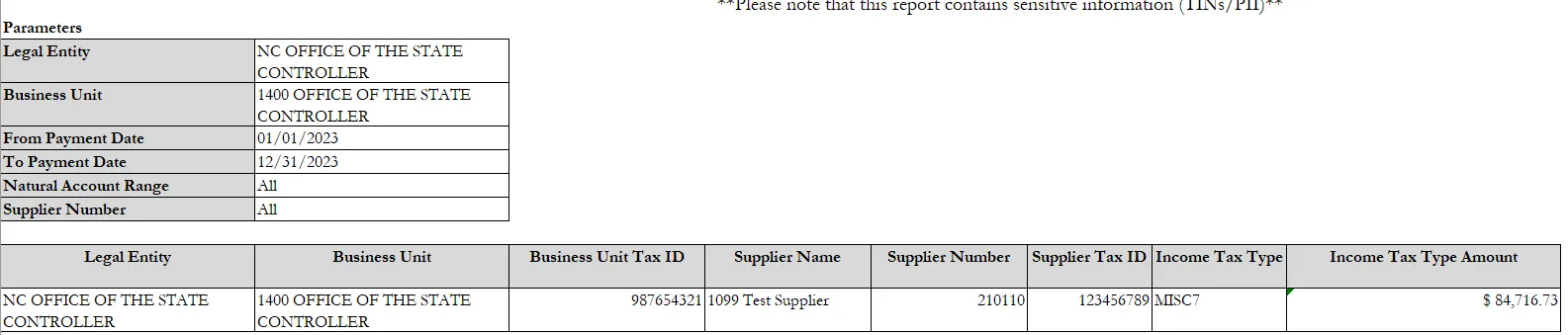

Summary Tab sample

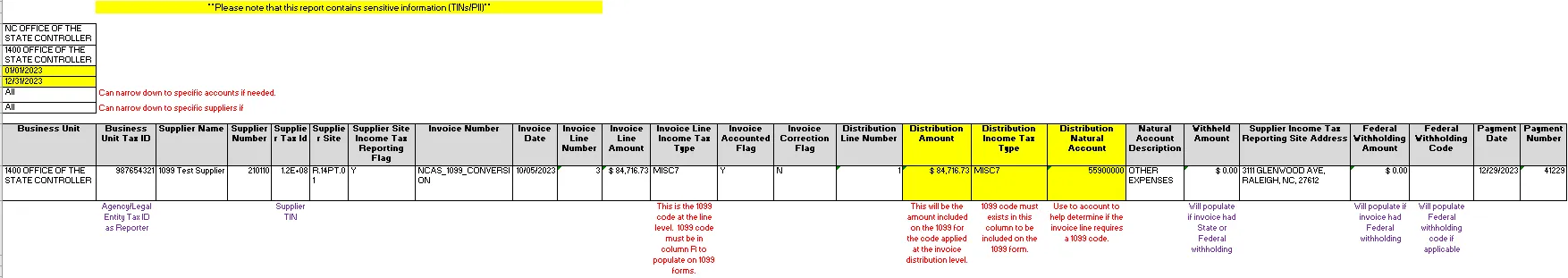

Details Tab sample – Important columns are highlighted in yellow. Please read the notes written below the columns for more information.

Tips and Tricks:

- Export report to Excel and use details tab for distribution level tax code application.

- Add filter and filter by account to make sure that all 1099able accounts are coded correctly.

- Filter by column M (Invoice Line Income Tax Type) to compare to column R (Distribution Income Tax Type).

- Differences indicate that the tax code may not have been updated at the distribution level.

- 1099 forms will only pull from the code on the distribution level and the tax code must exist in column R or 1099 will not be created.

- Filter with specific suppliers to ensure that 1099 codes are applied to all invoices for that supplier.

Updating 1099 Codes in the Invoice

- Changes to 1099 codes on NCFS invoices can be made on the invoice at the distribution level throughout the year to be included in the OSC Electronic Media submission to the IRS. The cutoff date for each year will be communicated by OSC.

- AP-33 1099 Codes and Descriptions

By January 31st of each year

- Agencies to print 1099 Forms.

- Agencies to mail 1099 forms to suppliers – Must be postmarked on or before January 31st of each year.

- OSC will submit the Electronic Media File to the IRS by January 31st of each year.

Update 1099 Code on Invoices After Payment

To update the 1099 code on invoices after payment, please follow the steps below. There are 7 steps to complete this process.

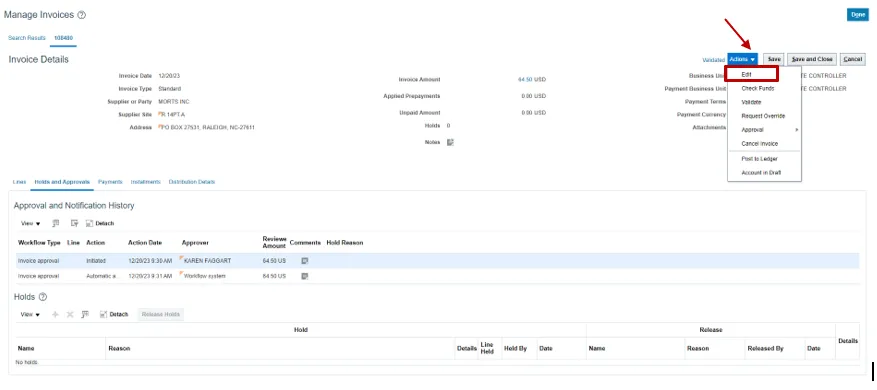

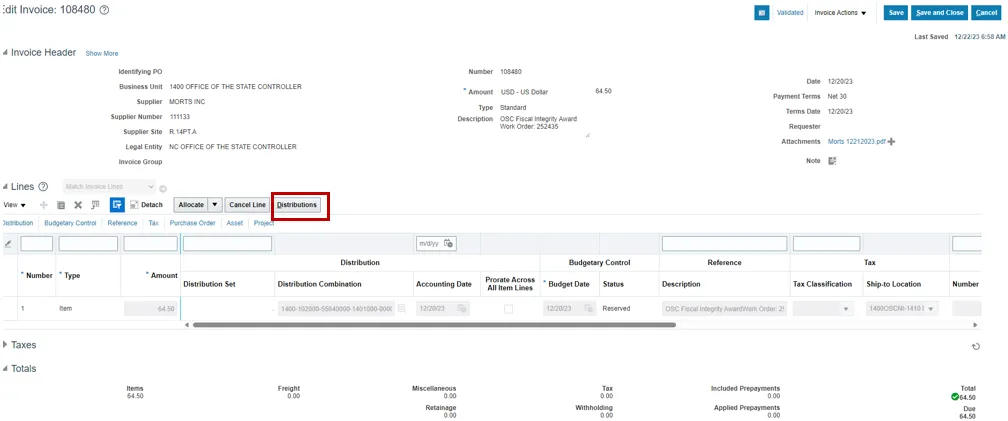

Step 1. Navigate to invoice and click Actions > Edit.

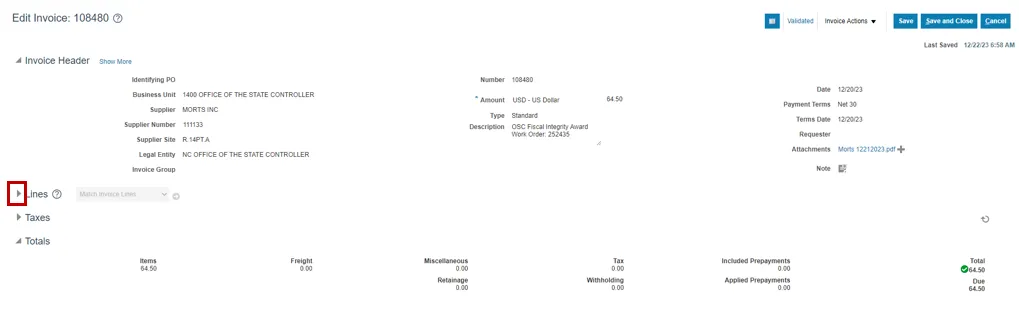

Step 2. Click the Triangle icon to expand lines section of invoice.

Step 3. Click the Distributions button.

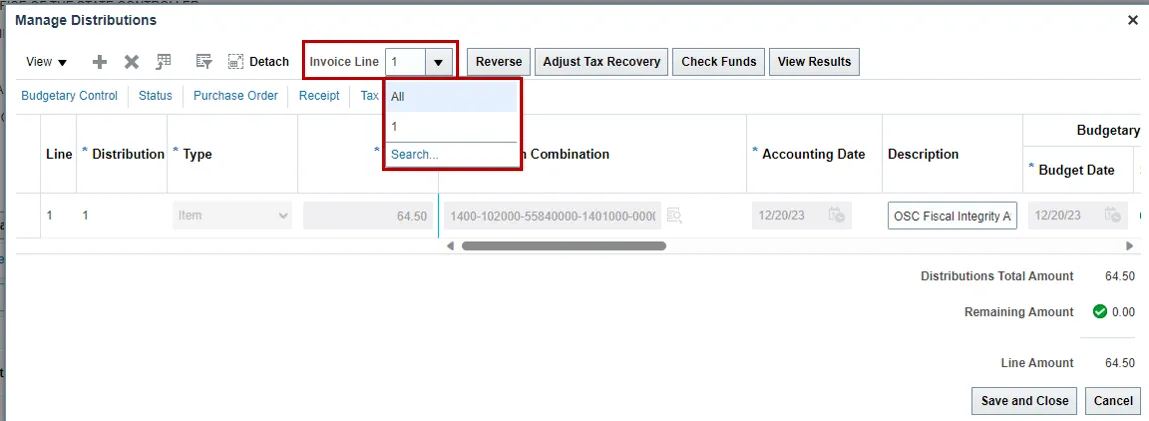

Step 4. Manage Distribution window will display, select the Invoice Line that needs to be updated.

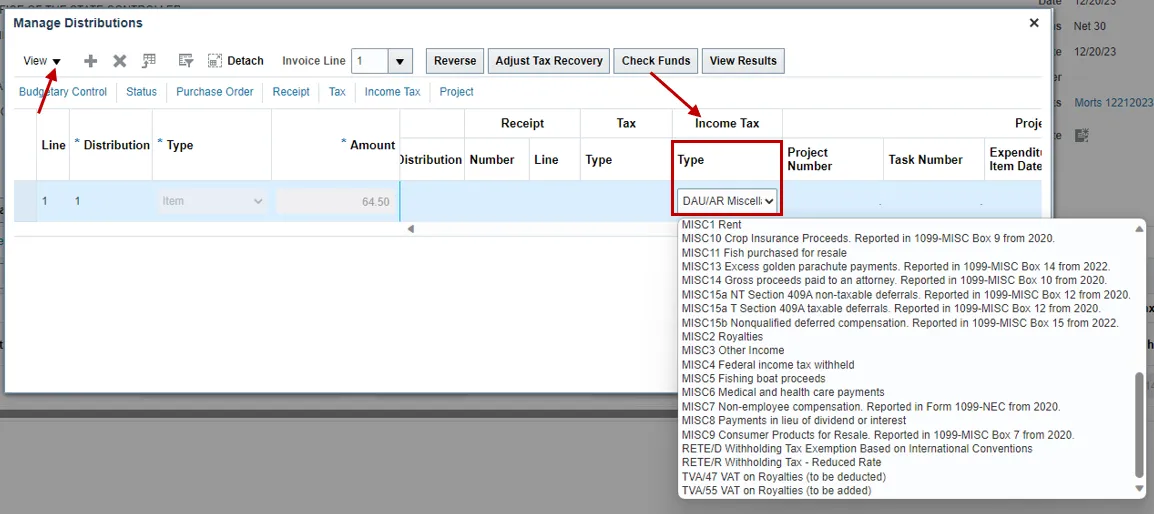

Step 5. Scroll to the Income Tax Type field and select the correct 1099 code. To unflag a line for 1099 reporting select DAU/AR Miscellaneous – Other.

Note : If you do not see the Income Tax menu, click on the View dropdown list, and include Income Tax menu to the distribution view.

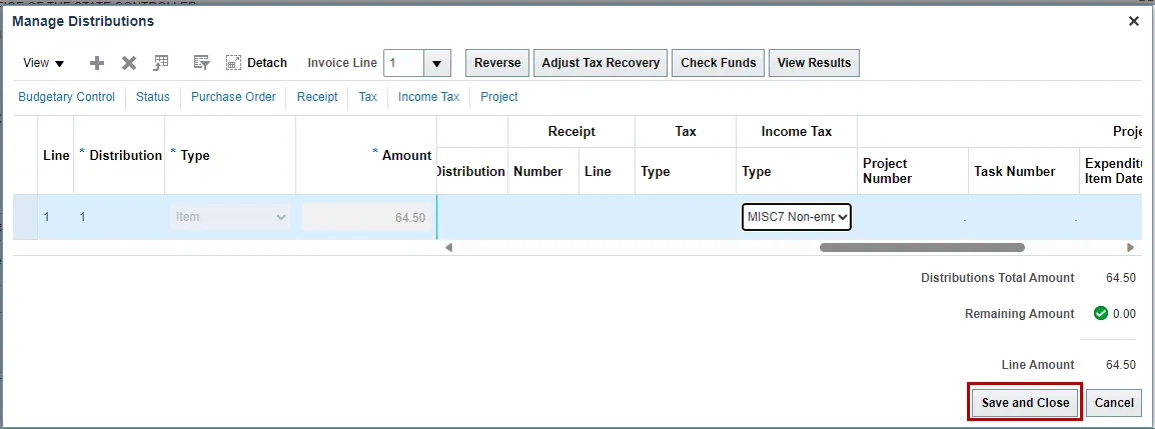

Step 6. Click Save and Close.

Step 7. Click Save and Close on the invoice header.

Wrap-Up

This QRG gives you an overview and steps to update 1099 code on an invoice after payment.

Additional Resources

- Virtual Instructor-Led Training (vILT)